There is a lot of hype around the potential of AI these days. Fueled by the rise of ChatGPT and the subsequent race for AI supremacy, all the Big Tech gang are looking to get a piece of the action.

There’s no danger of the opportunity being overhyped, according to Rosenblatt analyst Hans Mosesmann. In fact, the 5-star analyst knows exactly which company is best positioned to benefit the most from this huge development.

“We see Nvidia (NASDAQ:NVDA) driving the biggest technology inflection the world may have ever seen in transformational AI everywhere and in everything,” Mosesmann said. “CEO Jensen Huang’s AI vision is openly playing out coincident with what appears to be Intel’s structural secular decline, signaling a changing of the guard in silicon valley for generational semiconductor global leadership.”

Mosesmann’s comments come ahead of the chip giant’s first quarter of fiscal 2024 report (April quarter), which the company will deliver on May 24. Mosesmann expects the company will meet or deliver slightly better results than those anticipated by the Street – consensus has revenue hitting $6.5 billion, and so does the company +/- 2%. The Street is calling for non-GAAP GMs (gross margins) of 66.5%, above Nvidia’s guide for ~65.3% +/- 50 bps.

The analyst highlights the data center Hopper H100 ramp, “solid Gaming trends (Ada Lovelace), and stable networking” as reasons behind the optimistic forecast.

Looking ahead to the July quarter, Mosesmann expects Nvidia’s top-line guide to come in at ~$7.10 billion, just ahead of the Street at $7.09 billion. That said, at the other end of the spectrum, Mosesmann is looking for non-GAAP EPS of $1.04 – a little below the $1.06 consensus estimate.

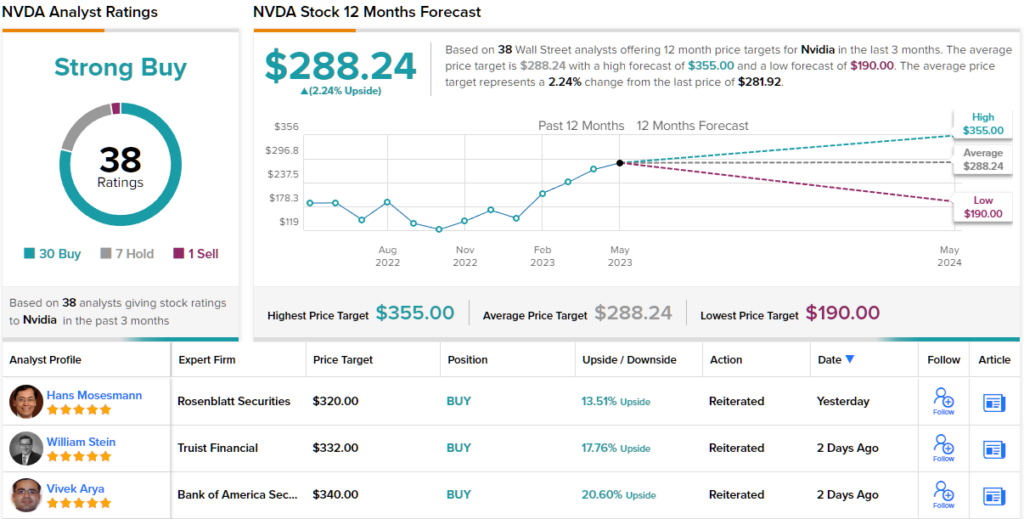

All told, there’s no change to Mosesmann’s Buy rating or $320 price target. There’s potential upside of 13.5% from current levels. (To watch Mosesmann’s track record, click here)

Turning now to the rest of the Street, where, in total, 38 analysts have thrown the hat in with NVDA reviews over the past 3 months. These break down into 30 Buys, 7 Holds and 1 Sell, all coalescing to a Strong Buy consensus rating. However, considering the shares have soared by 93% year-to-date, the $288.24 average target implies a modest 2% upside. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.