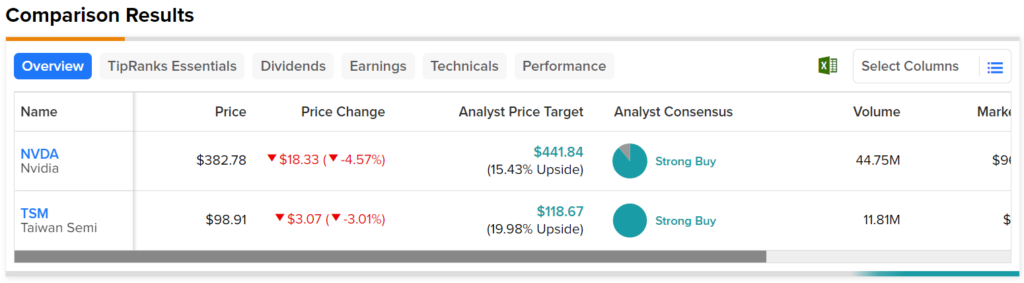

In this piece, I evaluated two chipmaker stocks, NVIDIA (NASDAQ:NVDA) and Taiwan Semiconductor (NYSE:TSM), using TipRanks’ comparison tool to determine which is better. Both have skyrocketed this year, although NVIDIA is outperforming most, if not all, other stocks on U.S. exchanges, gaining 180% year-to-date. Meanwhile, Taiwan Semiconductor is up a mere 38% year-to-date.

With such massive gains, a closer look is needed to determine whether there could be any more upside left. For comparison, the U.S. semiconductor industry is trading at a price-to-earnings (P/E) multiple of 40.6 versus its three-year average of 27.1. The industry is trading at a price-to-sales (P/S) ratio of 6.7 versus the three-year average of 5.6.

NVIDIA (NASDAQ:NVDA)

At a P/E of 208.5 and a P/S of 38.3, NVIDIA initially looks massively overvalued versus its industry. However, the chipmaker’s five-year mean P/E is about 66.7, while its five-year mean P/S is about 17.7, showing that it typically trades far above its industry. Nonetheless, it seems clear from the headlines about NVIDIA that it’s in a bubble, suggesting a bearish view might be appropriate for now.

This year’s massive rally in NVIDIA shares has made the company into the next $1 trillion company, joining the few blockbuster Big Tech names like Apple and Microsoft in the over-$1 trillion-market-capitalization club. However, that rally also suggests NVIDIA could be a bubble stock, and if there’s one thing all investors know about asset bubbles, it’s that they pop — eventually.

NVIDIA skyrocketed nearly 30% just in the last five days to hit a new record high of about $419 after reporting a 21% year-over-year increase in net income for the first quarter. Management also used a key phrase in their earnings commentary that helped drive that massive rally: “generative AI.”

The hype over artificial intelligence this year — likely stemming from the release of ChatGPT — has boosted the shares of virtually every company that has anything to do with AI. In his earnings commentary, NVIDIA CEO Jensen Huang predicted that $1 trillion worth of installed global data infrastructure “will transition from general-purpose to accelerated computing as companies race to apply generative AI into every product, service, and business process.”

Notably, NVIDIA’s data-center revenue surged to a record $4.28 billion in the first quarter. While the chipmaker is and will continue to be a winner in the AI race, euphoria doesn’t last forever, and the shares have flattened out after their initial earnings-related surge.

In fact, insiders have unloaded almost $8 million worth of NVIDIA shares over the last three months, and the rally over the last five days suggests more sales could be reported soon.

