The coronavirus pandemic has forced economic shutdowns around the world, as nations and governments try to cope with the ill and prevent or slow the further spread of the disease. Stock markets have crashed in recent weeks; the Dow Jones is down 32% from its most recent peak, and the S&P 500 has lost 29%. With the advent of a true bear market cycle, economists are growing more certain in their warnings of a recession this year.

But despite the near-certainty that an epidemic-related recession is on the way (or already here), there is considerable doubt that it will be long-lasting in its effects. Economic conditions were reasonably strong before the coronavirus hit, and both the January and February jobs reports showed better than expected gains in employment and increases in wages. So, it may be no surprise that investment bank Morgan Stanley sees current conditions as an opportunity for traders.

Expanding on that, the bank’s CIO of Wealth Management, Lisa Shalett, describes the main indexes as “close to a bottom.” She adds, “Now we see some very good opportunities to dollar-cost average back into a market that’s likely to bump around this bottom,” and says that investors should expect another three to six months on market weakness. Her colleague Mike Wilson gives a concurring analysis, pointing out that by now the markets are “pricing in” recession conditions, and that, with prices this close to bottom, now is the time to get back into stocks.

In the mid-term, Morgan Stanley’s investment team sees a mild recession in the offing, with a shallow unemployment cycle. The bank’s analysts see earnings rebounding next year, and recommends moving into US-based large-cap stocks, as that is where the growth potential resides.

Morgan Stanley didn’t just leave its forecast to the realm of general conditions. The firm’s analysts have also released reports on specific equities which they believe will lead the turnaround when markets improve. We’ve used TipRanks database to pull up the data on three of those stocks – each shows a Buy consensus rating, and greater than 10% upside potential. Let’s dig a little deeper.

Chegg, Inc. (CHGG)

Since everyone is home, and many school districts are closed, we’ll start with a company particularly well-suited to benefit from home schooling. Chegg is a tech company specializing in online textbook rental, flash cards, study guides, writing guides, and tutors – in short, all of the web-based services you’ll need for effective home schooling, whether short- or long-term. The company has expanded aggressively in the past two years, clearing its field by acquiring competitors.

The value of Chegg’s niche is clear from a look at its earnings reports. The company has beaten the EPS forecasts in each of the last five quarters, and until the market collapse of the last few weeks it had been matching the S&P’s overall gains. The Q4 earnings capped this trend with a 17% EPS beat (35 cents per share reported) and a 34% year-over-year revenue gain, with the top line reported at $125.5 million.

Morgan Stanley analyst Josh Baer sums up Chegg’s performance in clear, unmistakable terms: “Near-term, Chegg’s value proposition becomes stronger as universities shift to virtual classes and students require more tools to supplement education. Long-term, a prolonged COVID-19 impact and potential recession in [our] bear case could result in higher student enrollment.”

Baer reiterates his Buy rating on CHGG stock, and his price target, $49, predicts 63% upside growth, showing his confidence in the stock. (To watch Baer’s track record, click here)

