Nordstrom (NYSE:JWN) shares tanked nearly 7% at the time of writing after the fashion retailer delivered a mixed set of third-quarter results. Revenue declined by 6.5% year-over-year to $3.32 billion, falling short of expectations by about $100 million. EPS of $0.25, on the other hand, exceeded estimates by $0.13.

During the quarter, gross merchandise value (GMV) decreased by 7.1% and Nordstrom banner net sales plummeted by 9.4%. Additionally, net sales at Nordstrom Rack ticked lower by 1.8%. Still, the company saw promising growth in active and beauty categories and despite softening consumer spending, maintained a favorable inventory position ahead of the holiday season.

Nordstrom ended the quarter with $1.2 billion in liquidity and a relatively unchanged store count of 360. Looking ahead to Fiscal Year 2023, Nordstrom expects a decline of 4% to 6% in its top line. Adjusted EPS for the year is anticipated to land between $1.90 and $2.10.

Is Nordstrom a Good Stock to Buy Now?

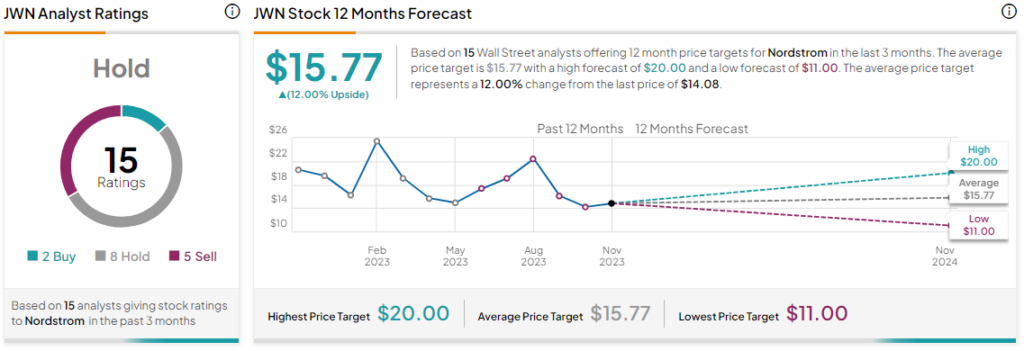

Overall, the Street has a Hold consensus rating on Nordstrom. Following a nearly 30% price correction in the company’s shares over the past year, the average JWN price target of $15.77 points to a modest 12% potential upside in the stock.

Read full Disclosure