As earnings season draws to a close, there remain a few intriguing companies who have yet to file their quarterly reports. Among the more interesting of those is graphic chip giant Nvidia (NVDA), which will release fiscal third quarter results after the market close on Thursday, November 14.

Investor expectations are surely riding high for the company, whose stock price has been performing wonderfully in recent months. Shares have returned 57% this year, whipping the S&P 500’s 23% return, and they are just 1% off their 52-week high reached today.

Analysts expect Nvidia to report revenue of $2.9 billion, down from last year’s $3.18 billion, with EPS expected at $1.58, compared to last year’s $1.84. So despite the positivity, the graphic card specialist still has a way to go as it seeks to reestablish sales growth. Nevertheless, for investors looking for year-over-year sales trend improvements, the company’s F4Q20 outlook should make for sunny reading, as the bar is set pretty low following last year’s fourth quarter, when sales plummeted by 24%.

Granted, not everyone is enthusiastic about Nvidia. With the earnings report around the corner, 5-star Deutsche Bank analyst Ross Seymore remains on the fence. The analyst reiterated a Hold rating on NVDA stock, while raising his price target to $190.00 (from $160.00), which still implies about 10% downside from current levels. (To watch Seymore’s track record, click here)

While remaining optimistic about the company’s potential in the secular growth markets, Seymore believes the stock price already reflects that growth opportunity. The analyst noted, “We see investors expecting a solid beat/raise heading into earnings. While NVDA’s track record of beating guidance has been strong historically (3yr avg revs +6% vs guide), that trend has become much more muted in the last year as due to the crypto bust, data center pause and gaming transitions […] We remain Impressed with NVDA’s ability to address a wide array of rapidly growing sectors (AI, Datacenter, Gaming, ADAS/AV etc.) and expect optimism on these vectors to remain high heading into FY21. However, we believe much of this goodness is already reflected in NVDA’s share price.”

All in all, Nvidia has been one of Wall Street’s biggest standouts of 2019, and the biggest question for investors, then, is whether the stock remains attractive.

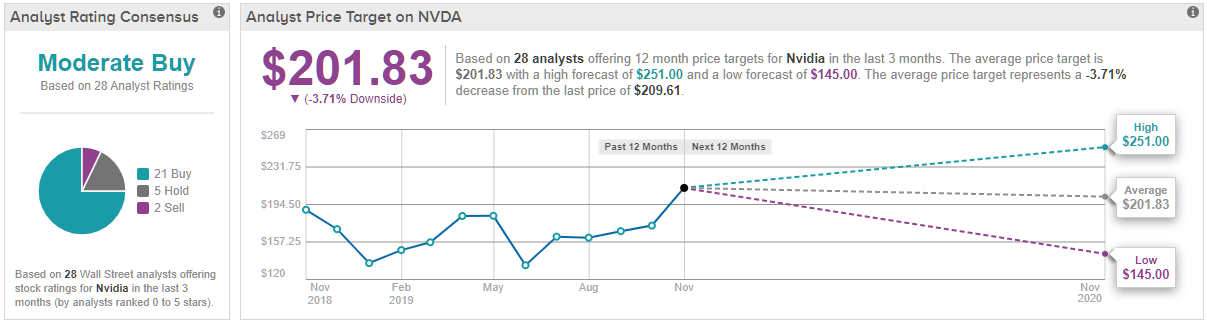

The verdict: Wall Street sizes up NVDA as a ‘Moderate Buy’ stock, as the bulls edge out the cautious on the GPU leader. In the last 3 months, NVDA has received 21 bullish ratings versus 5 analysts hedging their bets, and 2 bears who doubt the rally can be sustained. That said, the $201.83 average price target shows mixed thoughts on the stock, as it represents a 4% drop from today’s closing price. However, this may simply be a case of analysts playing catch-up in updating their models since NVDA’s surge. (See Nvidia stock analysis on TipRanks)