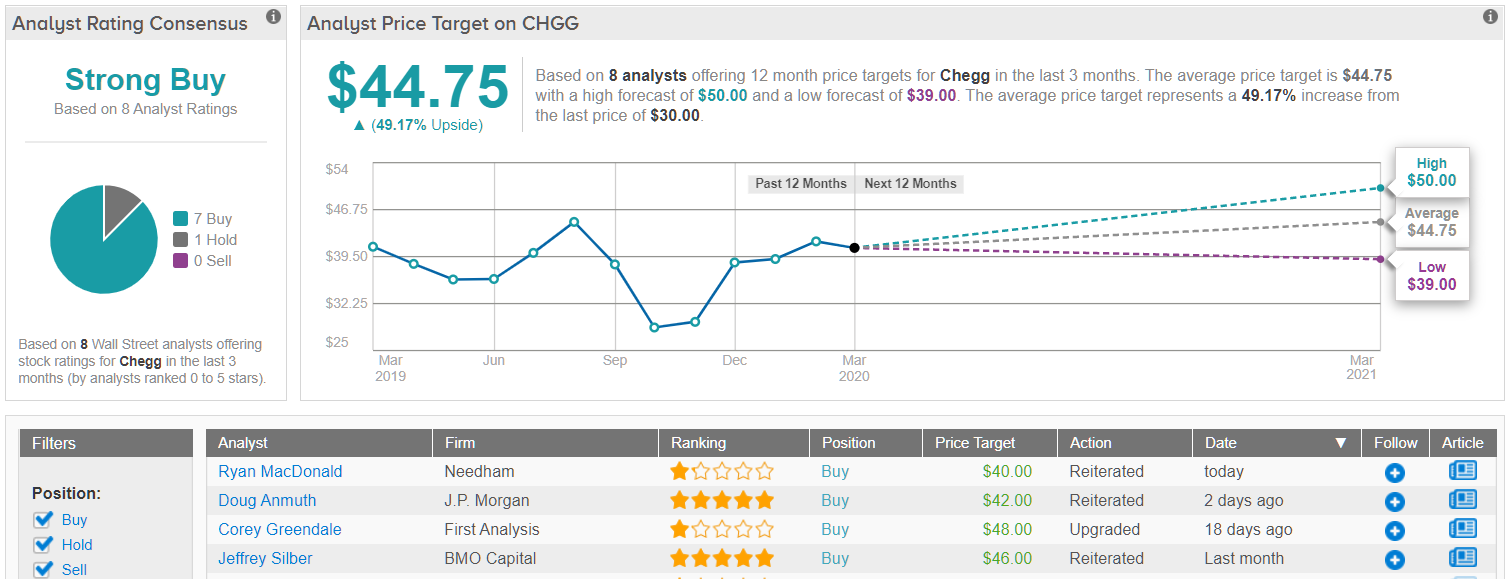

Chegg shares are rated a Strong Buy from the analyst consensus, as 7 out of 8 recent reviewers came down on the Buy-side. The lone holdout rated the stock a Hold. The average price target of $44.75 suggests a premium of nearly 50% from the current share price of $31. (See Chegg stock analysis on TipRanks)

Broadcom, Inc. (AVGO)

Next up on our list is one of the largest players in the semiconductor chip industry. Broadcom was the sixth largest chip maker, by revenues, last year, and saw $22.6 billion in sales for the 2019 fiscal year. In Q4, the company brought in $5.8 billion revenues, and saw that improve sequentially to $5.9 billion in Q1 fiscal 2020. Earnings for Q1 were reported at $5.25, edging above the estimates but slipping 5.4% year-over-year.

From an investor’s perspective, Broadcom’s value is enhanced by its reputation as a dividend champion. The current quarterly payment , $3.25, annualizes to $13, and gives an impressive yield of 6.8%, almost 3.5x the average among the company’s S&P peers, and far higher than Treasure bonds are yielding. Broadcom has been paying out dividends reliably for the last nine years, and has raised the payment three times in the last three years.

5-star analyst Craig Hettenbach, writing on the stock for Morgan Stanley, rates AVGO shares a Buy. His $340 price target suggests an upside of 74%, strong by any standard.

In his comments on the stock, Hettenbach says, “We … think the stock is poised to outperform after meaningfully lagging the past 2 years… This creates a low bar, and we think AVGO will be able to execute on synergies… If AVGO is able to execute in software it would add to what we view as a very compelling franchise in semis, creating a diversified, highly profitable and cash generative business.” (To watch Hettenbach’s track record, click here)

