After nearly a decade of steady stock returns, U.S. markets have hit a rough patch. U.S.-listed stocks, which hit record highs on February 19, have tumbled rather dramatically and quickly since the coronavirus, deemed as COVID-19, was uncovered in China. As has been widely covered in the press, it has since started to spread throughout the world.

A few market pundits predict a lasting or sustainable hit to global economic growth. Largely as a precautionary measure, the U.S. Federal Reserve lowered interest rates by 50 basis points and stands ready with further rate cuts to prop up the economy. Certain industries, including travel-related and economically sensitive ones, could continue to struggle, but most others are projected to see a more limited downturn and a V-shaped recovery, or a quick bounce back to normal financial conditions.

Downturns can also present buying opportunities for contrarian-minded investors. Investment firm Needham has recently been thinking along these lines and came out with a report of its best ideas on stocks that should rally when the spread of COVID-19 will stabilize, and eventually decline.

We’ve taken three of Needham’s top picks and looked them up in the TipRanks database. These are investments that the Stock Screener tool reveals as “Strong Buy” analyst consensus rated and, more importantly, all three offer robust upside potential. Let’s take a closer look.

Athenex Inc (ATNX)

Starting with biotech. Needham’s Chad Messer lists Athenex as his best idea once the COVID-19 situation settles down. The biggest near-term risk is that much of Athenex’s manufacturing capabilities reside in China, which is seeing rather severe coronavirus complications to its supply chain.

Athenex has ambitions to become a global leader, hoping to bring innovative cancer treatments to the market and improve outcomes for patients. It has two lead drug candidates – a treatment for skin condition actinic keratosis, and an oral treatment for metastatic breast cancer. Both have Food and Drug administration (FDA) applications pending.

According to Dr. Messer, “the overwhelming driver for ATNX remain NDA acceptance for its oral chemotherapy Oraxol, which we expect in 2Q.” In preparation for the expected release, Athenex management is building out its sales force and should start to see significant sales come in next year.

Messer’s financial model projects a stellar 74% sales jump next year, reaching $150 million for the full year. However, profits aren’t expected for a few more years. As a result, the $30 price target that accompanies his Buy rating is based off of 5 times the 2025 sales estimate, discounted back to today, and implies 186% upside potential. (To watch Messer’s track record, click here)

The stock is down 31% so far this year. This leaves significant room for upside once Oraxol starts hitting the marketplace. The company also has $161 million on the balance sheet, which is a nice cushion until sales start really coming in.

With 100% Street support, the message is clear: ATNX is a Strong Buy. Should the $27.33 average price target be met, shares could be in for a 161% twelve-month gain. (See Athenex stock analysis on TipRanks)

Mimecast (MIME)

Needham analyst Alex Henderson, who covers networking and security firms, has pegged London, UK-based Mimecast Limited a compelling pick once the COVID-19 situation improves. In a recent report, he touted Mimecast as “the premiere company protecting against email-borne threats.”

Specifically, Mimecast is an email and data security company that provides cloud security and risk management services. Its Mimecast Email Security services are built for threat protection, such as the threat from emails containing malicious links.

The stock chart is far from pretty. The shares have fallen 22% so far this year and a much more severe 37% over the past month. Henderson attributes the severe drop to the fact that nearly half of revenue stems from international sources, including 29% from Europe where COVID-19 containment efforts have not been as effective as in the rest of the world.

Mimecast could struggle to boost sales in the near-term. Henderson characterizes the firm’s sales approach as “high-touch” where travel restrictions could hamper the needed approach from the sales team. Henderson projects 17%-21% average annual sales growth over the next three to five years. He highlighted a couple of new products at the company’s recent investor day, including a browser isolation service targeted for email and web security, as well as a threat intelligence service that allows for the integration of third-party applications to enhance security offerings. Some compelling growth markets, for sure.

Despite these myopic worries, the analyst maintains a Buy rating and price target of $65 per share, suggesting 91% upside potential from the current share price. (To watch Henderson’s track record, click here)

