Rating agency Moody’s Investors Service changed 3M Company’s (MMM) outlook to negative from stable due to expectations of higher leverage needs and weaker earnings for this year.

Moody’s reaffirmed 3M’s A1 senior unsecured debt rating. The rating agency expects the company’s revenue and margins to decline “meaningfully” in 2020 as a result of a protracted period of falling demand exacerbated by the coronavirus crisis.

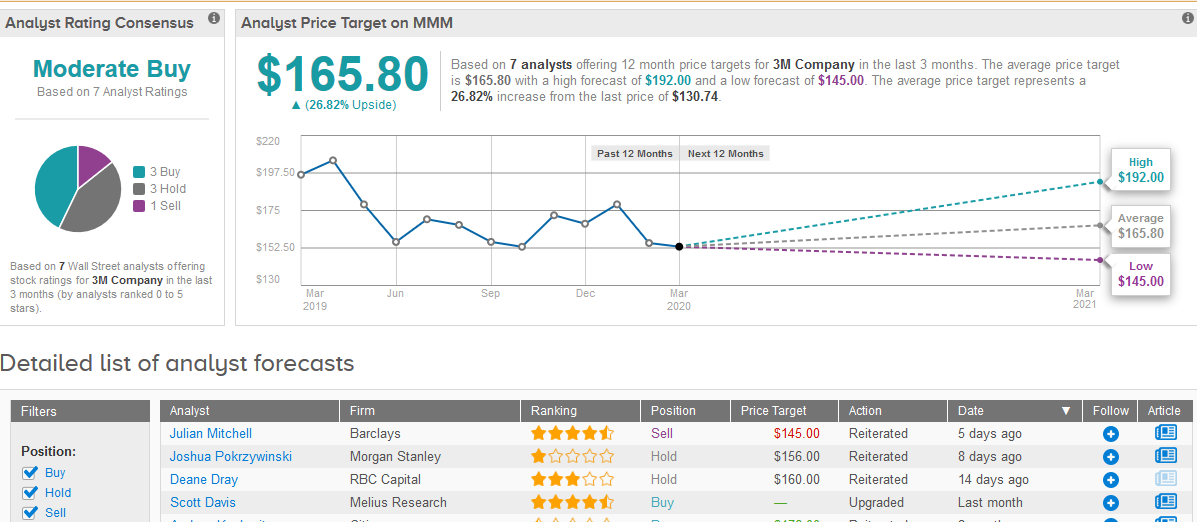

3M has a Moderate Buy analyst consensus rating, based on 3 Buys, 3 Holds, and 1 Sell. The average price target of $165.80 suggests potential room for a 26% gain in the next 12 months. (See 3M’s stock analysis on TipRanks)

“3M’s exposure to the automobile and electronics end markets, as well as the production and supply chains in China, Korea, and Japan, render the company vulnerable to shifts in market sentiment and operational disruption in these unprecedented times,” Moody’s said in the report.

Moody’s believes that 3M will continue to show strong liquidity supported by cash reserves and free cash flows of over $1 billion annually through 2021.

Related News:

Facebook Looks Compelling at Current Levels, Says Top analyst

Coronavirus Weighs on Square’s Ecosystem, Estimates Lowered

Follow the Top 25 Financial Bloggers with TipRanks