The chaos gripping global markets is showing no signs of abating just yet, with the major indexes bleeding heavily at the start of the week.

The ultimate near-term impact of COVID-19 is difficult to quantify, noted a recent Needham research report. While the investment firm notes that no name is immune from the inevitable slowdown in economic activity caused by a global pandemic, there are some better positioned to cushion the blows.

“If the worrisome number of deaths leads to widespread erosion in consumer confidence both in the United States and abroad, there are companies that may be better insulated from this worst-case scenario.” Needham Research said.

With that in mind, we pulled up 3 of Needham’s top picks which could act as a safe haven should the crisis deepen, and honed in on them with the help of TipRanks’ Stock Screener. In addition to Needham’s endorsement, all three investment opportunities currently come with a Buy rating from the Street. Let’s get the lowdown.

Athersys (ATHX)

Athersys is a small cap clinical-stage biotech which develops novel and proprietary therapies designed to extend and enhance the quality of human life. Year-to-date, the stock is holding up relatively well, exhibiting a modest 2% downturn.

Driving the narrative for the company is its “off-the-shelf” stem cell therapy platform, Multistem. The therapy is being developed for several indications, but most pertinently right now, for pneumonia-induced acute respiratory distress (ARDS). Pneumonia/ARDS is one the leading causes of death for patients infected with COVID-19 and there are no approved drug treatments to address it.

Currently, Athersys’ partner Healios is running a study in Japan, which could potentially support approval. At the least, Needham’s Chad Messer believes an extended COVID outbreak should make enrolling the study easier and would put pressure on the Japanese FDA to approve it quicker.

Messer further added, “In a more extreme scenario the Japanese or even US governments could allow temporary pre-approval use of the drug. MultiStem is in 2 large Phase III stroke trials (one in Japan and one in US/EU) so it has a decent size safety database. Here in the US the drug has Regenerative Medicine Advanced Therapy (RMAT) status and it benefits from favorable treatment for regenerative medicine in Japan under the Pharmaceuticals and Medical Devices Act.”

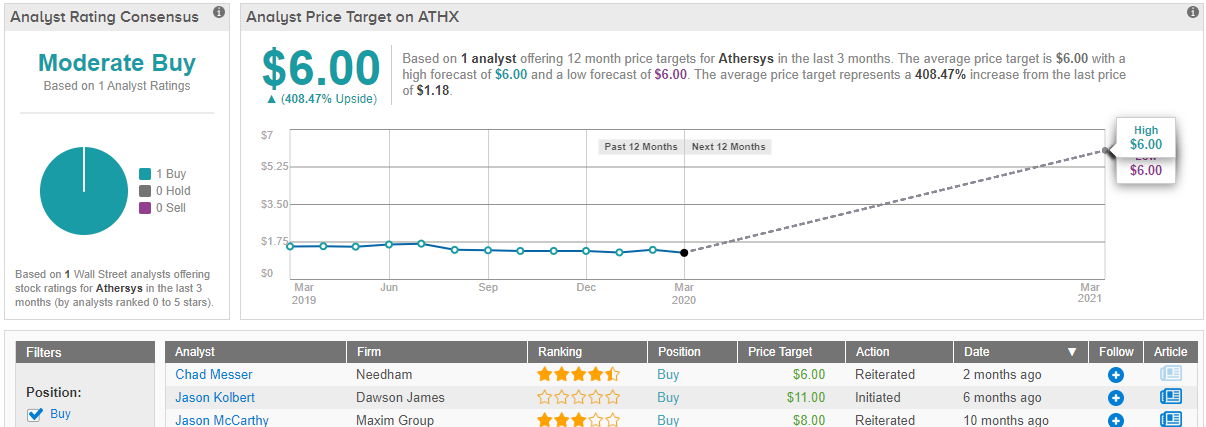

Messer puts a $6 price target on this stock, to go along with his Buy rating. The implication? Upside potential of a blockbusting 396%. (To watch Messer’s track record, click here)

