Nokia’s (NOK) strong customer base and upcoming role in the global rollout of 5G networks should see it through COVID-19. So says Canaccord analyst Michael Walkley. The 5-star analyst backs the Finnish telecom equipment maker to deliver “longer-term higher margin growth.”

Walkley reiterated a Buy rating on Nokia shares, along with a $5.50 price target. Expect upside of a handsome 55%, should the analyst’s thesis play out in the coming year. (To watch Walkley’s track record, click here)

So, what’s behind Walkley’s confidence? First of all, solid Q1 results, despite COVID-19 related China supply disruption resulting in a miss on the topline. Revenue of €4.91 billion missed by €240 million and exhibited a year-over-year drop of 3%. But on the other hand, in a difficult macro environment, Nokia managed to squeeze out a tiny profit and met EPS estimates of €0.01, with the company “benefitting from strong gross margin performance in Mobile Access as well as Software.”

Highlights included the progress of Nokia’s new chipset for 5G networks, ReefShark, which amounted to 17% of 5G shipments, an increase of 10% quarter-over-quarter, and on target for the 2020 goal of 35%.

Nokia now boasts “70 5G wins including 21 live networks,” and both Enterprise and Software segments reported strong figures. Enterprise added 30 new logos and Software posted 13% year-over-year operating margin expansion “driven by cloud-native efficiencies.”

Looking ahead, bucking the current trend to remove guidance, management mostly kept its 2020 guidance as is, with non-IFRS EPS (at the midpoint) bought down a touch from €0.24 to €0.23 and operating margin pared back from 9.5% to 9.0%.

Nokia estimates the current quarter will probably be the worst hit, but with a strong balance sheet and its position as a leader in network infrastructure, Walkley implores investors to focus on the long term. Walkley maintains “Nokia will reach its targets through its diversified supplier base to position the company with a more competitive cost structure for 2021 and beyond.”

The analyst concluded, “Despite near-term margin pressure and likely soft 1H/20 results exacerbated by COVID-19 impacting the timing to complete projects given an increasing number of countries under lockdowns, we expect Nokia to emerge as a long-term leader for 5G buildouts with steadily improving margins over the next several years. We believe the risk-reward on the shares is positive for longer-term investors.”

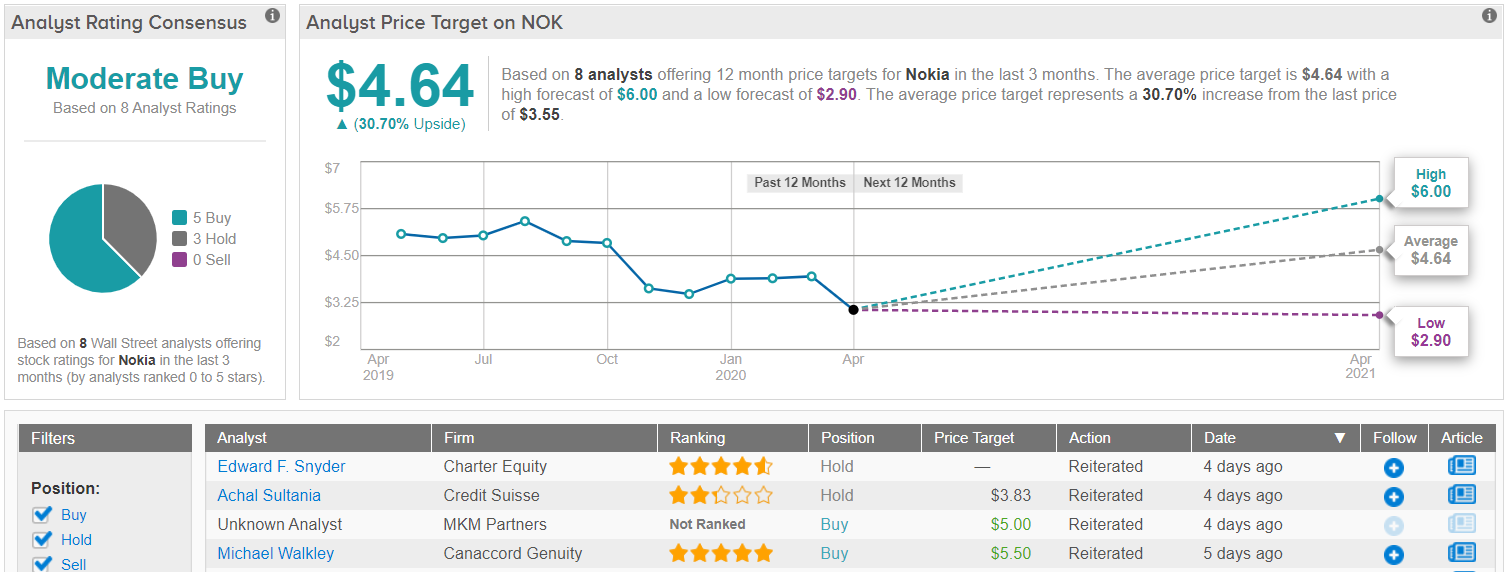

What does the rest of the Street make of Nokia’s prospects? Based on 5 Buys and 3 Holds, the analyst community rates the stock a Moderate Buy. The average price target is $4.64 and suggests gains in the shape of 29% in the next 12 months. (See Nokia stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.