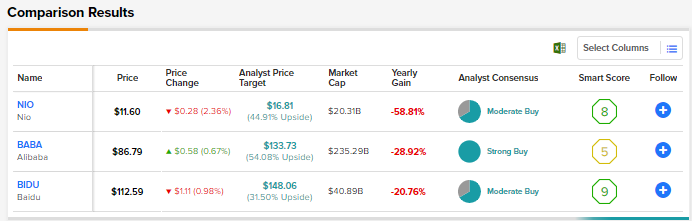

High inflation and fears of an economic slowdown have been a common theme for global stocks this year. However, Chinese stocks had to deal with country-specific risks as well, including the COVID-led disruptions, delisting concerns, and the growing U.S.-China tensions. The easing of COVID-19 restrictions over recent days has revived investors’ hopes. Nonetheless, uncertainty still prevails due to rising COVID-19 cases. Amid this backdrop, we used TipRanks’ Stock Comparison Tool to pit Nio (NYSE:NIO), Alibaba (NYSE:BABA), and Baidu (NASDAQ:BIDU) against each other to pick the most attractive Chinese stock.

Nio (NYSE:NIO) Stock

Production disruptions severely hit Nio and other Chinese electric vehicle (EV) makers this year. The company has ramped up its production to ensure that it ends the year on a strong note. Earlier this month, Nio reported deliveries of 14,178 vehicles for November, reflecting 30.3% year-over-year growth and about 41% month-over-month increase.

The company aims to deliver between 43,000 and 48,000 vehicles in Q4, reflecting year-over-year growth of 71.8% to 91.7%. The easing of COVID restrictions bodes well for Nio’s growth targets.

Looking ahead, Nio aims to boost its sales and improve its profitability, backed by the launch of several new models and its expansion in Europe. During the Q3 earnings call, the company stated that it aims to launch five new models in the first half of 2023. Recently, NIO’s CEO, William Li, announced that the company would launch two new cars at the NIO Day 2022 event slated to be held on December 24.

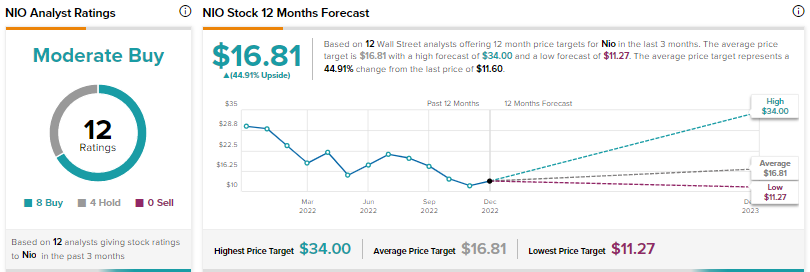

What is the Prediction for Nio Stock?

Wall Street is cautiously optimistic about Nio stock, with a Moderate Buy consensus rating based on eight Buys and four Holds. The average Nio stock price target of $16.81 implies nearly 45% upside potential from current levels. Shares have declined 63% year-to-date.

Alibaba (NYSE:BABA) Stock

Regulatory crackdown, the COVID-19 situation in China, and increasing competition has weighed on Alibaba over recent quarters. The e-commerce giant’s revenue grew 3% in the fiscal second quarter (ended September 30, 2022). While Q2 FY23 revenue improved compared to the fiscal first quarter, it lagged analysts’ estimates. Moreover, investors were also concerned about the slowdown in the company’s cloud computing revenue growth to 4%, compared to 10% in Q1 FY23.

Amid a difficult environment, Alibaba continues to drive cost efficiency, which helped it drive a 15% growth in its Fiscal Q2 earnings to RMB 12.92 ($1.82) per ADS. Alibaba expects its businesses to do well once the macro situation starts improving in China.

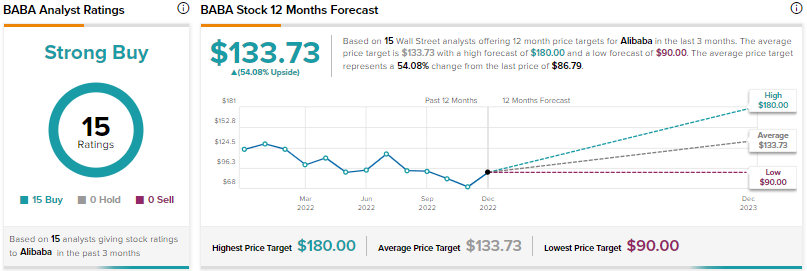

What do Analysts Say about Alibaba Stock?

Benchmark analyst Fawne Jiang feels that the weakness in Alibaba’s Fiscal Q2 results and “soft” Q3 outlook reflect the impact of tough macro conditions and COVID mobility constraints on growth, especially on Alibaba’s core customer management revenue (CMR). CMR indicates revenue that Alibaba derives from services such as marketing that it offers to merchants on the Taobao and Tmall e-commerce platforms.

While Jiang feels that Alibaba is “not out of the woods in terms of a fundamental turnaround,” she is positive about the macro environment in FY24 and expects a recovery in CMR growth with the gradual reopening of China’s economy. Jiang lowered her price target for Alibaba stock to $180 from $206 but maintained a Buy rating.

The Strong Buy consensus rating for Alibaba stock is supported by 15 unanimous Buys. The average BABA stock price target of $133.73 implies 54.1% upside potential. BABA shares have declined nearly 27% year-to-date.

Baidu (NASDAQ:BIDU) Stock

Search engine giant Baidu delivered market-beating third-quarter results, fueled by the strength in the company’s AI Cloud revenue and gradual recovery in its online marketing business. Revenue grew 2% year-over-year to RMB 32.5 billion ($4.57 billion), while adjusted earnings per ADS increased 15% to RMB 16.87 ($2.37). Baidu’s efforts to control costs and shift away from certain lower-margin businesses drove its Q3 profitability.

While Baidu’s ad revenue declined 4% year-over-year, it grew 10% compared to the second quarter. The company’s non-online marketing revenue grew 25%, fueled by AI Could and other AI-powered businesses.

Baidu continues to invest in its AI businesses, including AI Cloud and intelligent driving, to boost its long-term growth. Revenue from AI Cloud increased 24% in Q3 and is a key growth driver for Baidu’s non-advertising revenue. Apollo Go, Baidu’s robotaxi business, which completed over 474,000 rides in Q3, reflects the growing strength of the company’s autonomous ride-hailing business.

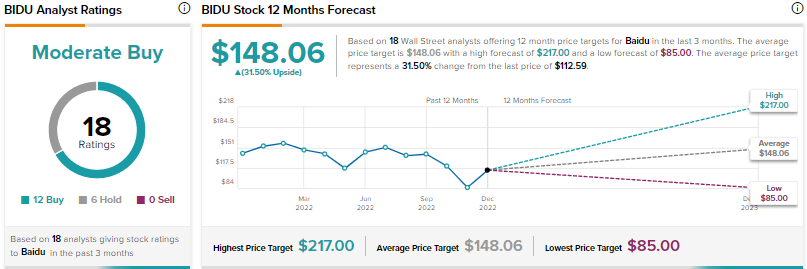

What is the Target Price for Baidu?

Susquehanna analyst Shyam Patil remains optimistic about Baidu despite persistent macro uncertainty. The analyst highlighted the company’s leading position in China’s search market, strength in the feeds market, and its dominant position in AI applications. Patil slashed his price target for Baidu stock to $150 from $195 but maintained a Buy rating.

Overall, Wall Street has a Moderate Buy consensus rating on Baidu stock based on 12 Buys and six Holds. The average BIDU stock price target of $148.06 suggests 31.5% upside potential. Baidu stock is down over 24% this year.

Conclusion

Wall Street seems more optimistic about Alibaba than Nio and Baidu and estimates a higher upside potential in BABA stock than the other two Chinese stocks. Despite the slowdown in Alibaba’s key businesses due to macro challenges, analysts seem confident about the company’s long-term potential in high-growth markets, like cloud computing.

Nonetheless, investors should exercise caution and consider all the risks associated with Chinese stocks before making an investment decision.