Over the last 3 months, no other reviews of Athersys were published by the analyst community. Therefore, Masser’s thesis provides Athersys with a Moderate Buy consensus rating to go along with the 4-star analyst’s price target. (See Athersys price targets and analyst ratings on TipRanks)

Trulieve Cannabis (TCNNF)

It’s no secret that the last year has been a hard one for the cannabis industry. The space hasn’t yet been able to achieve lift off on the promised cannabis 2.0 catalyst, and several big names in the sector have seen valuations tumble dramatically, as the effects of regulation and over supply issues have hampered their progress. Trulieve went against the over-all trend in 2019 and added an impressive 46% to the share price over the year. In 2020, with the advent of the coronavirus, the company hasn’t been spared; TCNNF stock is down by 24% year-to-date.

Unlike other US MSO’s (multi state operators) that try and gain a foothold in as many US legalized states as possible, Trulieve has been singularly focused on the Florida market. 45 out of the company’s 47 operational dispensaries are located in the state, resulting in the company’s status as the dominant force in Florida’s legal marijuana market. By keeping all its buds in one basket, the company has been able to build brand awareness in the state without resorting to massive marketing campaigns.

Needhams’ Matt McGinley argues “company revenues and growth prospects are likely not altered with Coronavirus.”

The analyst said, “Trulieve sells medical cannabis in Florida where patients must have a physician recommendation, and as such, sales are consistent and unlikely to exhibit volatility related to pandemic concerns… Our overarching conclusions are that momentum and profitable growth in Florida will continue, we expect strong financial performance in ‘20, and we’d expect new market entry via M&A. In a status quo regulatory environment in Florida (which is increasingly likely in ’20), we believe Trulieve will thrive, and that its business is undervalued relative to that growth.”

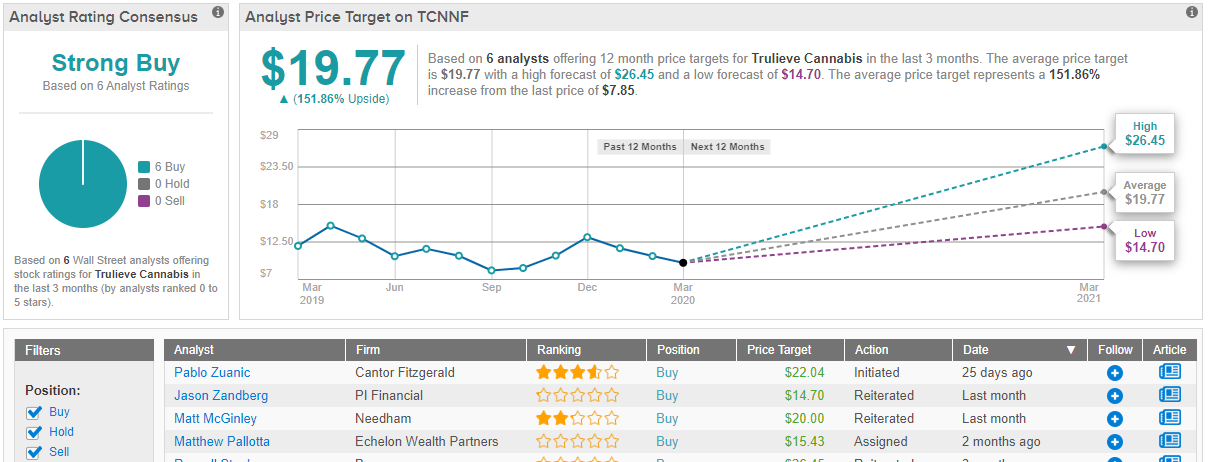

Accordingly, McGinley reiterates a Buy on Trulieve, along with a $20 price target. The figure implies upside of a handsome 122%. (To watch McGinley’s track record, click here)

Other Wall Street analysts are bullish on Trulieve, too. With 6 Buy ratings assigned in the last three months as opposed to no Holds or Sells, the word on the Street is that the stock is a Strong Buy. Given the average price target of $19.95, the upside potential comes in at 121.5%. (See Trulieve price targets and analyst ratings on TipRanks)

Applied Materials (AMAT)

This large cap semi-conductor company blasted its way through 2019, adding 90% to the share price over the year. Applied Materials, like many other names has experienced an outbreak inspired recent pullback, and the stock has shed 5% so far in 2020.

