Swiss drugmaker Novartis AG (NVS) said Monday it has acquired U.S. software start-up Amblyotech, to develop digital technology to treat children and adults with lazy eye.

Novartis said it will work in collaboration with video game creator Ubisoft and McGill University to develop the purchased digital technology for the treatment of the lazy eye condition, also known as amblyopia. Terms of the acquisition were not disclosed. Lazy eye can lead to poor vision and affects roughly 3% of the world’s population, the drugmaker said.

“By offering a noninvasive solution that has the potential to be significantly faster than current standards of care such as patching for children and adults impacted by lazy eye, Amblyotech’s software is a great example of how we can reimagine medicine using digital technology,” said Nikos Tripodis, Head of Global Business Franchise and Ophthalmology. “We look forward to using our deep clinical development expertise in ophthalmology to accelerate this platform toward regulatory approval, and our global commercial footprint to maximize access for patients who need it.”

Amblyotech uses active gaming and passive video technology with 3-D glasses, training the eyes to work together to view an image in full. Its software employs visual presentation, called dichoptic display, where each eye is presented with different images using a proprietary algorithm.

In early clinical studies, Amblyotech’s software demonstrated improvements in vision in both children and adults with faster onset compared to standard of care treatments. The Swiss drugmaker said it plans to work together with Ubisoft to develop the Amblyotech software as a medical device, create a series of engaging games for the device, and conduct a proof of concept study (PoC), expected for later in 2020.

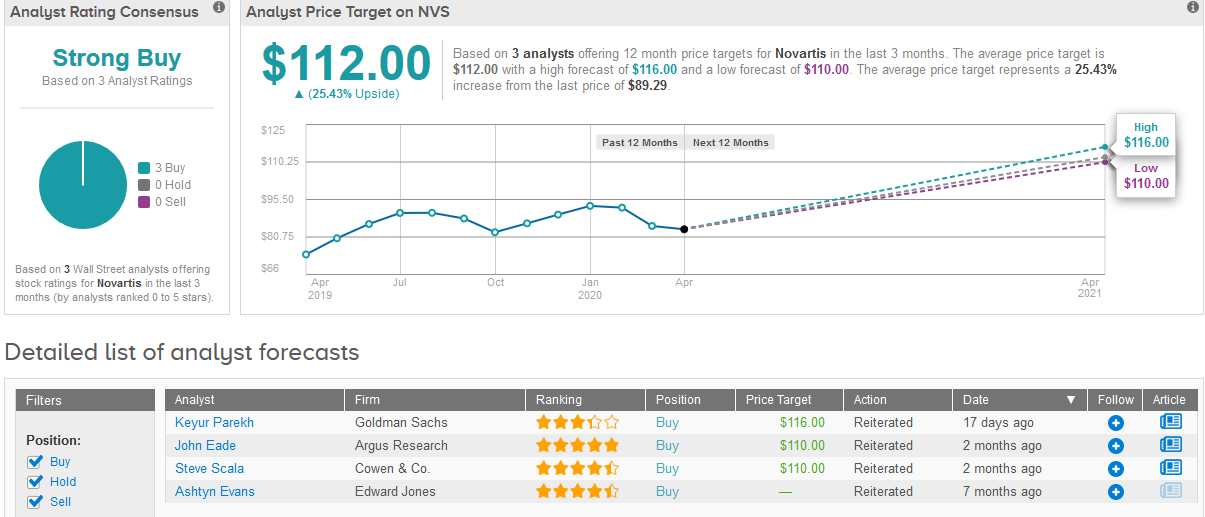

Wall Street analysts are bullish on Novartis stock. TipRanks data shows that all three analysts covering the company in the past three months have a Buy rating adding up to a Strong Buy consensus. The $112 average price target implies a 25% upside potential in the next 12 months (See Novartis stock analysis on TipRanks).

Related News:

Verizon Snaps Up Zoom Video-Conferencing Rival BlueJeans

China Development Bank, General Electric Cancel Boeing 737 MAX Jet Order

3 Top Biotech Stocks with FDA Approvals on the Horizon