Not for the first time, the superlatives are piling up for Nvidia (NVDA) following the chip giant’s exceptional July quarter earnings.

That said, you will be hard pressed to find a more enthusiastic reception to the results than that of Rosenblatt analyst Hans Mosesmann, who says Nvidia is on “an entirely different plane vs. other semiconductor companies.”

So, what did Mosesmann like about the quarter’s display? Perhaps a better question might be: what not? With the ongoing uncertainty around the ARM deal aside, the answer would be, not much.

First off, there were naturally beats on both the top-and bottom-line numbers. Non-GAAP EPS of $1.04 came in $0.02 ahead of the estimates, while revenue increased by 68.2% year-over-year to reach $6.51 billion, in the process beating the Street’s call by $170 million.

The outsized sales were driven by growth in almost all segments, including record revenues in Gaming ($3.06 billion, up 85% from the same period a year ago), Data Center (up by 35% to $2.37 billion), and Professional Visualization. Supply continues to outstrip demand in the Gaming segment, while the Data Center growth was “primarily from hyperscale customers building infrastructure to commercialize Ai in their services.”

Moving forward, the company’s outlook is a confident one too. For the October quarter, Nvidia anticipates revenue of $6.80 billion, a 4.5% sequential uptick and above the consensus estimate of $6.48 billion. All end-markets should see growth in the next quarter, with Data Center poised for “accelerated demand.”

More than the array of impressive metrics, Mosesmann believes the results reflect the “overall alignment of many years of architectural, hardware, and software efforts into the current transition of AI ‘training’ to AI production or inferencing.”

The analyst says the rise of AI could amount to the “biggest technology inflection ever,” calling it the “Mother-of-all-Cycles.” No prizes here for guessing who will lead the charge as the “premier AI play.”

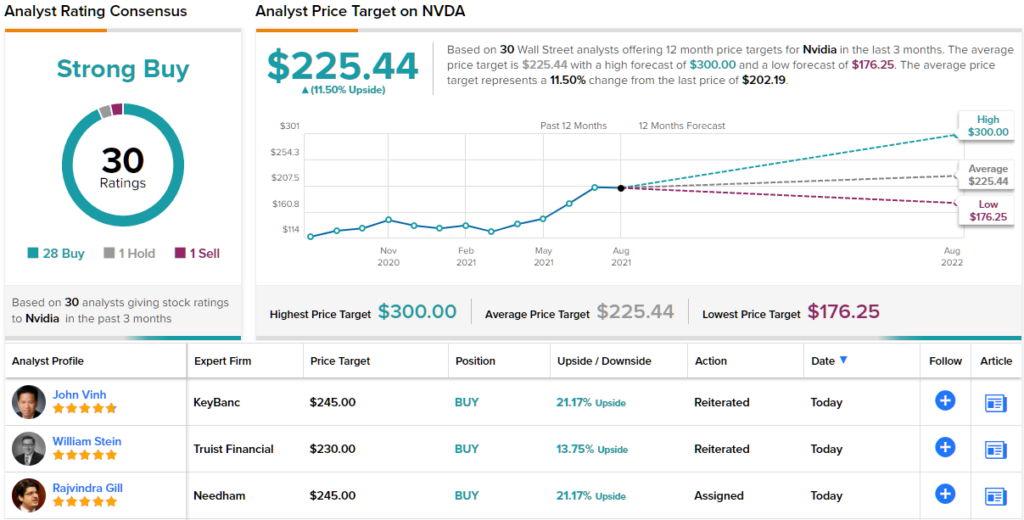

To this end, Mosesmann boosted his price target on NVDA from $250 to a Street high of $300. Investors could be pocketing gains of 57%, should Mosesmann’s thesis play out accordingly in the year ahead. (To watch Mosemann’s track record, click here)

Nvidia remains a firm favorite on Wall Street. Barring 1 Hold and Sell, each, all 28 other recent reviews say Buy, culminating in a Strong Buy consensus rating. Shares are expected to be changing hands for a 11.5% premium 12 months from now, given the average price target stands at $225.44. (See NVDA stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.