Nio and Sinopec have inked a strategic partnership deal to enhance the development of China’s smart electric vehicle industry. The two companies have unveiled the NIO Power Swap Station 2.0, Nio’s inaugural second-generation battery swap station.

The NIO Power Swap station is a one-of-a-kind mass-produced battery swap station that enhances vehicle maneuverability. The swap station is part of Nio (NIO) and Sinopec’s efforts to offer a better charging and swapping experience for electric vehicle owners.

Each station will come with 239 sensors designed to enable automatic maneuvering. It will also come with 4 collaborating cloud computing systems. NIO and Sinopec are planning to collaborate on smart EV tech, Battery-as-a-service, and facility construction.

Under the strategic partnership, the two companies intend to leverage their edge in developing innovative collaboration models in the global energy and automotive industries. Their ultimate goal is to accelerate the transformation from petroleum product sales to a non-oil business focusing on battery swapping and fast charging.

Nio shares are down 25.6% year to date after an 1100% gain in 2020 (See Nio stock analysis on TipRanks).

In March, Morgan Stanley’s analyst, Tim Hsiao, reiterated an Overweight rating on NIO despite chip shortages leading to temporary production suspension at the JAC-NIO manufacturing plant. A five-day production suspension resulted in the company cutting its 1Q 21 delivery guidance by 4% to 19,500 units.

“NIO previously indicated that lingering battery and chip shortages might cap monthly production at 7.5k units in 2Q21; the deteriorated supply dynamics, for chips, in particular, may pose a greater supply risk for now. Our checks with Li Auto and Xpeng suggest sufficient chip supply maintains daily production”, stated Hsiao.

The analyst has a $64 price target on the stock, implying 77.78% upside potential to current levels.

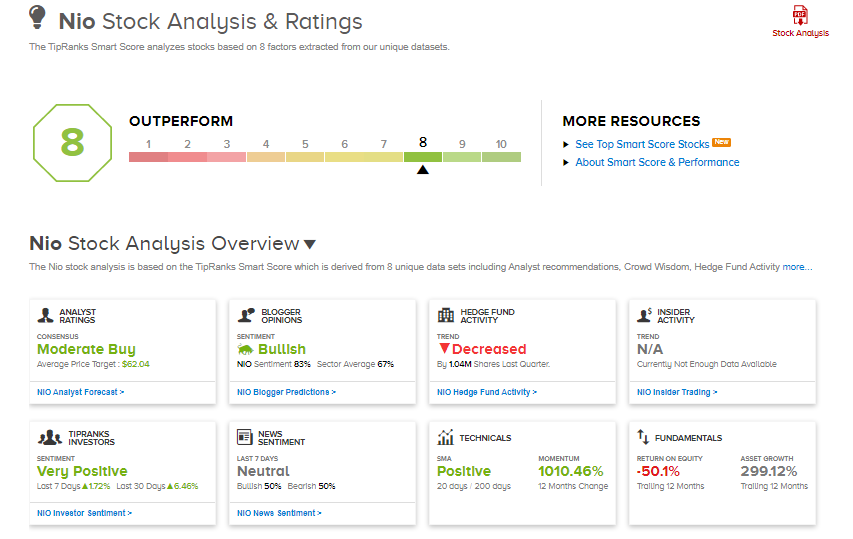

Nio stock commands a Moderate Buy consensus rating on Wall Street. Six analysts rate it as a Buy and 3 as a Hold. An average analyst price target of $62.08 implies 71.90% upside potential to current levels.

NIO scores a strong 8 out of 10 on the TipRanks’ Smart Score tool, implying it is well-positioned to outperform the broader market.

Related News:

DraftKings Inks Betting Deal With NFL; Shares Up 5.3%

PepsiCo Beats 1Q Estimates; Reiterates Outlook

Dell To Spin-Off 81% Stake In VMware; Shares Pop 8.5%