The coronavirus’ impact spares no one. Nike (NKE) surprised Wall Street on Friday, when the sportwear giant took a beating by COVID-19 in its F4Q20 earnings report. The market reacted as the market does and sent shares down by 7.5% in the session.

In the quarter, the swish machine reported revenue of $6.31 billion, exhibiting a 38% year-over-year drop and missing the estimates by $950 million. GAAP EPS of -$0.51 missed by $0.54. The overall decline pressured gross profit margin, which came in at 37.3%, lower than the Street’s call for 43.4%.

Broken down by region, sales in the U.S. dropped by 46%, and in Europe by 44%. Only China came in positive, clocking a slight 1% uptick, with sales improving during the quarter.

It was impossible to avoid the coronavirus’ devastating effect across the globe. For eight weeks in F4Q, 90% of Nike stores were shut across North America, EMEA (Europe, the Middle East, and Africa) and APLA (Asia Pacific & Latin America). While digital demand pushed ahead, showing 79% year-over-year growth, it could not make up for the overall slump in retail sales.

90% of Nike stores have now reopened, and despite improving traffic, the numbers are still down year-over-year, prompting Nike to guide for lower F1H21 sales.

However, the crushing quarterly statement hasn’t dimmed Needham analyst Rick Patel’s enthusiasm for Nike. The analyst expects the footwear and apparel giant to bounce back “faster, leaner and stronger.”

Patel commented, “Covid-19 hurt Nike sales more than expected in F4Q20, and FY21 sales growth is planned to be muted. Despite headwinds that should continue through F1H21, we view NKE’s LT bull case remains intact: 1) Growth through direct channels is accelerating due to digital demand; 2) Greater China has already rebounded to positive growth and remains an attractive LT opportunity; 3) Innovative products and marketing are driving outperformance of women’s and kids, areas of strategic importance; and 4) data science is enabling better decision-making, benefiting sales and margins.”

Accordingly, Patel reiterated a Buy on NKE along with a $113 price target. Upside from current levels is 15%. (To watch Patel’s track record, click here)

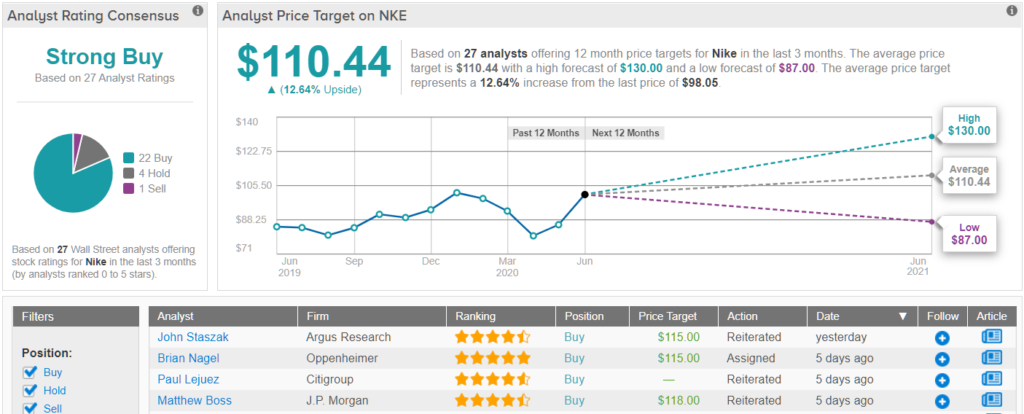

Overall, sentiment remains extremely positive across the Street. 1 Sell and 4 Holds are up against 21 Buys, which coalesce to a Strong Buy consensus rating. There is 18% upside in the cards, should the average price target of $110.21 be met over the next 12 months. (See Nike stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.