It’s time to take out the crystal ball and try to see what lies ahead for the stock market this year. So far, it’s clear that stocks are rebounding somewhat from the trough of 2022, and one Wall Street expert says there’s more runway for gains.

Writing of the 2023 market situation, Larry Adam, chief investment officer from Raymond James, notes that last year was the second consecutive year of multiple compression – but that situation rarely repeats a third time. He’s predicting a multiple expansion to ‘drive stock market returns’ going forward. To wit: “history suggests that our view of mild recession ending by year end, moderating inflationary pressures, falling interest rates and a less aggressive Fed all suggest that the ‘bad news’ has been priced into the multiple and sets up the prospects for multiple expansion in 2023.”

Adam does concede that earnings are likely to decline this year, but he’s still targeting a year-end S&P 500 at 4,400, or about 10% above current levels. Backing this stance – with multiple expansionary factors – Adam specifically cites the prospect of reduced inflation, with price increases moderating back to ~3%; a consequent slowdown in interest rates, as higher rates will not be needed to combat increasing prices; and a Fed shift to just two further increases in the funds rate, ceasing in March.

So, in the Raymond James view, we should look for a better investment environment coming into play in the second half of this year – and the firm’s stock analyst Andrew Cooper has picked out two equities that he sees primed for gains, and recommends buying in now. Let’s take a closer look.

Natera, Inc. (NTRA)

We’ll start with Natera, a biotech company operating in the cell-free DNA testing niche, or cfDNA. cfDNA tests are minimally invasive, based on a simple blood draw, and focus on naturally occurring DNA fragments that float freely in the bloodstream. Natera’s technology captures those fragments and uses them for genetic testing.

The company’s testing platforms are based on novel molecular biology techniques and AI driven bioinformatics software, and can detect single DNA molecules in a blood sample tube. Natera uses this technology for accurate, non-invasive prenatal testing (the Panorama platform), tumor-specific assay testing for individualized cancer treatments (the Signatera platform), and best-in-class rejection assessment testing prior to kidney transplantation (the Prospera platform).

Diagnostic DNA testing is big business, and Natera is capitalizing on patients’ desire for a less invasive medical experience. The company’s revenues have been showing steady growth for the past several years, and in the last reported quarter, 3Q22, Natera saw a top line of $210.6 million, up 33% year-over-year. The revenue gain came on top of a 27% increase in processed tests during 3Q22, from 407,300 to 517,500. Of that total, the oncology segment saw the strongest growth; the company processed 53,000 oncology tests in the quarter, for a 153% y/y increase.

Natera revised its forward guidance upward in the Q3 report, projecting full-year 2022 revenue of $810 million to $830 million. This was up $40 million at the midline from the previously published guidance. The company is expected to report the 4Q22 results late in February, and we’ll find out then how the guidance holds up.

Joining the bulls, Raymond James’ Andrew Cooper takes an upbeat stance on this company and its stock.

“With each of its segments growing nicely in the near- and intermediate-terms and a catalyst rich setup in 2023, particularly in oncology, we are upgrading shares to Outperform. Leadership in the burgeoning MRD space, where we think it can win additional coverage and potentially guideline inclusion at least for CRC, generates the excitement, while an increasingly profitable women’s health business has its own catalysts in conversation around 22q. This all comes at a valuation that looks, at least on a relative basis, reasonably accommodative all things considered,” the analyst opined.

Cooper’s Outperform (i.e. Buy) rating on NTRA comes with a $58 price target, which implies a one-year upside potential of 35%. (To watch Cooper’s track record, click here)

Overall, this interesting biotech has picked up 9 recent analyst reviews, including 8 Buys against a single Hold – for a Strong Buy consensus rating. The shares are trading for $42.94 and their average price target, at $63, suggests an upside of ~47% for the next 12 months. (See NTRA stock forecast)

Fulgent Genetics, Inc. (FLGT)

Fulgent, the second Raymond James pick we’re looking at, is a full-service genomic testing firm, with a focus on improving patient care in the fields of oncology, infectious and rare diseases, and reproductive health. The company operates a proprietary technology behind its testing platform, and has created menu of tests that is broad, flexible, and able to expand with improved offerings with the growth of the genetic reference library.

