Novavax reached an agreement in principle with the Government of Canada to supply up to 76 million doses of NVX-CoV2373, its COVID-19 vaccine candidate.

Novavax (NVAX) and Canada expect to finalize an advance purchase agreement under which the company will supply doses of NVX-CoV2373 as early as the second quarter of 2021. The purchase arrangement will be subject to licensure of the Novavax vaccine by Health Canada.

“We are pleased to work with the Canadian government on supply of our COVID-19 vaccine, an essential step to ensure broad access of our vaccine candidate,” said Novavax CEO Stanley C. Erck. “We are moving forward with clinical development of NVX-CoV2373 with a strong sense of urgency in our quest to deliver a vaccine to protect the world.”

Canada Minister of Public Services and Procurement Anita Anand said that the agreement will give its citizens “access to a promising COVID-19 vaccine candidate”.

NVX-CoV2373 is currently in multiple Phase 2 clinical trials. The Phase 2 portion of the Phase 1/2 clinical trial to evaluate the safety and immunogenicity of NVX-CoV2373 kicked off in August in the US and Australia. The trial expands on the age range of the Phase 1 portion by including older adults 60-84 years of age, which make up about 50% of the participants. Secondary objectives include preliminary evaluation of efficacy. In addition, a Phase 2b clinical trial to assess efficacy began in South Africa in August.

The latest agreement builds on a number of supply deals Novavax has closed with other countries in recent weeks including last month’s agreement with the UK for 60 million doses of NVX-CoV2373.

Novavax’s vaccine candidate has been selected to be part of Operation Warp Speed (OWS), a US government program that seeks to begin supplying millions of doses of a safe, effective vaccine for COVID-19 in 2021. As part of the program, the company has been awarded with $1.6 billion in funding for testing and manufacturing as well as the supply of 100 million doses of the potential vaccine to the US as early as late 2020.

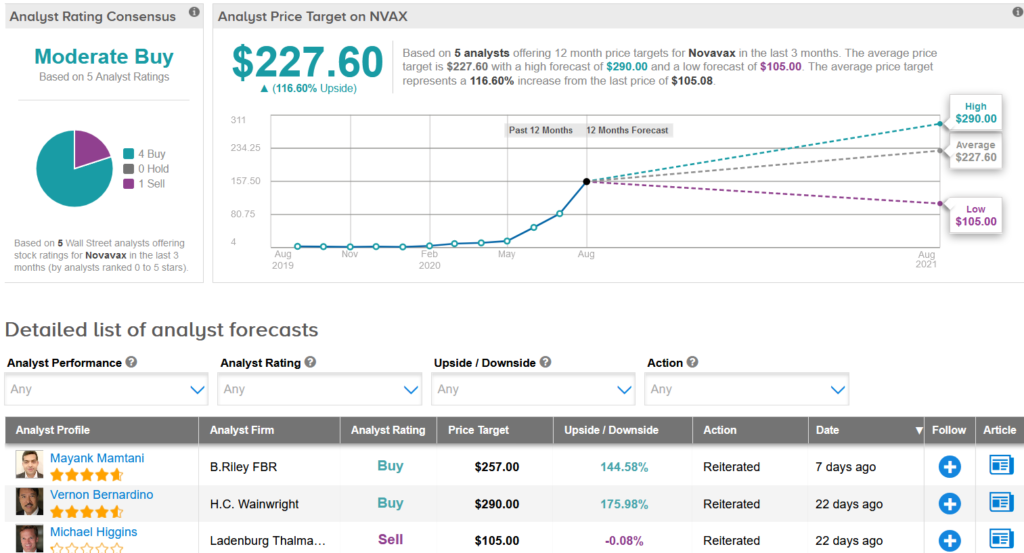

Despite the positive news, the stock dropped 4.8% to $105.08 at the close on Tuesday, taking the decline over the past month to 33%. It looks like investors are continuing to take some profits after shares rallied 2,539% this year in the run-up to developing a coronavirus vaccine candidate. (See Novavax stock analysis on TipRanks).

Ladenburg Thalmann analyst Michael Higgins last month cut the stock to Sell from Hold and maintained a $105 price target, saying that the rally has gone too far.

“We believe Novavax’s current valuation overestimates the revenue and net profit opportunity, as we continue to reach our price target of $105, which produces our Sell rating from Neutral,” Higgins wrote in a note to investors. “There are at least three COVID-19 vaccines ahead of Novavax’s vaccine in the US.”

The rest of the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus shows 4 buy ratings versus Higgins’ sell rating. Meanwhile, the $227.60 average analyst price target indicates a promising 117% upside potential from current levels.

Related News:

Sanofi Says Kevzara Drug Fails To Meet Endpoints in Covid-19 Study

AstraZeneca Kicks Off US Late-Stage Trial Of Covid-19 Vaccine Candidate

T2 Bioystems Spikes 19% On FDA Nod For Covid-19 Molecular Test