The retail industry has had to adapt to a new paradigm since the turn of the century. The rise of e-commerce has changed the way consumers shop, with brick-and-mortar stores finding it difficult to compete with the ease of online shopping. For these names, it comes down to the reigning mantra of adapt or die.

Investment firm Needham recently surveyed its shopping basket of retail stocks under coverage in order to reassess how they look going into the year ahead. “We favor companies with strong secular tailwinds, those with discounted valuations that can benefit from self-help, and premium brands with pricing power,” said analyst Rick Patel.

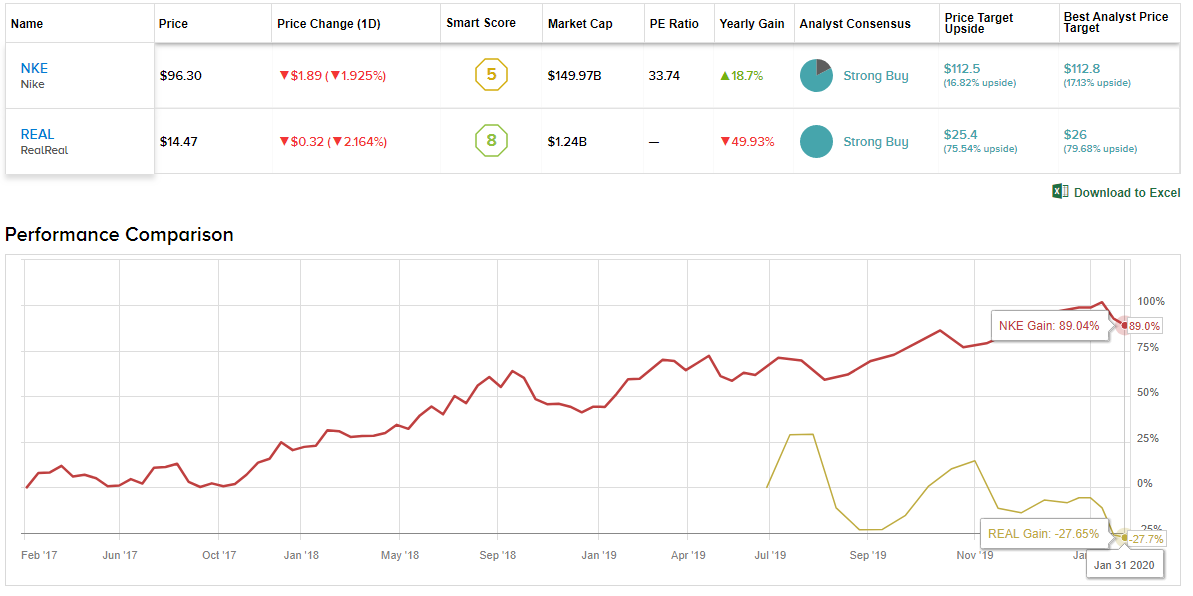

Taking these factors into consideration, we did some research of our own. Using TipRanks’ handy Stock Comparison tool, we were able to get a clearer picture of how the year will pan out for 2 of the investment bank’s choices. It turns out that on top of the Needham recommendation, both currently boast a “Strong Buy” consensus rating from the Street. Let’s take a closer look.

Nike Inc. (NKE)

Nike, obviously, needs no introduction. The global swish machine has a market cap of $150 billion and is the biggest athletics company in the world. Not to mention it had a strong run in 2019, ending the year with an additional 38% attached to its share price. According to Patel, the positive momentum is set to continue through 2020, too.

One of the key drivers for Nike this year is this summer’s Tokyo Olympics. Nike’s superior product and marketing has come to the fore during global sporting events, and the world’s biggest one will present an opportunity to gain market share. The company has hinted that several products in the pipeline could be launched around the time of the event, which in turn, could be a potential catalyst for sales.

Further momentum from China (sales grew nearly 20% in F2Q20), heightened focus on the women’s segment and expected MSD percentage growth in North America are noted as additional drivers in the year ahead. Where the company is really expected to shine, though, is in its Direct business. The direct-to-customer segment has been a success so far, with the Nike and Sneakers app driving 38% digital growth in the previous quarter. Management has stressed the Direct segment could one day represent the majority of Nike’s business.

Patel said, “We anticipate Nike will continue its positive momentum through FY20 as the core business remains strong and opportunities remain compelling across Direct, international and women’s. We see company’s structural shift towards Direct as its strongest growth driver given this channel represents an estimated 20%-plus sales vs Nike’s intermediate target of 30%.”

