Netflix (NFLX) said it saw subscriber numbers increase by 15.8 million in the first three months of the year as more viewers flocked to use its video streaming services during global lockdown orders around the world.

The video streaming company had expected to add 7 million subscribers in the first quarter. Out of the 15.8 million subscribers in the first quarter, 4.4 million new customers came from Europe. As of the end March, Netflix had a total of 182.9 million paying customers.

“Like other home entertainment services, we’re seeing temporarily higher viewing and increased membership growth,” Netflix said in a letter to shareholders. “We expect viewing to decline and membership growth to decelerate as home confinement ends, which we hope is soon.”

Total revenue rose to $5.77 billion in the first quarter from $4.52 billion in the same period last year, compared with analysts’ estimates of about $5.76 billion. In addition, Netflix said that the strength of the U.S. dollar impacted its international revenue.

In a forward-looking comment, the company estimated that in Q3 and Q4 it will have lower net customer additions than last year as countries are poised to lift their lockdown restriction orders and the world recovers from the coronavirus pandemic. Moreover, the video streaming service provider, said that its guidance for 7.5 million global paid net subscribers in Q2 was “mostly guesswork” due to the uncertainty of the duration of the global lockdowns.

“The actual Q2 numbers could end up well below or well above that,” Netflix said.

Overall, Netflix said it would maintain its target of a 16% operating margin for the full year 2020.

Netflix shares have been on a winning streak this year surging more than 30%, while the benchmark S&P 500 Index saw a decline of about 12% during the same period. Shares were down 0.8% to close at $433.83 on Tuesday before the earnings release.

Five-star analyst Matthew Harrigan at Benchmark Co. assesses that Netflix’s share price is too expensive as it’s build more on perception than reality. Harrigan yesterday initiated Netflix coverage with a Sell rating and a $327 price target, which is about 25% below current levels.

“Our cautious view is based on our belief that the shares already reflect a ‘lazy long’ halo from the perception of a COVID-19 safe haven,” Harrigan wrote, adding that growing competition and potentially limited pricing power for Netflix doesn’t fit in well with its long-term earnings perspective.

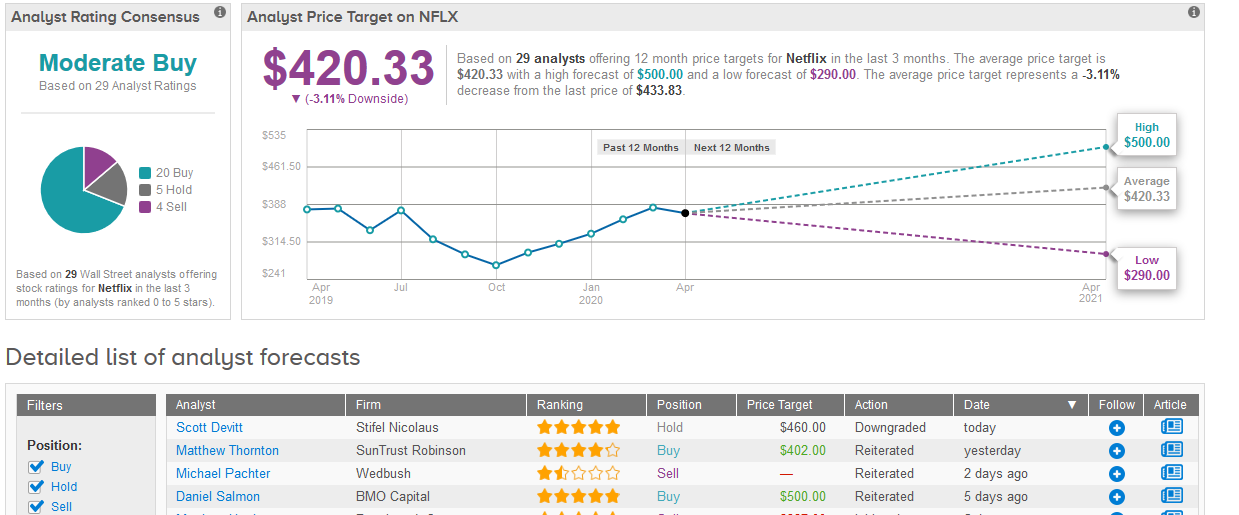

Today Scott Devitt , analyst at Stifel Nicolaus downgraded Netflix’s stock to Hold from Buy with a price target of $460.

Against this, the majority of the Street is bullish when considering Netflix’s prospects. 20 Buys, 5 Holds and 4 Sells add up to a Moderate Buy consensus rating among Wall Street analysts. However, following the recent rally, the average price target of $420.33, implies 3.1% downside potential in the shares in the coming 12 months. (See Netflix stock analysis on TipRanks).

As of the end of the first quarter, Netflix had $5.2 billion in cash, as well as an unused $750 million credit line, the company said.

Related News:

Don’t Jump on the Bandwagon for Netflix (NFLX) Stock, Says Analyst

Facebook Invests An Eye-Watering $5.7B in India’s Jio Platforms

Flir Shares Lifted on Report Amazon Starts Use of Thermal Cameras