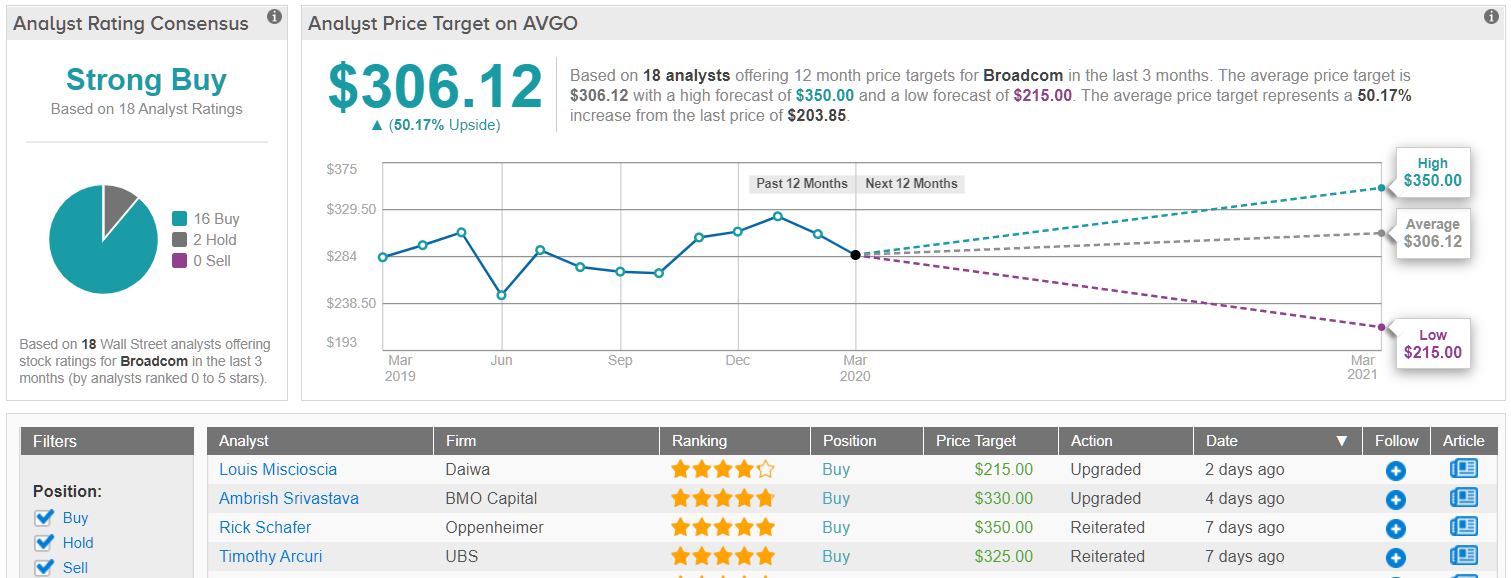

The analyst consensus on AVGO shares is a Strong Buy, based on no fewer than 16 Buy-side reviews against just 2 Holds. It’s not a cheap stock, selling for $191.20, but the $306.12 average price target implies an upside of 50% growth in the coming 12 months. (See Broadcom stock analysis on TipRanks)

Adobe, Inc. (ADBE)

We’ll wrap up with Adobe, a long-time staple of the markets. The company, first founded in 1982, has long been a leader in tech, invented the PDF format, and offers the popular Photoshop and Illustrator graphic editing software packages. The company’s strength is clear from its $11.2 billion in fiscal 2019 revenues.

ADBE shares rose steadily for five months, from October last year until the current market drop began this past February 19. Unlike many companies, Adobe’s rise was high enough that it still shows a net gain for this period (up 17.6% from its most recent trough on October 23 last year). The company’s quarterly reports have reflected the share gains; Adobe has beaten the estimates in seven of the last eight quarters. In Q4 2019, ADBE showed $2.08 billion in revenue and $1.74 in EPS, which increased to $3.09 billion and $2.27 EPS in Q1 fiscal 2020.

A solid financial base and popular, well-known products put Adobe in a sound position to hold its own during a market downturn, especially its software products are cloud-based and amenable to work-from-home conditions. According to Morgan Stanley, Adobe ‘carries momentum’ into the current viral epidemic crisis.

