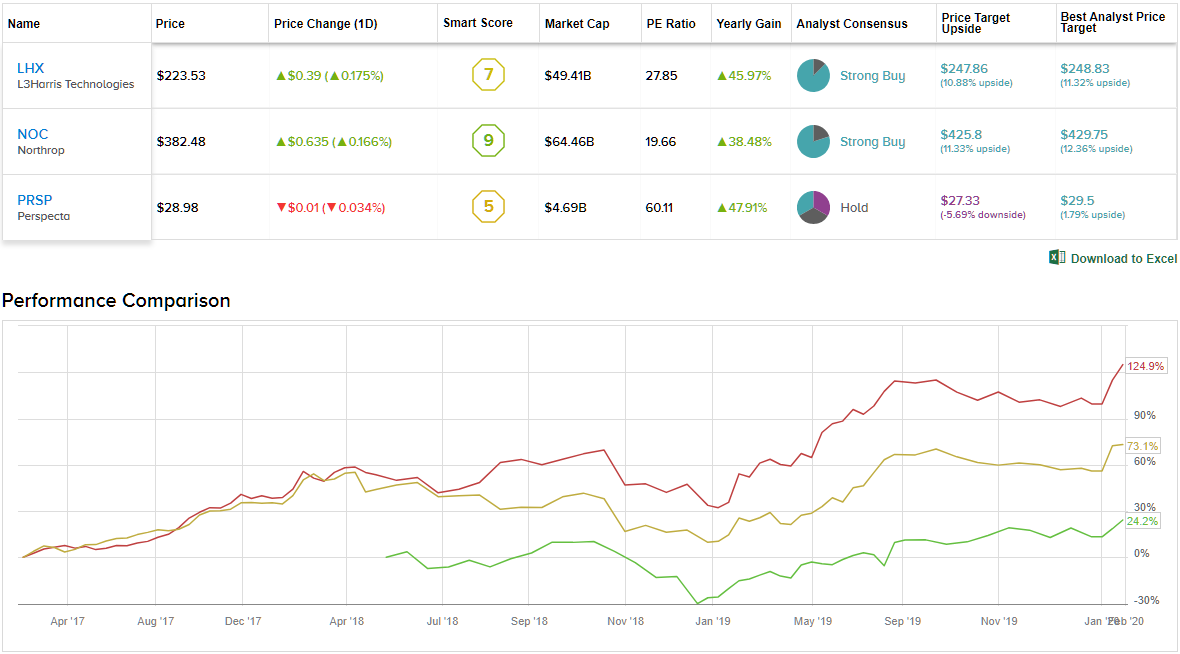

Since Trump won the election in 2016, the iShares U.S. Aerospace & Defense exchange-traded fund (ITA) has risen by over 70%. Geopolitical uncertainty, alongside a massive increase in military spending have been good news for defense stocks.

According to Buckingham Research Group analyst Richard Safran, the rally is set to continue in 2020. The analyst believes the fear of a possible left-leaning presidency’s negative impact on the sector is exaggerated. He said, “Although the 2020 elections remain an overhang on Defense stocks, we think the risks are way overstated and have hampered Defense multiples from expanding despite continued end-market growth.”

Investment bank Morgan Stanley recently reviewed the defense sector stocks under its coverage, and using TipRanks’ Stock Comparison tool, we lined up 3 of the tickers alongside each other to get the lowdown. The word on the Street is that the outlook appears rosy for two, while one demands more caution from investors. Let’s take a closer look.

L3Harris Technologies (LHX)

One of 2019’s success stories, L3Harris is in fact a new company – the result of a merger last June between L3 Technologies and Harris Corporation. The company’s share price appreciated by 47% in 2019, and 2020 has started in much the same vein. It is up by 13% year-to-date.

The company provides various products and services to the defense industry, including C6ISR systems, wireless equipment, tactical radios, avionics and night vision equipment, amongst others. The merger has significantly bolstered L3Harris’s proposition, as it took two midsize defense companies and created a larger beast capable of competing for large Pentagon contracts that, otherwise, would have been out of reach for both.

Alongside the merger, 2019’s market beating performance was instigated by a series of estimate beating reports and strong sales growth. So, now that L3Harris is no longer trading at such a bargain price, does it remain a tantalizing proposition in 2020?

