COVID-19 has provided opportunity for a number of healthcare companies to take the baton and run with it. One of the names to force its way into public consciousness has been vaccine specialist Novavax (NVAX). The company was quick off the mark to begin developing a vaccine and has positioned itself at the forefront of the fight against COVID-19. Accordingly, the share price has shot up by a massive 345% year-to-date.

But there’s more potential upside from here, argues H.C. Wainwright analyst Vernon Bernardino.

“We believe Novavax’ identification of NVX-CoV2373 as its lead candidate vaccine against SARS-CoV-2, supports our view of Novavax as a leading vaccine developer. Recall that the genetic sequence of SARS-CoV-2 had only become available in late January 2020. On April 8, 2020, Novavax announced that NVX-CoV2373 showed it was highly immunogenic in animal models,” Bernardino said.

Although still at the preclinical stage, Bernardino argues the results validate Novavax’s “promising approach.” With the first in-human trial of NVX-CoV2373 anticipated to begin this month and the potential of preliminary data available as early as July, the analyst believes “positive Phase 1 results could be a positive catalyst in 3Q20.”

Bernardino also expects more funding to be heading Novavax’s way. Back in March, the company received $4 million from the Coalition for Epidemic Preparedness (CEPI) to accelerate the vaccine’s development. Following BARDA’s (the Biomedical Advanced Research and Development Authority), grant of $438 million to rival Moderna for the development of its CoV vaccine, Bernardino believes additional funds could be provided for the development of other vaccine candidates.

“We believe Novavax can qualify for an initial BARDA grant of $5M later this year, with potential for a more lucrative long-term commitment from BARDA in early 2021,” said the 5-star analyst.

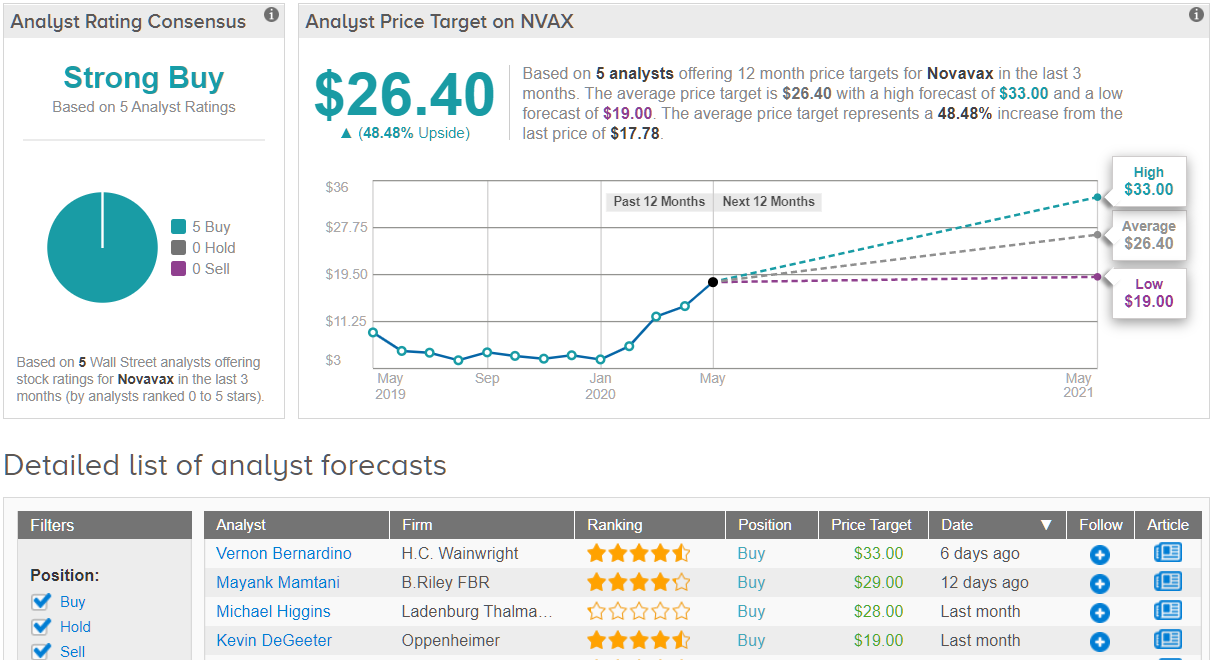

With so much to look forward to, Bernardino raises the price target for NVAX to $33 (from $24) along with a Buy rating. The implication for investors? Upside of a massive 86%. (To watch Bernardino’s track record, click here)

The Street is on the same page as Bernardino. 5 Buy ratings coalesce to a Strong Buy consensus rating. At $24.6, the average price target could provide investors with upside of 42% over the coming months. (See Novavax stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.