Amid news that the incoming Trump administration will likely relax regulations related to autonomous driving, Tesla ($TSLA) stock has risen over 80% in the last three months alone. Compared to chip designer Nvidia’s ($NVDA) more moderate 9.5% growth, it’s tempting to conclude that Tesla is the better investment at this point. However, my analysis suggests that Tesla could experience significant volatility in the coming year, while Nvidia’s price appreciation appears more robust for now.

Tesla Hits New Highs on Relaxed EV Expectations

Expectations of relaxed U.S. regulations under the Trump administration have fueled optimism for Tesla’s Full Self-Driving technology and robotaxi services, and I remain bullish on the company’s potential. Regulatory breakthroughs in Europe and China are also anticipated to support Tesla’s growth in 2025 and beyond.

For example, crash-reporting requirements under the National Highway Traffic Safety Administration currently impose significant operational and administrative burdens on automakers. The Trump transition team has recommended repealing the requirement for companies to report automated vehicle crash data. This is just one of several ways in which Trump’s presidency and planned deregulation could benefit Tesla and the tech industry more broadly.

While this macro outlook is undoubtedly favorable for Tesla, whether the 80% stock price surge over the last three months is justified remains a separate question. In my view, the valuation is somewhat stretched in the short term, and I expect significant near-term downside volatility. However, Tesla’s stock remains a viable long-term holding.

My current valuation model for Tesla forecasts revenue growth at a 20% CAGR over the next five years, with an EBITDA margin reaching 20% by December 2029, driven by lower manufacturing costs and the increasing reliance on software through Tesla’s autonomous taxi network. I also anticipate the company trading at the midpoint of its five-year average present and forward EV-to-EBITDA ratios, which is 65.

The result of this model is an estimated enterprise value of $3.14 trillion for Tesla by December 2029. With its current enterprise value at $1.47 trillion, this implies a five-year CAGR of 16.39%. Furthermore, when discounting my 2029 forecast back to the present using the company’s weighted average cost of capital (WACC) of 15.35%, the implied margin of safety is 4.5%.

Is Tesla a Buy, Sell, or Hold?

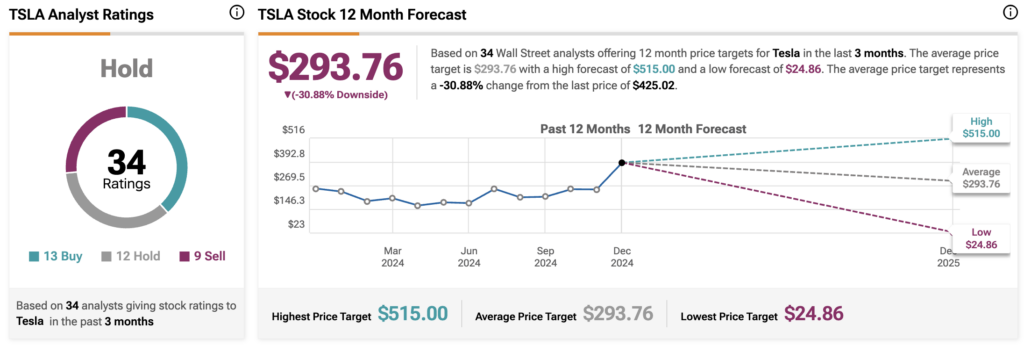

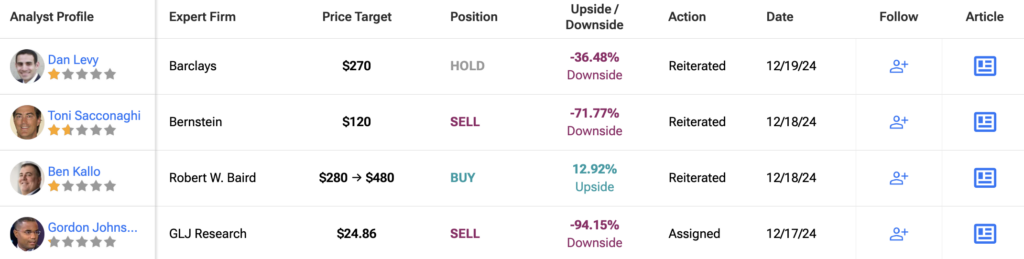

On Wall Street, Tesla currently holds a consensus Hold rating, based on 13 Buys, 12 Holds, and nine Sells. The average TSLA price target is $293.76, suggesting a potential downside of -30.9% over the next 12 months. This helps reaffirm my view that Nvidia is the better near-term investment, as I elaborate on below.

Nvidia Has Better Near-Term Prospects despite Long-Term Risks

Contrasting Tesla and Nvidia highlights their differing roles in capital allocation, with each offering strong return prospects. Nvidia faces potential revenue contraction in the next three to five years, likely causing significant downside volatility in its stock price. However, these cyclical dynamics, common in the semiconductor industry, are unlikely to manifest in the near term.

Given the substantial growth Nvidia is expected to achieve over the next two years, I believe it will outperform Tesla in the near term. Tesla’s stock price has already surged significantly, pricing in future growth ahead of time from many analysts’ perspectives, while Nvidia still has room to run.

When analyzing Nvidia’s valuation, I prefer to cap the timeframe in my model at two years to mitigate the impact of potential negative market sentiment as we approach a revenue contraction. My conservative estimate for Nvidia’s January 2027 annual revenue is $235 billion, with an EBITDA margin of 62%. At an EV-to-EBITDA ratio of 40—lower than its forward five-year average of 49 due to slowing growth—the company’s enterprise value is projected to reach $5.828 trillion.

With Nvidia’s current enterprise value at $3.16 trillion, this model indicates a two-year CAGR of 35.81%. Additionally, using the company’s WACC of 18.73% as the discount rate, the implied margin of safety when discounting my January 2027 enterprise value forecast to the present is 23.57%.

Is Nvidia a Buy, Sell, or Hold?

On Wall Street, Nvidia holds a consensus Strong Buy rating, based on 37 Buys, three Holds, and zero Sells. The average NVDA price target is $177.14, indicating a potential upside of 35.6% over the next 12 months. This aligns with my argument that Nvidia is the better investment compared to Tesla in the near term.

Conclusion: Nvidia Is the Better Buy Right Now

I remain more bullish on Tesla’s long-term prospects than Nvidia’s. However, Tesla will need time to achieve the growth and margin expansion required for its high-potential returns. Nvidia, on the other hand, is already benefiting from the momentum of AI, particularly through GPU sales to data centers. This trend is likely to persist through 2026 and 2027.

At their current valuations, I would feel comfortable buying Nvidia as a near-term investment while holding Tesla as a long-term play.