Ahead of Roku’s (ROKU) earnings report, questions were raised on whether the stock had rallied too far this year, and whether its meteoric rise was about to come to an end. It seems the market has answered that question today – Roku has taken a severe beating, dropping over-night by more than 10%.

The drop follows yesterday’s third-quarter earnings announcement, and at first glance it might seem confusing, as Roku reported revenue that came in better than Wall Street initially predicted. But, leading up to the report, high expectations were in place for the streaming-device maker.

Wedbush’s Michael Pachter believes Roku is strategically well placed for expansion. However, the analyst thinks the stock fairly values the positive outlook, and sees about 15% downside from current levels. As a result, Pachter reiterates a Neutral rating on ROKU with a $105 price target. (To watch Pachter’s track record, click here)

Citing the positives, Pachter notes that in Q3 Roku broke into the key European market and has continued to gain market share, adding that compared to its bigger competitors who have had to sacrifice profits for licensing contracts and sales volume, Roku’s cheaper OS has kept its price competitive.

On the other hand, the analyst argues that amongst other expenses, the company will be spending more on content to boost TRC (The Roku Channel) viewership and cites the company’s expanding workforce as factors which will significantly drive profit down in the near future.

The analyst said, “We expect the company to reach profitability within the next five years, but R&D spending may remain elevated for several years as Roku competes for TV licensing contracts and funds its international expansion. Roku has substantial growth opportunities, but we think the multiple is already stretched, adding, ”Our ten year discounted model backs up our view – for 2029 we estimate $6.5 billion in revenue (19% CAGR), 55% gross margin, 12% operating margin, 22% tax rate, and 123 million shares outstanding, the company would generate EPS of $4.94. Discounted by 10% annually, we reach a present value for EPS of $1.73.”

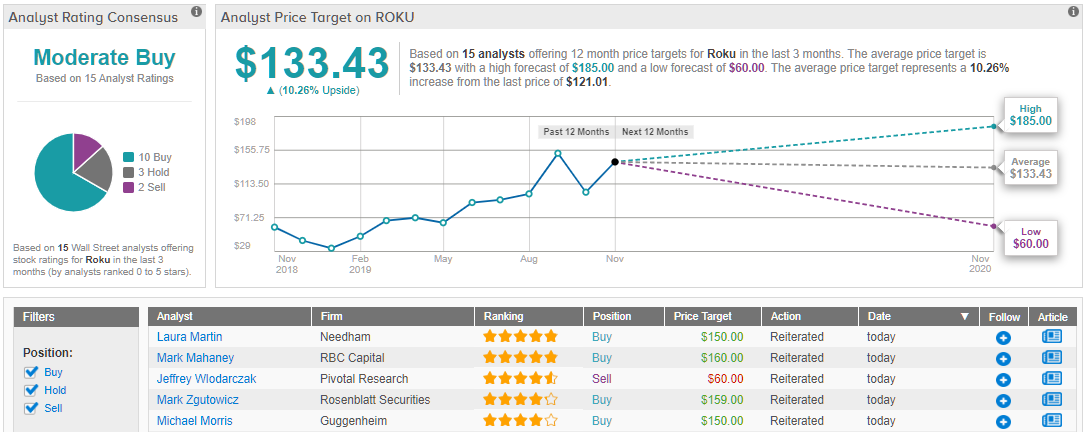

Most of the Street is more confident than Pachter’s sidelined stance, with TipRanks analytics showcasing ROKU as Moderate Buy. Based on 15 analysts polled in the last 3 months, 10 rate the stock “buy,” 3 suggest “hold,” while two say “sell.” The 12-month average price target stands at $133.43, marking about 10% upside from where the stock is currently trading. (See Roku stock analysis on TipRanks)