Semi-conductor companies were among the first to adjust future estimates upon being confronted with the news of the outbreak, as many in the space are reliant on a healthy Chinese economy. The slow-down in manufacturing along with supply chain disruptions will likely put a dent in future earnings for a large number of companies operating in the sector.

According to Needham’s Quinn Bolton, if the coronavirus situation gets worse, among semi-conductor companies under the firm’s coverage, Applied Materials is the “flight-to-quality” and “flight-to-liquidity” stock to own.

The analyst explained, “AMAT is more exposed to foundry/logic CapEx that is likely to prove more stable than memory. Top foundry/logic customers of AMAT, including TSMC, Samsung, Intel and China-based foundries, are unlikely to slow down their strategic investments this year. On the other hand, DRAM and NAND equipment demand could see more elasticity and is more likely to falter, should the coronavirus outbreak get worse.”

Additionally, the 5-star analyst adds, AMAT’s display segment, which under normal condition has high exposure to China is already at the cyclical bottom. Therefore, “the risk/reward profile is turning favorable as recovery is expected in 2H20.”

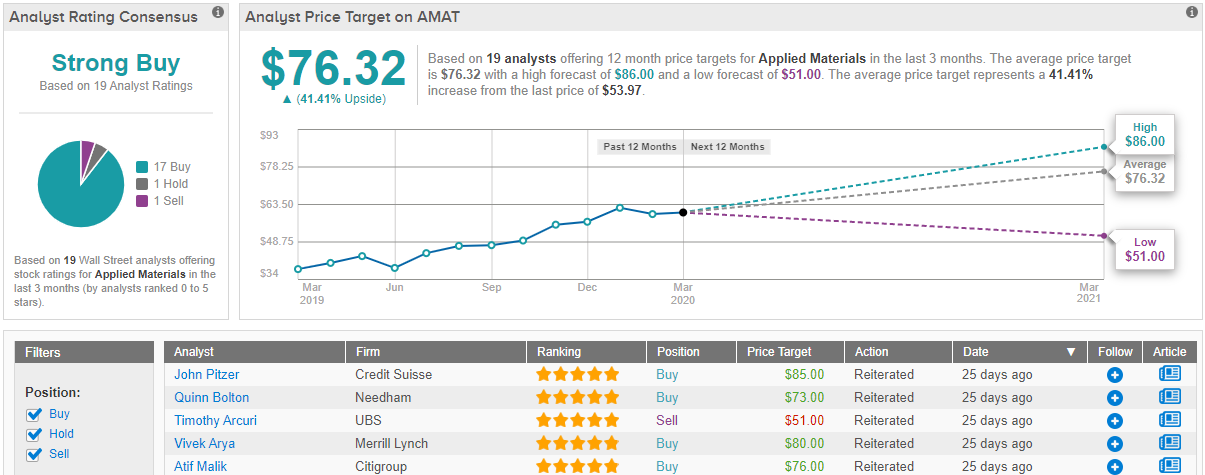

All the above are reasons for Bolton to maintain a Buy rating on Applied Materials. The $73 price target stays put, too, and implies potential upside of 26%. (To watch Bolton’s track record, click here)

AMAT has a large following on the Street, with the vast majority firmly on its side. 1 Hold and Sell each are overcome by 18 Buy ratings, which conclusively add up to a Strong Buy consensus rating. at $76.25, the average price target could provide investor with an additional 32% over the next year. (See AMAT stock analysis on TipRanks)