We’ve had more good news in the stock markets this week, lending credence to the view that recent gains are more than just a ‘bear market rally.’ Markets are up their recent trough, reached on March 23, and the gains appear to be both substantial and lasting.

Investment bank Morgan Stanley has been tracking the markets closely, watching for evidence that the true bottom has been reached. The bank’s US chief equity strategist, Mike Wilson, believes that it has. He points out the “unprecedented and unbridled monetary and fiscal intervention led by the U.S.” and goes on to add that, with stock valuations at their most attractive since 2011, “we stick to our recent view that the worst is behind us…”

Wilson believes that bear markets, with their low prices, typically end in recessions. The risk/reward ratio grows more favorable in an environment of low prices and high upside potentials. In addition, Wilson adds that today’s market levels should make a good entry point for traders seeking 6- to 12-month investment horizons.

Morgan Stanley’s analysts aren’t just taking the macro view, however helpful that may be to investors. Recent stock reviews from the bank’s research teams have pointed out particular stocks for investors to note. Some are buying moves; others are must-to-avoid.

We’ve pulled up three of Morgan Stanley’s recent calls, and run them through the TipRanks database. It turns out that two of the bank’s bullish picks have received significant support from other members of the Street. That being said, one name stands out as being an investment to avoid, falling out of favor with Morgan Stanley as well as the broader analyst community.

O’Reilly Automotive (ORLY)

Consumer automotive has always been a profitable niche in the USA; you have to expect that from the country that brought us the Motor City, the Mustang, and the Camaro. The company dates back to 1957, and has been providing aftermarket accessories, equipment, parts, supplies, and tools to both professional and DIY customers ever since.

The lockdown and quarantine regimes put in place to contain the spread of coronavirus have shut down many businesses – and also boosted do-it-yourselfers. With garages closed, home auto maintenance is rising, and customers are looking for tools, supplies, and advice. O’Reilly provides all of that – and the stock has outperformed the overall markets in recent weeks, losing 14% in the same time that the S&P 500 has slipped 21%.

Morgan Stanley’s Simeon Gutman, reviewing O’Reilly shares, sees the DIY auto sector as a solid position to take in advance of an economic recovery. Gutman writes, “DIY Auto has long behaved counter-cyclically as a weak economy depresses new car sales, which results in an aging of the car fleet and period of outsized same store sales.”

Gutman believes ORLY is due for better times, noting, “We view ORLY as a best-in-class operator in a fundamentally healthy sub-sector of Retail. Near-term COVID-19 disruption is a risk, but we think the stock’s recent selloff is overdone and presents a compelling buying opportunity with a valuation discount to other high quality retailers.”

As a result, the analyst upgraded his view of the stock from Neutral to Buy. His $360 price target implies a modest upside of 7%. (To watch Gutman’s track record, click here)

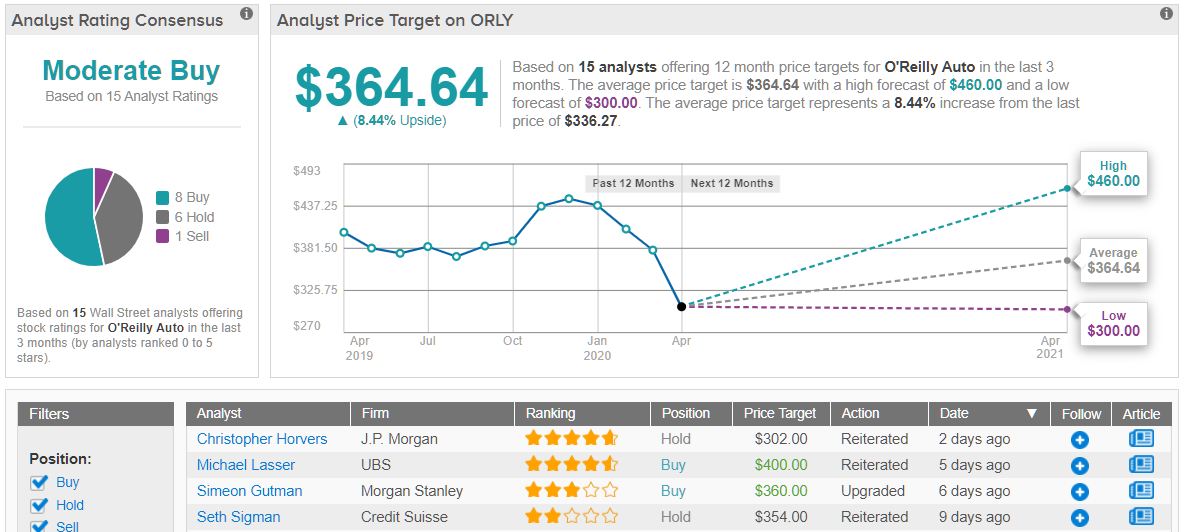

Overall, ORLY shares hold a Moderate Buy rating from the analyst consensus, based on 8 Buys, 6 Holds, and 1 Sell set in recent weeks. Meanwhile, the average price target, $364, indicates that there is room here for potential growth of 8% in the coming 12 months. (See O’Reilly stock analysis on TipRanks)

