The Magnificent 7 stocks: Alphabet ($GOOGL), Amazon ($AMZN), Apple ($AAPL), Meta Platforms ($META), Microsoft ($MSFT), Nvidia ($NVDA), and Tesla ($TSLA), are prominent tech companies that are known for their market dominance, innovation, and influence on the NASDAQ (NDAQ) and S&P 500 (SPX) indices. In 2024, semiconductor giant Nvidia led the pack, with a 171% gain fueled by the AI wave. Using TipRanks’ Stock Comparison Tool, we will compare three Magnificent 7 stocks with a Strong Buy consensus rating and “Perfect 10” smart score to pick the one with the highest upside potential, according to analysts.

Nvidia (NASDAQ:NVDA)

Nvidia stock has rallied over 132%, thanks to the robust demand for its advanced GPUs (graphics processing units) that are required to power AI models. The impressive growth in the company’s revenue and earnings in recent quarters reflects the solid momentum that NVDA’s GPUs are witnessing due to the ongoing generative AI boom. Given these AI tailwinds, Nvidia has surpassed iPhone maker Apple ($AAPL) to become the world’s most valuable company with a market cap of $3.61 trillion.

Looking ahead, there are high expectations from the company’s Blackwell platform. Moreover, the company is expected to benefit from the recently announced U.S. AI infrastructure project called Stargate.

Is NVDA a Good Stock to Buy?

Recently, Barclays analyst Thomas O’Malley highlighted the semiconductor stocks that he likes for 2025, including Nvidia. The analyst stated that Nvidia remains the dominant player in AI compute. He expects the company’s data center compute business to grow by nearly 60% year-over-year in 2025, driven by next-generation GPUs and advancements in networking architecture.

O’Malley expects the company’s Blackwell offering to generate around $15 billion in revenue in the first quarter, with the potential to more than double the number quarter-over-quarter. Additionally, the analyst sees significant upside in the second half of 2025, supported by the robust momentum in the B200 cycle and the growth in the B300/Ultra offerings.

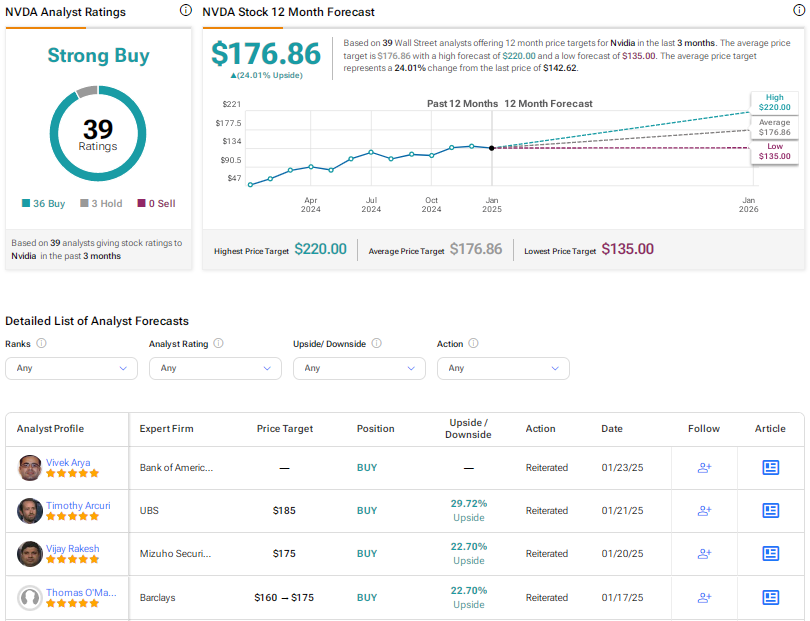

With 36 Buys and three Holds, Nvidia stock scores a Strong Buy consensus rating. The average NVDA stock price target of $176.86 implies 24% upside potential.

Alphabet (NASDAQ:GOOGL)

Alphabet shares have risen about 35% over the past year. The company reported market-beating third-quarter results, with 35% year-over-year growth in its Cloud unit and continued strength in the Search and YouTube businesses.

Despite investors’ concerns about the impact of growing competition in Search and regulatory pressures, Alphabet is optimistic about maintaining its dominance through its AI offerings.

Alphabet is scheduled to announce its Q4 2024 results on February 4. Analysts expect the company’s EPS (earnings per share) to rise more than 29% year-over-year to $2.12. They forecast a 12% growth in Q4 revenue to $96.62 billion.

What Is the Target Price for GOOGL Stock?

Heading into Alphabet’s Q4 2024 results, Truist Securities analyst Youssef Squali reiterated a Buy rating on the stock with a price target of $225. The analyst expects Q4 results to reflect persistent momentum in Search, YouTube, and Cloud, with AI continuing to be in focus.

Notably, Squali expects GOOGL’s Q4 2024 results to be almost in line with the Street’s estimates, with revenue up by low double-digits. Moreover, the analyst expects an operating margin of more than 30%, as efforts to control operating expenses are expected to have more than offset higher capital expenditure.

Overall, Alphabet stock scores Wall Street’s Strong Buy consensus rating based on 24 Buys and eight Holds. The average GOOGL stock price target of $217.93 indicates about 9% upside potential from current levels.

See more GOOGL analyst ratings

Meta Platforms (NASDAQ:META)

Meta Platforms stock has rallied 66% over the past year, thanks to the company’s streamlining efforts and rebound in ad spending. However, regulatory pressures, significant losses in the Reality Labs unit (operating loss of over $58 billion since 2020), and massive investments in AI could limit the upside in the stock this year.

On Friday, Meta CEO Mark Zuckerberg said that the company plans to invest $60 billion to $65 billion this year in capex to build AI infrastructure. Zuckerberg views 2025 as “a defining year for AI.” The company expects its massive AI investments to drive innovation and future growth.

Meanwhile, Meta Platforms is scheduled to announce its Q4 2024 on January 29. Analysts expect the social media giant to report about a 27% year-over-year jump in Q4 EPS to $6.75. Revenue is expected to rise 17% to $46.97 billion.

Is META Stock a Buy, Sell, or Hold?

In reaction to Zuckerberg’s announcement of the $60 billion to $65 billion in capex to support the company’s product roadmap, Citi analyst Ronald Josey reiterated a Buy rating on META stock with a price target of $75 and called it his Top Pick. Josey added that while Meta’s 2025 capex range is modestly ahead of his $58.5 billion estimate, he expects these investments to drive continued engagement growth and monetization benefits as “newer product vectors emerge, like Search (with Meta AI), Agents (with AI Studio), and Enterprise (with Llama 4), among others.”

Overall, Wall Street has a Strong Buy consensus rating on META stock based on 40 Buys, three Holds, and one Sell rating. The average META stock price target of $692.23 implies about 7% upside potential.

Conclusion

While analysts are highly bullish on the three Magnificent 7 stocks discussed here, they see higher upside potential in NVDA stock even after a stellar rally over the past year. Nvidia continues to capture the solid demand for its advanced GPUs in the AI space and is well-positioned to maintain its dominance in the semiconductor market through continued innovation and strong execution.