This company was founded in 2011, and in the years since it has developed a solid reputation for quality genomic testing. The company provides best-in-class support services for its testing platform, ensuring the best results for the best patient care and outcomes.

In 3Q22, the last reported quarter, the company had a top line of $105.7 million, less than half of the $227.9 million reported in 3Q21. The revenue fall should not be surprising, considering that billable tests dropped y/y from 2.2 million to 952,000. On a positive note, core revenue – which excludes COVID-19 testing products and services – grew by 110% year-over-year to reach $56 million, more than half of the total revenues. The company’s non-GAAP income came in at 32 cents per share, compared to $4.05 in the prior-year quarter.

In short, Fulgent prospered during the pandemic period, when COVID testing requirements boosted demand, and has seen that demand fall sharply as the pandemic has receded. While this has resulted in lower revenues, the company has two bright spots to fall back on: its expanding core revenues and it’s cash holdings, a legacy of the COVID boom time. Fulgent had $918 million in cash and liquid assets as of the end of 3Q22.

Checking in again with analyst Cooper, we find that he sees the company in the midst of a transition, from its profitable pandemic-era COVID testing to an oncology testing base that will provide for future operations.

“With a strong underlying technology backbone across both the wet lab, dry lab, and broader operations, we believe the company can successfully cross-sell these capabilities as well as add new customers for each. The ability to scale without compromising service (where the company boasts competitive if not leading turnaround times) will prove pivotal to the company’s success, but with aims at what the company views as a $105B total core testing TAM, the runway is substantial,” Cooper wrote.

“From an investment perspective, the ~$26 of net cash per share not only helps establish a floor for the stock, but creates additional capital deployment optionality,” the analyst summed up.

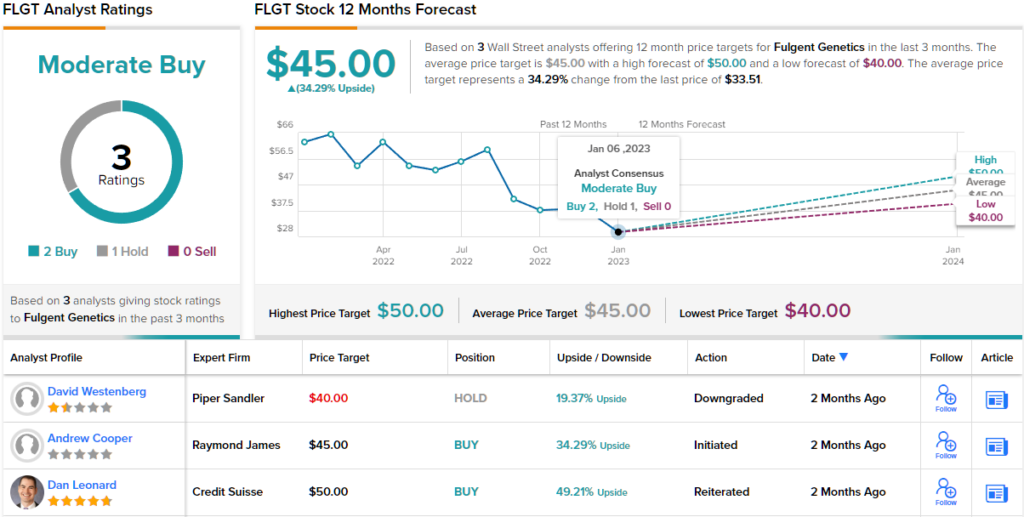

Overall, Cooper believes this is a stock worth holding on to. The analyst rates FLGT shares an Outperform (i.e. Buy), and his $45 price target suggests a solid upside potential of 34%.

Only 3 analysts have weighed in on FLGT shares, and their reviews include 2 Buys against 1 Hold for a Moderate Buy consensus rating. The stock’s average price target of $45 matches Cooper’s. (See FLGT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.