Norsk Hydro ASA has clinched a €1.38 billion deal to sell its rolling business to private equity firm KPS Capital Partners, in a move to improve profitability.

The Norwegian energy company announced that the sale of the aluminium foil production segment follows a two-year review and is expected to bolster its balance sheet.

As part of the transaction, Norsk Hydro (0Q11) will receive €435 million in cash proceeds, which will lower the company’s pension liabilities by €856 million. The deal, which is subject to approvals from competition authorities, is expected to be completed during the second half of 2021.

Norsk Hydro’s rolling business operations include seven plants, one R&D center, global sales offices, and around 5,000 employees of which 650 employees are in Norway and the remaining are mainly in Germany. The rolling operations will be recorded as discontinued operations from the first quarter of 2021. “The valuation indicates an impairment of €160 – 190 million, which will be included in the annual financial statements for 2020,” the company stated.

“Hydro’s ambition is to lift profitability and drive sustainability, creating value for all stakeholders. The sale of Rolling will strengthen our ability to deliver on our strategy, strengthening our position in low-carbon aluminium, while exploring new growth in areas where our capabilities match global megatrends,” said Norsk Hydro CEO Hilde Merete Aasheim. “This is a good solution for both Hydro and for the employees in Rolling, who will continue their efforts and continued growth in a new, dedicated downstream company.”

In 2020, Norsk Hydro’s rolling business contributed about 24 billion Norwegian crowns in revenue, or 17% of the company’s total and 1.3 billion Norwegian crowns in underlying EBITDA, or 9% of its total. Sales of the rolling business amounted to 864,000 tonnes aluminium.

Shares of Norsk Hydro have had a great run, ballooning over 90% over the past year, and are up more than 20% so far this year. (See Norsk Hydro stock analysis on TipRanks)

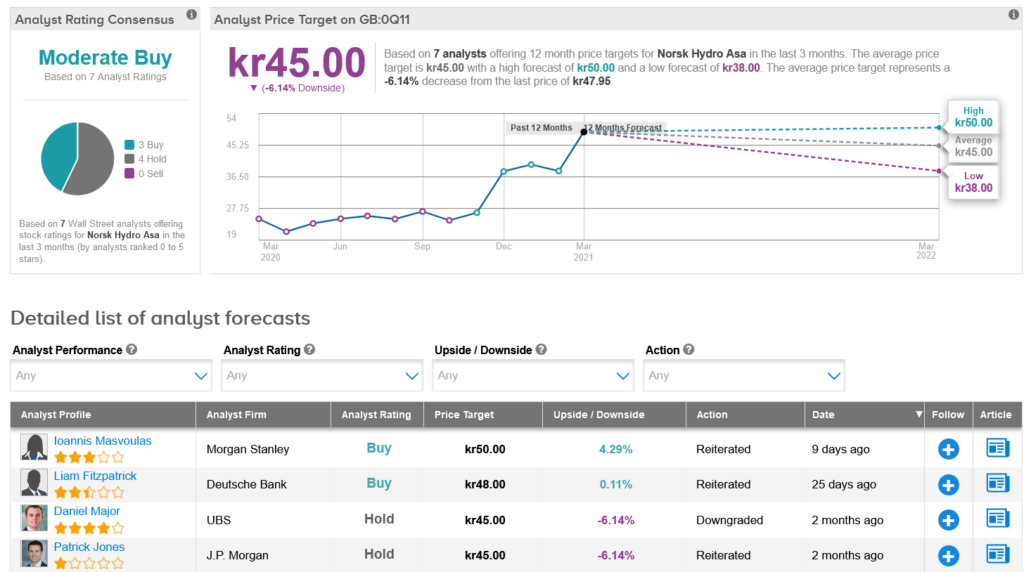

The analyst community is cautiously optimistic about the stock. The Moderate Buy consensus rating breaks down into 3 Buys and 4 Holds. Meanwhile, the average analyst price target of kr45, implies about 6% downside potential lies ahead over the coming 12 months.

Related News:

GM, LG Energy Mull Second Battery Cell Plant In US; Street Is Bullish

Snowflake’s Loss Doubles In 4Q; Shares Drop 3.8%

Splunk’s 4Q Results Top Wall Street Estimates; Shares Jump 5.1%