Tech behemoth Microsoft (MSFT) has been a growth juggernaut over the past several years. Yes, the company was originally synonymous with PC operating systems, but its pivot to cloud computing is perhaps its biggest strength now.

Furthermore, Microsoft is presenting clear signs of a rebound with its robust financial quarter and incredible showing in its cloud computing segment.

Therefore, MSFT stock seems like an incredible long-term play, especially since it’s down 24% year-to-date. We are bullish on the stock.

Cloud Computing – A Massive Growth Catalyst for Microsoft

As mentioned earlier, Microsoft initially focused on PC operating systems but has shifted to cloud computing to make up for the decline in demand for PCs and spread risk across multiple revenue streams. This resulted in Microsoft’s cloud computing service Azure, which stands toe-to-toe with Amazon (AMZN) Web Services (AWS).

So, tech giants, including Amazon, Alphabet (GOOG), and Microsoft, have cloud computing segments worth billions of dollars. Yet, according to research, IT companies have ignored and underspent on cloud computing despite a considerable growth opportunity.

So, the pivot to cloud computing offers a massive opportunity for Microsoft to scale further. Not to mention, Microsoft’s decision to invest in cloud computing with Azure helped the company reach a $2 trillion market cap.

According to research firm Gartner (IT), currently, less than one-third of digital work is done on cloud operating platforms, but by the end of 2025, more than 95% of work will be carried out on the cloud. So, the robust growth in the cloud could bring about a revolution for Microsoft.

The Growth Machine Isn’t Stopping

Microsoft’s Fiscal Q3 earnings, released in late April, were very impressive. The company posted revenue of $49.36 billion, up 18% year-over-year. Not just this, but the revenue exceeded analysts’ expectations of $49.05 billion.

The company credited a chunk of its third-quarter growth to the cloud, with revenue climbing 29% in this segment. In addition, the company generated earnings per share of $2.22 against expectations of $2.19.

This is impressive, but what’s shocking is Microsoft’s results in Intelligent Cloud. The company generated more than $19 billion in Intelligent Cloud, reporting an increase of 26% year-over-year. In addition, the company’s CEO, Satya Nadella, mentioned that the number of Azure deals worth more than $100 million increased over 100% year-over-year.

In contrast, the company’s Productivity and Business Processes segment generated $15.79 billion in revenue, which surpassed estimates. Furthermore, Microsoft’s income during the first three quarters of 2022 amounted to $56 billion, 25% higher than the prior year period. Rising margins offer operating leverage to Microsoft and enable the company to keep its competitors on their toes.

In its guidance, the company mentioned that it expects robust revenue growth in the upcoming quarter. However, it also noted that some parts of the business might yield single-digit growth due to the Russia-Ukraine war and Chinese production shutdowns due to the pandemic. Unfortunately, these macroeconomic headwinds are inescapable, so there’s little that Microsoft can do.

However, on a positive note, Microsoft ended its third quarter with more than $25 billion in operating cash flow, which is up 14% year over year. The high level of cash generation is augmenting Microsoft’s healthy balance sheet. Currently, the company has over $104 billion in cash and cash equivalents.

Wall Street’s Take on MSFT Stock

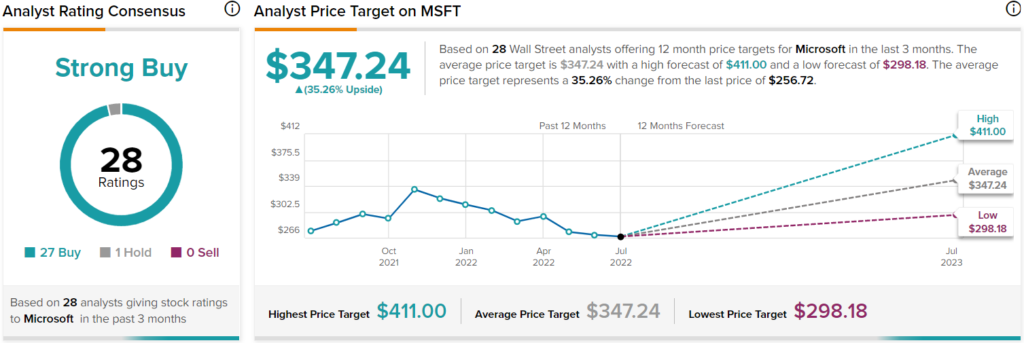

Turning to Wall Street, MSFT stock maintains a Strong Buy consensus rating. Out of 28 total analyst ratings, 27 Buys, one Hold, and zero Sell ratings were assigned over the past three months.

The average MSFT price target is $347.24, implying 35.3% upside potential. Analyst price targets range from a low of $298.18 per share to a high of $411 per share.

The Takeaway – Don’t Dismiss Microsoft’s Potential

Microsoft is a household name in the tech sphere and a darling for investors. The company has generated billions in revenue and profits, exceeding analyst expectations. Microsoft’s third-quarter reports suggest that it’s still on an upward journey.

Moreover, the business’s cloud segment is thriving, which can contribute immensely to its growth story. Considering the reach of Microsoft’s businesses, it is safe to say that the company is a tech conglomerate.

Yes, Microsoft hasn’t been able to escape the uncertainty in the tech industry, but its financial outlook implies that investors have little to nothing to worry about. So, even with its fair share of challenges, MSFT isn’t a stock that investors would want to write off.