ServiceMaster Global Holdings (SERV)

Next up is a name in the maintenance industry. ServiceMaster caters to both the residential and commercial sectors, offering customers a wide range of services, including lawn and landscape maintenance, termite and other pest control, furniture repair and home and office cleaning. The company has responded to the COVID-19 epidemic in a clever way – by announcing a ‘full mobilization’ of services for cleaning and disinfecting both homes and offices.

The company’s stock has underperformed in the recent market slide, and is down 33% year-to-date. And these losses come after SERV finished up 2019 with some mixed numbers for Q4. The quarterly results, reported in early March, saw revenues just miss the forecast, although the $507 million reported was up 11% YoY. EPS edged just over the estimates, and grew 16% year-over-year. The year-over-year growth didn’t boost the stock, as SERV shares are down 22.5% over the past year, which compares poorly to the 11.8% loss among its industry peers.

Toni Kaplan, covering SERV for Morgan Stanley, sees the company with a clear path to weather the current storms. Kaplan writes, “We view SERV as somewhat hedged to the ongoing pandemic, as 80% of revenue is recurring, residential customers still have a need for pest control services, and commercial customers … will also have a need to keep facilities serviced for when workers return… We think SERV is well positioned for the immediate fallout from COVID-19, and the potential upcoming economic recession.”

Kaplan upgrades SERV shares from Neutral to Buy, and sets a $35 price target that shows confidence in a robust 36% upside potential. (To watch Kaplan’s track record, click here)

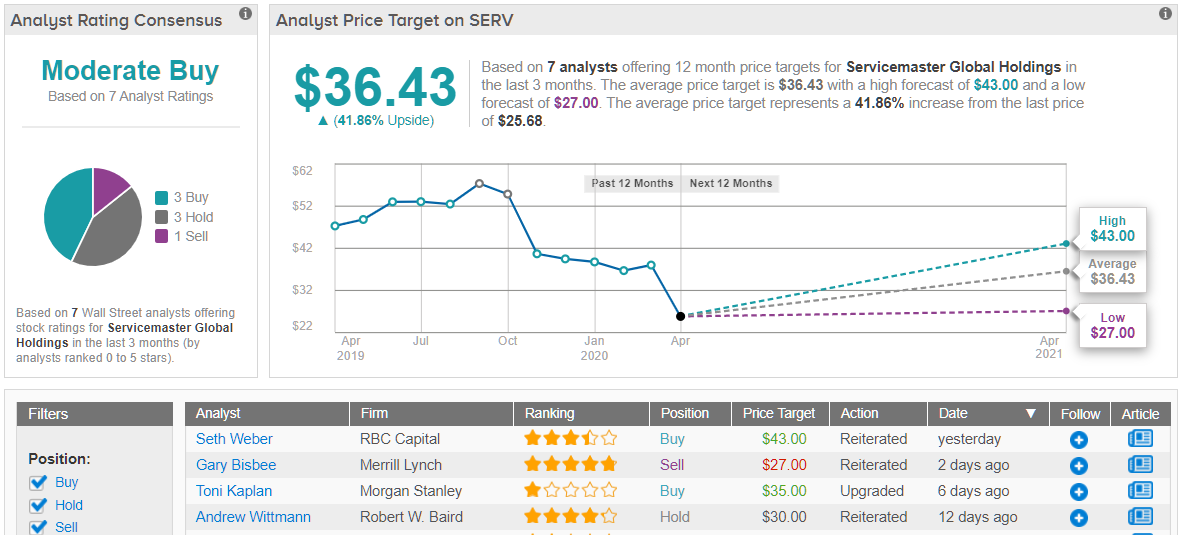

Overall, ServiceMaster’s Moderate Buy analyst consensus rating is based on an even split among the stock’s reviews: 3 Buys, 3 Holds, and 1 Sell. The stock sells for an affordable $26.15, a low entry point that helps to mitigate forward risk. The average price target, $36.43, shows the possible reward: a 42% upside potential for the next 12 months. (See ServiceMaster stock analysis on TipRanks)

UDR, Inc. (UDR)

UDR is a real estate investment trust, focused on the residential apartment sector. The company is among the largest apartment owners in the US, and operations brought in over $1.15 billion in revenue for 2019. The company’s earnings were strong enough that management increased the dividend, with the new quarterly payment of 36 cents taking effect this month.