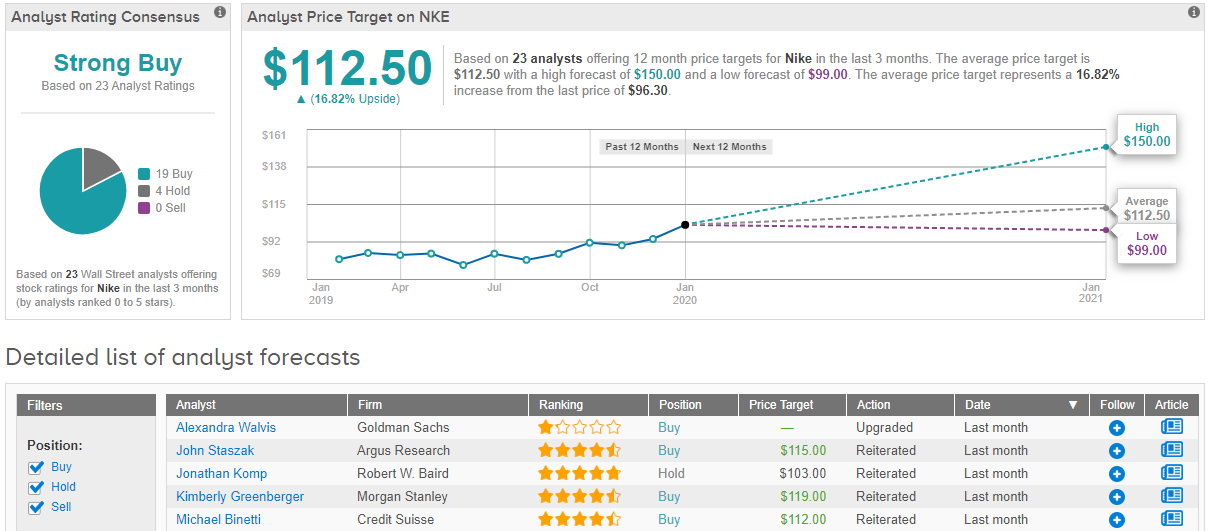

Accordingly, Patel maintained his Buy recommendation on Nike along with the $105 price target. Investors can expect a 9% hike to the Nike share price, should the target be met over the next 12 months. (To watch Patel’s track record, click here)

What does the rest of the Street have to say, then? Of the 23 analysts tracked over the last three months, 19 say Buy, while 4 suggest a Hold. Therefore, Nike earns a Strong Buy consensus rating. At $112.50, the average price target implies upside potential of 17%. (See Nike stock analysis on TipRanks)

RealReal Inc. (REAL)

If Nike represents the old guard trying to keep up with the new kids on the block, then the RealReal’s modus operandi is a very modern proposition. The company’s online luxury consignment marketplace sells second-hand luxury goods – anything from clothes and shoes to jewelry, toys and watches, with all products receiving an authentication stamp from industry experts.

One of the trends becoming increasingly important to millennial and Gen Z consumers is that of sustainability and reduction of waste. RealReal noted in its 2019 Luxury Resale Report that sustainability was a major factor for 82% of the brand’s customers and a further reason for shopping with them. According to a report by Global Fashion Agenda and The Boston Consulting Group, the fashion industry’s production of waste will reach 148 million tons by 2030. RealReal’s emphasis on resale, then, positions it well in what is an emerging sector.

The resale industry is still in its nascent stages and expected to grow substantially over the coming years. More than 35% CAGR (compound annual growth) through 2023 is estimated for the apparel resale category, according to a Global Data & thredUP survey. Patel believes this is a major factor that supports REAL’s growth story.

The analyst said, “The RealReal is our top pick for 2020 as we anticipate a year of strong GMS and sales growth, in addition to significant progress on margin improvement. By connecting luxury consignors with buyers, we view REAL is particularly well positioned to benefit from growth in the emerging resale industry, in addition to ongoing growth in digital commerce and luxury.”

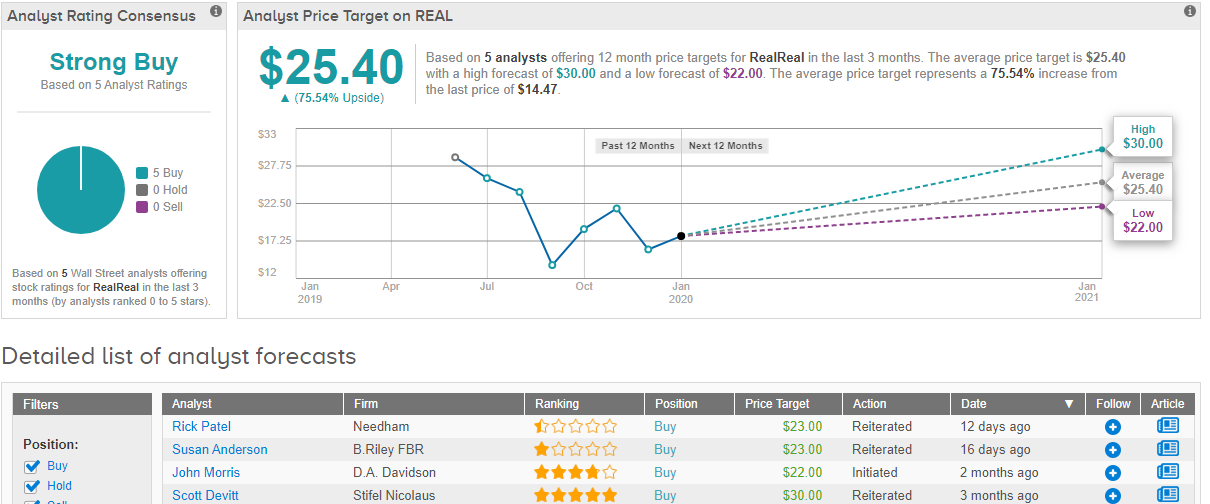

Taking all of this into consideration, Patel kept his Buy rating and $23 price target as is. This means that shares could climb 59% higher in the next 12 months.

The rest of the Street thinks REAL is for real, too. 5 Buy calls coalesce into a unanimous Strong Buy consensus rating. With an average price target of $25.40, the analysts see a 76% increase to the share price in the year ahead. (See RealReal stock analysis on TipRanks)