Shares of Novavax sank more than 9% in Monday’s pre-market session as the drugmaker further delayed the start of the US late-stage trial of its COVID-19 vaccine.

In an update on the Phase 3 trials of NVX-CoV2373, Novavax’s (NVAX) vaccine candidate, the company said that it will roll out the pivotal clinical trial in the US and Mexico in the coming weeks. The trial, which is set to enroll up to 30,000 participants, was expected to begin at the end of November, after already being delayed before.

NVX‑CoV2373 is a stable, prefusion protein made using Novavax’s recombinant protein nanoparticle technology and includes the company’s proprietary Matrix‑M adjuvant.

“Novavax is in a leading position to significantly contribute to the need for safe and efficacious vaccines that will ultimately end the worldwide COVID-19 pandemic,” said Novavax CEO Stanley C. Erck. “We continue to make meaningful progress as we work to test, manufacture and ultimately deliver NVX-CoV2373 with unprecedented speed, as well as put partnerships in place that would ensure widespread and equitable access worldwide.”

Meanwhile, Novavax said that overall, two of the three planned late-stage efficacy trials for NVX-CoV2373 are fully enrolled, and more than 20,000 participants have now been dosed to-date. The primary efficacy endpoints for these trials have been harmonized and reviewed by global regulatory agencies to facilitate regulatory approval, the company said.

In the UK, Novavax completed the enrollment of 15,000 participants in a pivotal Phase 3 clinical trial being conducted to evaluate the efficacy and safety of NVX-CoV2373. Interim trial data results are expected as soon as the first quarter of 2021, although the timing depends on the overall COVID-19 rate, the company added. The data will serve as the basis for the licensure application in the UK, European Union and other countries.

Novavax is also conducting a Phase 2b trial in South Africa to evaluate safety and to provide an early indication of efficacy. A total of 4,422 volunteers are taking part in the trial, which includes 245 medically stable, HIV-positive participants. The availability of efficacy data depends on the illness rate in South Africa and may also be available as soon as the first quarter of 2021, the company said.

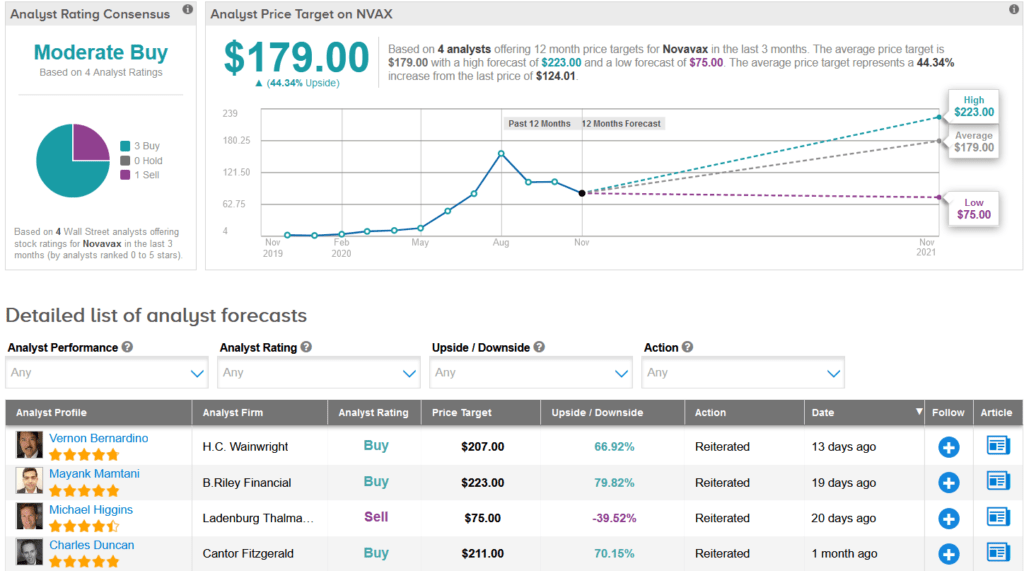

Despite the late-stage trial delay, the stock is up 54% over the past month, taking this year’s run to a stellar 3,030%. (See Novavax stock analysis on TipRanks).

In reaction to the recent delay, H.C. Wainwright analyst Vernon Bernardino lowered the stock’s price target to $207 (67% upside potential) from $290, but reiterated a Buy rating as he believes that Novavax has a “first-class vaccine development program,” and the stock represents an “attractive value proposition.”

“However, with the recently announced delay in manufacturing adequate supply of the antigen component of NVX-CoV2373, we moved our projection for the vaccine’s Emergency Use Authorization (EUA) to 1H21 vs. our prior YE20 projection,” Bernardino wrote in a note to investors. “While we believe front-runners in the race to advance regulatory approval of a COVID-19 vaccine, may be ahead 4-6 months with their programs, we believe the scope and robustness of Novavax’ COVID-19 vaccine program remains underappreciated for its broad clinical strategy, the most comprehensive global vaccine distribution plan, in our opinion, in the CoV vaccine landscape, and plans for manufacturing scale up and top-line clinical readouts that are optimized to dovetail into multi-hundred million vaccine dose readiness and EUA by mid-2Q21.”

The rest of the Street has a cautiously optimistic outlook. The Moderate Buy analyst consensus is based on 3 recent Buy ratings versus only 1 Sell rating. Meanwhile, the average analyst price target of $179 indicates another promising 44% upside potential from current levels.

Related News:

Moderna To File For Covid-19 Vaccine Emergency Use Today; Shares Pop 13%

Moderna Inks UK Deal For 2M Covid-19 Vaccine Doses; Street Sees 15% Downside

Fulgent Genetics Lifts 2020 Sales Outlook; BTIG Flips To Hold