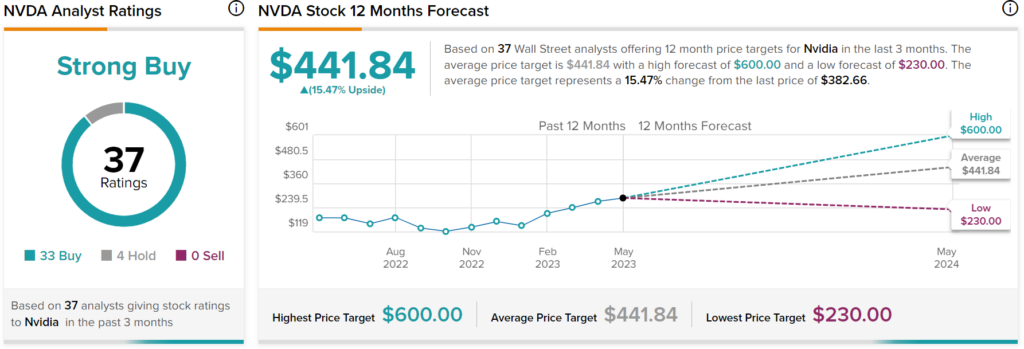

Is Nvidia a Buy, Sell, or Hold?

NVIDIA has a Strong Buy consensus rating based on 33 Buys, four Holds, and zero Sell ratings assigned over the last three months. At $441.84, the average NVIDIA stock price target implies an upside potential of 15.47%.

Taiwan Semiconductor (NYSE:TSM)

At a P/E of 15.5 and a P/S of 6.4, Taiwan Semiconductor trades at a discount to its industry P/E and in line with its industry P/S. Thus, it looks much more reasonably valued than NVIDIA, especially considering its five-year mean P/S of eight. However, a neutral view might be appropriate in the near term due to the geopolitical overhang for Taiwanese stocks.

Taiwan Semiconductor Manufacturing has enjoyed a nice 11% lift over the last five days due to NVIDIA’s good news, enjoying their best week in almost a year. TSM is likely to see some sales increase from the AI transition because it manufactures NVIDIA’s chips, but any impact is likely to be modest.

Unfortunately, the company could face issues amid the growing tensions between Taiwan and China, which convinced Warren Buffett to dump most of his $4.1 billion stake after less than a year. Given Buffett’s long-term focus, it’s highly unusual that he would sell the position after holding it for such a short time.

Thus, while Taiwan Semiconductor could end up being an excellent long-term investment at current prices, the recent rally paired with the geopolitical tensions suggests a neutral view for now.

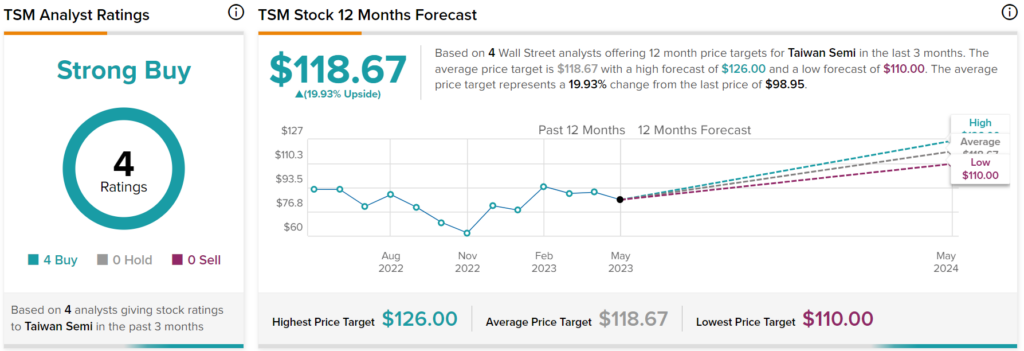

Is Taiwan Semiconductor a Buy, Sell, or Hold?

Taiwan Semiconductor has a Strong Buy consensus rating based on four Buys, zero Holds, and zero Sells assigned over the last three months. At $118.67, the average Taiwan Semiconductor stock price target implies upside potential of 19.93%.

Conclusion: Bearish on NVDA, Neutral on TSM

NVIDIA and TSM clearly have excellent long-term prospects, given their AI exposure. However, it seems like buying NVIDIA shares at current prices could be playing with fire, given its bubble-like aspects that could bring a better entry price.

TSM’s valuation is more attractive and could be a good play on AI, but the geopolitical overhang adds significant risk to owning the shares.