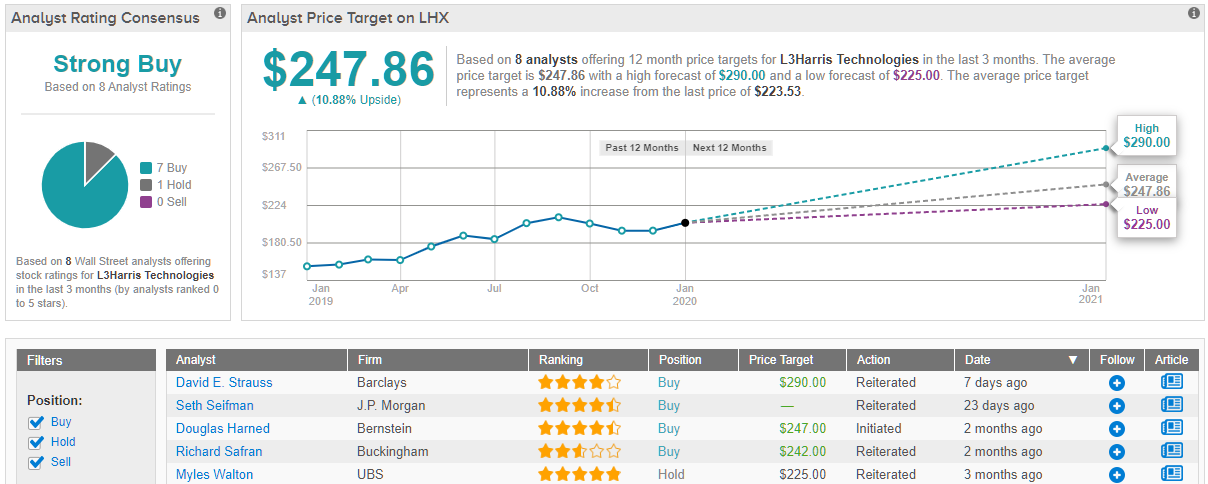

It does, according to Morgan Stanley’s Matthew Sharpe. Sharpe thinks “LHX remains a peer leader on topline growth”.

Sharpe noted, “Post the LLL-HRS merger, we believe LHX sets itself up as a leading Defense Prime with wide ranging capabilities from radios to small satellites. Given above-average potential around sales growth, margin expansion, FCF generation, and capital returns, alongside a leadership team that has previously executed, we see no reason why the legacy HRS premium valuation should not be retained (at 5-6% FCF versus 2021 at ~7%).”

Bottom line, then? Sharpe keeps his Overweight rating along with the price target of $259. This conveys the analyst’s confidence L3Harris can add a further 16.5% to the share price over the coming months. (To watch Sharpe’s track record, click here)

The Street is on the bullish side, too. 7 Buys and a single Hold coalesce into a Strong Buy consensus rating. The average price target comes in at $247.86 and indicates possible gains of 11%. (See L3Harris stock analysis on TipRanks)

Northrop (NOC)

With annual revenue of more than $30 billion, global aerospace and defense technology company Northrop Grumman is one of the world’s largest weapons manufacturers. Like L3Harris, Northrop outperformed the market last year, adding 43% to its share price along the way. It has kept up the pace in 2020, too; the heightened tension between the US and Iran, and the fear of a looming war have been good news for the company. In fact, Northrop just this month notched an all-time high, closing January 16th’s session trading at $383.78.

As befits a multinational the size of Northrop, the company is involved in large scale development programs; Northrop is currently developing the B-21 Raider, a long-range strategic bomber which will replace its own B-2 Spirit, the world’s only known stealth bomber. The company is also involved in NASA’s Space Launch System program, for which it is producing the solid rocket boosters.

Additionally, in December, following Boeing’s removal of its bid for the coveted GBSD (Ground Based Strategic Deterrent) contract, Nothrop remains the sole bidder for the development of the intercontinental ballistic missile system, worth a purported $63 billion.

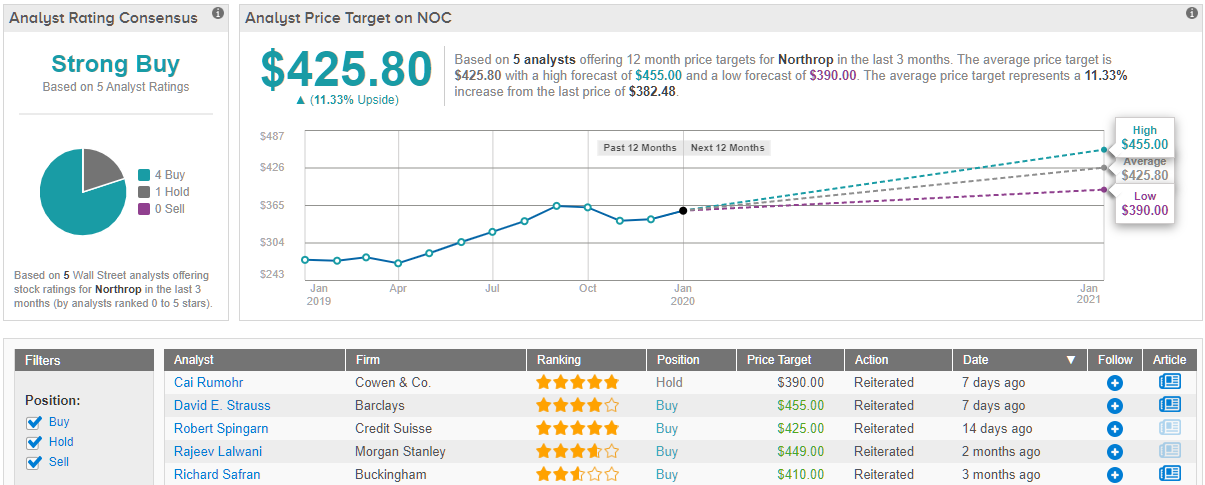

Following 2019’s consistent execution, in which the company beat earnings estimates in all 4 calendar reports, Sharpe expects the upcoming report to show “improved revenue growth relative to prior quarters”. The analyst predicts expansion of 9% year-over-year to $8.9 billion.

