COVID-19 has left the U.S. economy reeling, yet Wall Street is pushing forward. Unemployment has reached alarming levels, with the loss of 20.5 million jobs in April bringing the U.S. unemployment rate to 14.7%, but the S&P 500 has staged somewhat of a recovery. While the index dipped Tuesday as investors weighed reopening efforts against fears of a second wave of infections, it has gained about 30% since hitting lows in March.

So, what’s driving this stock market disconnect? Mike Wilson, Morgan Stanley’s chief U.S. equity strategist, argues that investors are betting on a future recovery, with these bets being primarily fueled by concrete actions rather than the unknown. Additionally, he points out that market watchers believe the rebound will be “V-shaped”, the most ambitious form of an economic recovery.

“Our client conversations have changed dramatically over the past month, shifting from whether we will have a re-test of the March lows to what does the shape of a recovery look like. Our view is that we will see a sustainable V-shaped recovery,” Wilson commented. He added, “… primarily because history tells us this is the way it always looks and feels in a recession — a highly uncertain recovery path, pessimistic investors, and volatile asset markets reacting to daily updates about the exogenous shock that got us here in the first place.”

Taking Wilson’s statements to heart, we used TipRanks’ database to take a closer look at two stocks that have received Morgan Stanley’s stamp of approval. TipRanks revealed that both Buy-rated names have amassed support from other analysts and boast over 25% upside potential.

Zentalis Pharmaceuticals (ZNTL)

Focused on the creation of differentiated small molecule treatments that target biological pathways of cancer, Zentalis believes it has developed an integrated approach that will allow it to overcome the limitations of current cancer therapeutics. Morgan Stanley highlights the speed of its pipeline advancement and the quality of its technology as making this company a standout in a crowded space.

Representing the firm, five-star analyst Matthew Harrison cites ZNTL’s four INDs in a short period of time as proof of its development capabilities. “Small molecule targeted oncology is an attractive area for investment as initial results on efficacy and safety can quickly de-risk an asset and lead to fast approvals. Management has built a top-notch, differentiated chemistry group which has allowed Zentalis to quickly build a large pipeline against key targets,” he explained.

Looking specifically at its lead asset, ZN-c5, a small molecule selective estrogen receptor degrader (SERD) designed for use in breast cancer, Harrison points out that it has already demonstrated clinically and preclinically low levels of major side effects as well as robust efficacy. This is important because while oral SERDs could be used across multiple stages of breast cancer and are more convenient than injectables, other oral SERDs in development have caused side effects like rash, diarrhea and vomiting. Based on all of this, the analyst thinks the opportunity for ZN-c5 could land in the billions.

The good news doesn’t stop there. Harrison stated, “Importantly, the rest of the pipeline is robust, offering additional compelling targets.” In particular, he estimates that its Wee1 (ZN-c3) candidate could see peak sales hit $1 billion. When it comes to Bcl-2 (ZN-d5), Harrison argues that this therapy is a de-risked target with only one key competitor, with it possibly allowing ZNTL to differentiate itself. It should also be noted that the company has a third generation EGFR inhibitor that could be used alongside its SERD.

It should come as no surprise, then, that Harrison joined the bulls. To kick off his coverage, he put an Overweight call and $45 price target on the stock. Should this target be met, a twelve-month gain of 26% could be in store. (To watch Harrison’s track record, click here)

Does the rest of the Street agree with Harrison? With 100% Street support, or 4 Buy ratings to be exact, the consensus is unanimous: ZNTL is a Strong Buy. In addition, the $43.67 average price target implies 23% upside potential. (See Zentalis stock analysis on TipRanks)

Quest Diagnostics Inc. (DGX)

When it comes to laboratory diagnostic information services company Quest Diagnostics, Morgan Stanley has had a change of heart. Back in March, the firm downgraded the stock due to the overwhelming headwinds it thought couldn’t be offset by COVID-19 testing, but now it’s singing a different tune.

Weighing in on DGX for the firm, five-star analyst Ricky Goldwasser argues that expanded testing guidelines as well as new market opportunities bode well for the company. Even though Wall Street has been laser-focused on the opportunity related to serology testing recently, based on Goldwasser’s analysis, the COVID-19 diagnostic testing opportunity could be two times larger if testing is added as part of a pre-elective procedure routine. She also points out that since March, supply shortages have limited COVID-19 testing, which in turn has spurred restrictive testing guidelines in an effort to save supplies.

Expounding on this, Goldwasser stated, “Over time, as supplies become more available, testing guidelines are starting to expand. We expect Quest Diagnostics to meaningfully benefit from the market evolution to phase II of the testing paradigm and out of the four walls of the hospital. Our analysis suggests COVID-19 diagnostics could translate to ~689 million revenue opportunity and $372 million in EBIT through 2021.”

That’s not to say serology testing isn’t important for DGX, with Goldwasser noting it’s a “critical component in reopening business.” She added, “Employers who are developing their return to work programs are working with the national labs to create testing programs. While the opportunity is going to be split among other supply chain participants (drug retail chains included), we estimate this as a $335 million revenue opportunity for Quest through the fall of 2020 helping to offset some of the declines in core testing.”

All of the above prompted Goldwasser to upgrade her rating from Equal-weight to Overweight. On top of this, she bumped up the price target from $95 to $139. This new target suggests shares could surge 29% in the next twelve months. (To watch Goldwasser’s track record, click here)

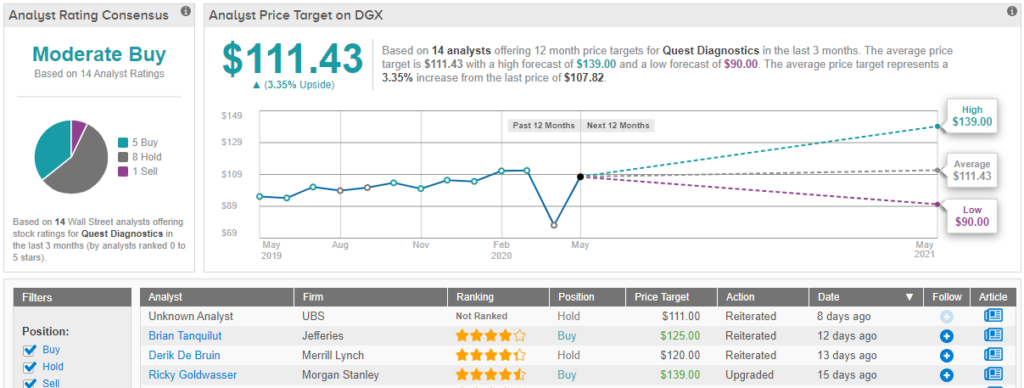

Looking at the consensus breakdown, DGX has been assigned 5 Buys, 8 Holds and 1 Sell in the last three months. As a result, it earns a Moderate Buy consensus rating. At $111.43, the average price target puts the upside potential at a modest 3.4%. (See Quest Diagnostics stock analysis on TipRanks)

Read more: