Industry eyes will be closely watching Intel (NASDAQ:INTC) CEO Lip-Bu Tan as he takes to the stage at the company’s annual Foundry Day on April 29.

Launched last year as a way for Intel to demonstrate its leadership in the foundry space, there were some big announcements unveiled at the inaugural Foundry Day gathering last February – including the company’s ambition to be the number two foundry in the world by 2030.

Much has changed in the year plus since the last event, including at the very top. Since coming aboard, Tan pledged to revamp the struggling company’s fortunes, including establishing Intel as a “world-class foundry.”

Intel’s investors are eager for some good news, after the company’s Q1 2025 earnings report last week left a bit to be desired. Though the company delivered both top- and bottom-line beats, Intel also acknowledged that revenues for the current quarter will be down.

One investor known by the pseudonym JR Research believes that change is coming, but it will take some time. In other words, don’t expect a quick fix anytime soon.

“While Tan is a highly accomplished semiconductor executive, he also recognizes that there’s no magic bullet in turning around Intel’s fortunes, even as he gets ready to unveil the next strategic steps for Intel Foundry,” explains the 5-star investor.

JR notes that Intel is facing a litany of challenges, including a “bloated” workforce (Tan has already announced that staffing cuts will begin soon), the loss of data center market share, and the U.S.-China trade spat. The investor points out that 29% of Intel’s revenues during fiscal 2024 came from China, making the company particularly exposed to this geopolitical rift.

“The challenges facing Intel aren’t just monumental, but also era-defining, as Tan aptly framed it as a ‘make-or-break’ moment for what used to be America’s preeminent chipmaker,” adds JR.

The investor is therefore keen to understand Intel’s progress with its foundry business, believing that this will have “substantive ramifications” for how the market treats the company in the coming years.

Still, JR expects plenty of potholes on the road ahead, with the outcome far from certain.

“The fundamental thesis propelling a sustainable Intel recovery against all odds while facing formidable competition seems hopeful at best,” concludes JR Research, who is assigning INTC a Hold (i.e. Neutral) rating. (To watch JR Research’s track record, click here)

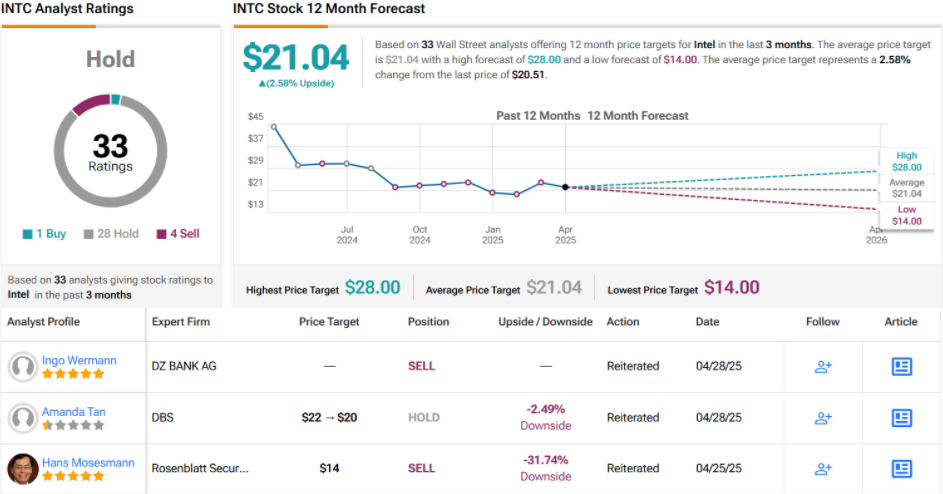

That seems to be the thinking on Wall Street as well. With 28 Hold ratings far above 1 Buy and 4 Sell ratings, INTC is a consensus Hold (i.e. Neutral). Its 12-month average price target of $21.04 implies minimal movement in the year ahead. (See INTC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.