The firm’s 5-star analyst Keith Weiss describes Adobe as a ‘steady ship in stormy seas,’ and writes of the stock, “In volatile environments, we favor owning the most durable EPS stories – where the business model, end-markets and management commitment to sustaining operating margins could enable profitability to better weather a difficult spending environment. In Q1 results, Adobe showed why they are included in our list of high-quality software franchises to own through the current volatility.”

Weiss puts a $366 price target on ADBE shares, indicating room for potential growth of 19%, and supporting his Buy rating. (To watch Weiss’s track record, click here)

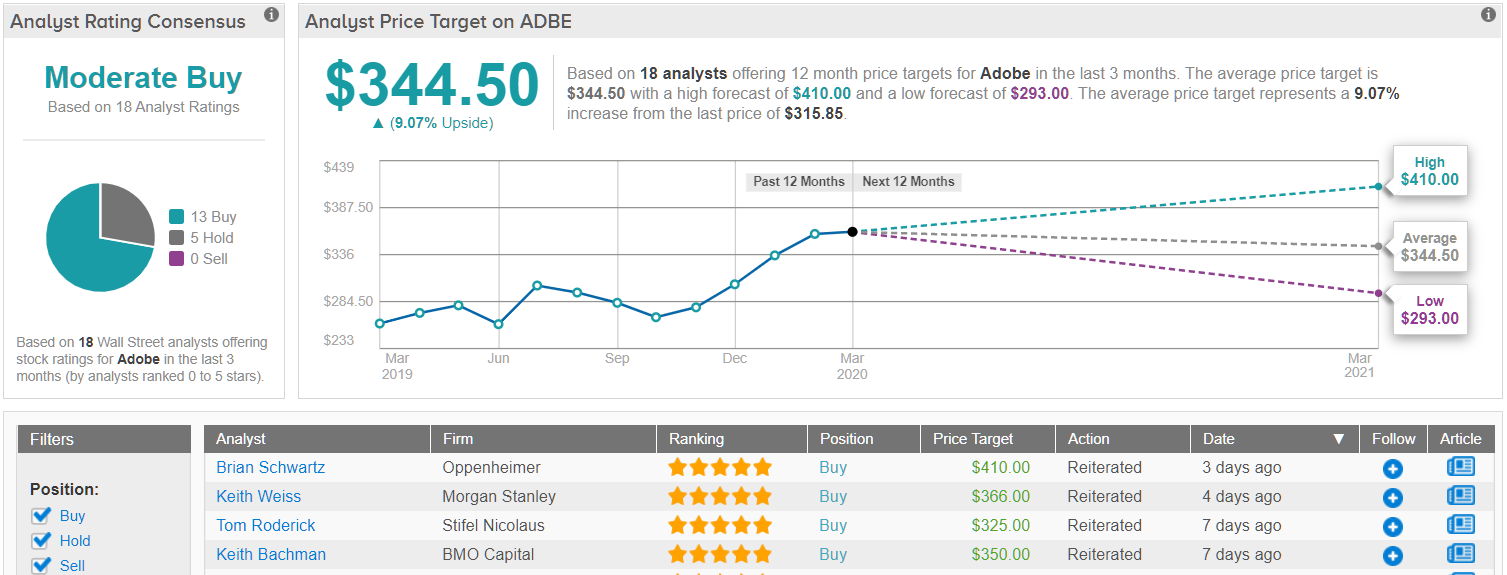

Weiss is not alone is rating ADBE shares a Buy. The company has received another 13 Buy-side reviews in recent weeks, and taken with the 5 Holds the stock has a Moderate Buy rating from the analyst consensus. Adobe does not pay a dividend, and the stock is expensive at $307, so investors are looking for gains in share appreciation. The average price target of $344.50 suggests that there is room for 12% upside growth in the coming year. (See Adobe stock analysis on TipRanks)