UDR’s dividend deserves note. The annualized payment, $1.44, gives a yield of 4.1%, on the low end for an REIT, but still more than double the average dividend found on the S&P 500. The company also has an 11-year history of reliably keeping up the payments.

However, as Morgan Stanley analyst Richard Hill points out, apartment-based residential REITs are more likely to take a cyclical hit in a recession. As job losses grow, more people will have trouble paying their rent – and with apartment dwellers more likely both to fit the demographic profile of those facing layoffs, and less likely to possess adequate savings to see them through a time of dearth, the apartment-owning REIT’s are primed to see a decline in income.

This makes the big question for UDR, Is a recession on the way, or are we looking at a V-shaped recovery?

Hill believes that we are looking at a probably recession, along the lines of the one following 9/11, or the 2008 financial crisis. With that in mind, he has downgraded his stance on UDR shares, rating the stock a Sell. His price target, $33, suggests a likely downside of 7% this year. (To watch Hill’s track record, click here)

Backing his stance, Hill writes, “UDR has the most downside risk in our FCF yield analysis, as we think their strengths (portfolio diversity, NextGen operating platform, predictive analytics, and capital allocation) are already reflective in the price… we see the risks skewed to the downside if job growth slows in the Company’s West Coast-focused markets.”

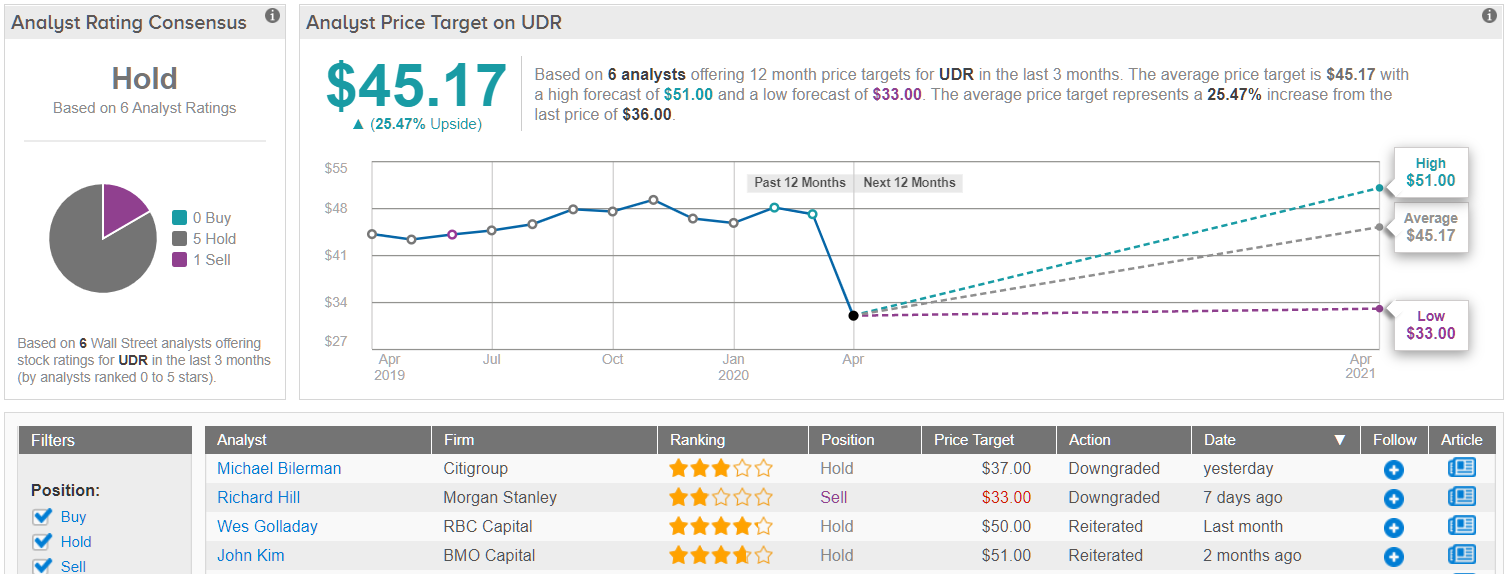

All in all, UDR shares have received 5 Holds and 1 Sell rating in recent weeks, making the analyst consensus view here a Hold. The stock sells for $35.39, and at $45.17 the average price target still shows a 27% upside potential for the year. (See UDR stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.