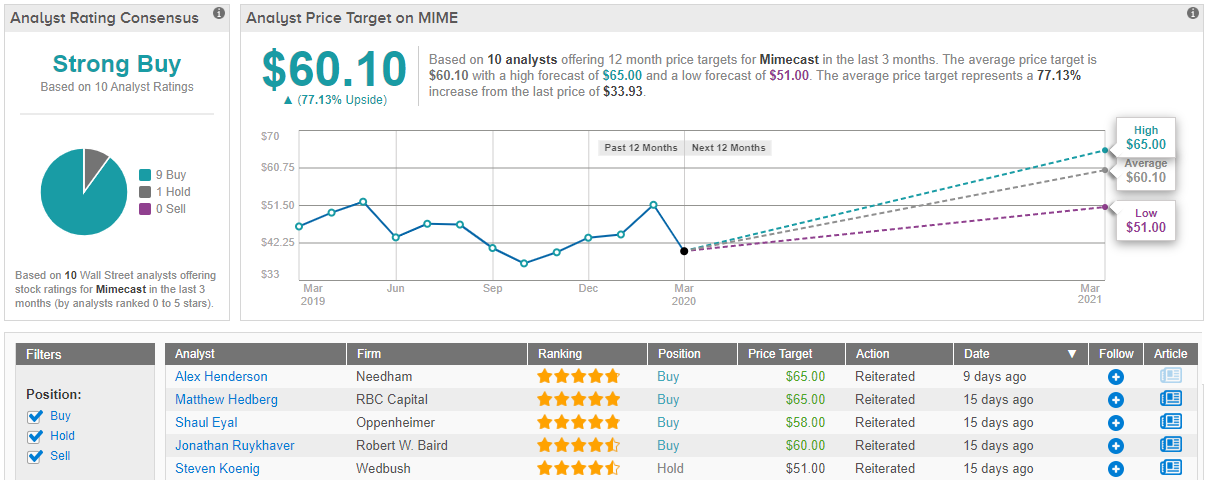

What does the rest of the Street think? It turns out that other analysts are generally on the same page. With 9 Buy ratings vs 1 Hold received in the last three months, the word on the Street is that MIME is a Strong Buy. Not to mention the $60.10 average price target suggests 79% upside potential. (See Mimecast price targets and analyst ratings on TipRanks)

Medallia Inc. (MDLA)

In the software-as-a-service (SAAS) space, Needham analyst Scott Berg has pegged San Francisco-based Medallia as his pick-to-click once COVID-19 complications subside. Medallia bills itself as a deep learning-based artificial intelligence technology that can analyze structured and unstructured data from signal fields in human, digital, and Internet of Things interactions. It’s known as experience management.

Medallia will produce positive operating cash flow later this year, according to his valuation model. Until profit targets improve, the analyst estimates an enterprise value to revenue multiple of 14 times off 2021 sales of $480 million.

The share-price decline of 32% has also been severe this calendar year. That being said, sales growth projections are impressive and the company will be profitable well ahead of target if it reaches these lofty top-line expectations.

Berg maintains a Buy rating on Medallia, and his $45 price target is based on average projected sales growth of above 20% in each of at least the next three years. The price target also suggests the stock can more than double from the current share price of $21.29. (To watch Berg’s track record, click here)

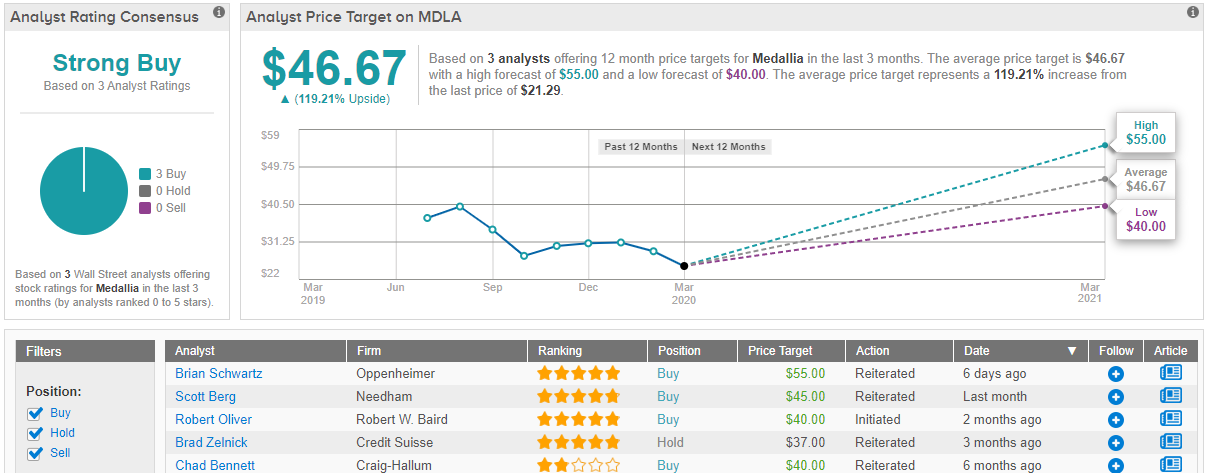

Looking at the consensus breakdown, 3 out of 3 analysts that have published a recent review see the stock as a Buy, making the consensus rating a Strong Buy. At $46.67, the average price target puts the upside potential at 130%. (See Medallia stock analysis on TipRanks)