Sharpe added, “We believe NOC is well positioned given its longer duration capability and high-end technology focus, that is well aligned to the NDS, including the Prime position on B-21 ($50B+), pursuit of GBSD (~$85B), and acquisition of Orbital ATK (~$9B) for space. As such, inflecting revenue and margin potential, along with portfolio shaping opportunities (via Technology Services), and an easing investment cycle support an attractive FCF yield come 2021 at ~7%.”

Sharpe, then, reiterates an Overweight rating on the weapons manufacturer, alongside a $449 price target. The figure implies further upside potential of 18.5%.

Looking at the consensus breakdown, it appears the bulls have it. With 4 Buys and a single Hold, the word on the Street is that NOC is a Strong Buy. At $425.80, the average price target presents possible upside in the shape of 11.33%. (See Northrop stock analysis on TipRanks)

Perspecta Inc (PRSP)

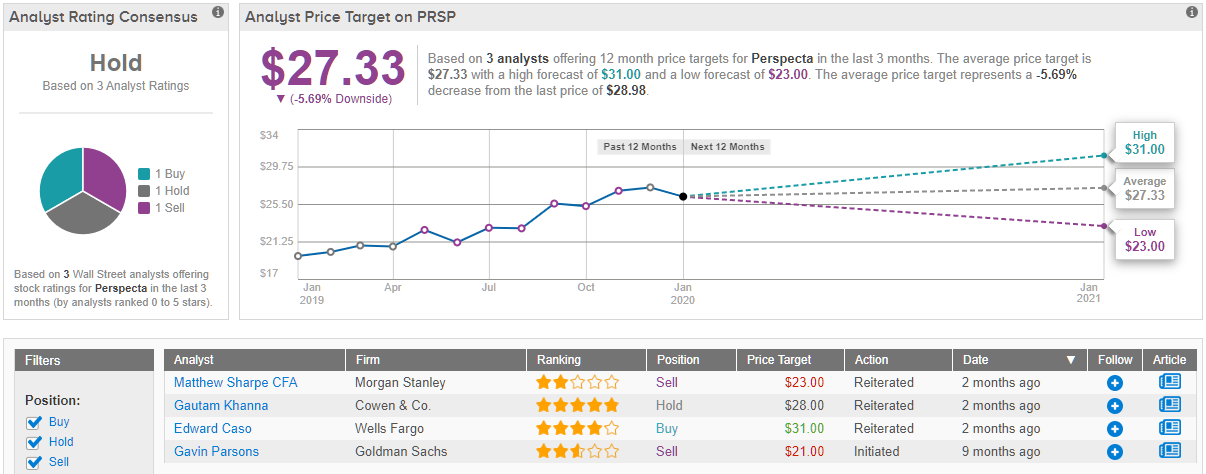

Like the two previous companies on our list, Perspecta’s 2019 involved upward movement. A very healthy addition of 55% over the year has been followed with a further 7% year-to-date. What sets the government IT firm apart, according to Sharpe, is the outlook for the year ahead.

Sharpe expects quarterly results to exhibit a “sequential deceleration in topline growth to ~2%”. The reason is mainly down to Perspecta’s loss of the NASA NEST program; last year the company lost out to Leidos for Nasa’s $2.9 billion enterprise IT contract. All eyes are now focused on whether Perspecta can hold onto its lucrative NGEN contract with the U.S. Navy Department. The contract will expire in September with formidable competitors General Dynamics and Leidos hoping to replace Perspecta. Losing the contract could cost the company 10-15% of revenues, driving FY21 growth rates negative and potentially pressuring margins due to cost absorption.

Sharpe said, “Our view for the company over the near- to mid-term highlights a number of challenges that contrast with the broader environment, where we see more attractive opportunities with lower risk. Firstly, PRSP has a significant amount of concentration at a contract level, introducing elevated recompete risk to the profile that drives a particularly wide range of potential outcomes. In addition, the company has an elevated leverage profile that limits shareholder returns over the coming years as it focuses on paying down debt. Lastly, with respect to EBITDA, the company is earning mid-teen margins, in contrast to competitors at closer to HSD levels, indicating the company could be over earning.”

Sharpe, then, kept an Underweight rating on PRSP, along with his price target of $23. The implication? Possible downside of 19% over the next 12 months.

The Street’s take is slightly more positive. Perspecta’s Hold rating breaks down into a Buy, a Hold and a Sell, each. With the average price target coming in at $27.33, the analysts foresee downside of nearly 6% in the year ahead. (See Perspecta’s price targets and analyst ratings on TipRanks)