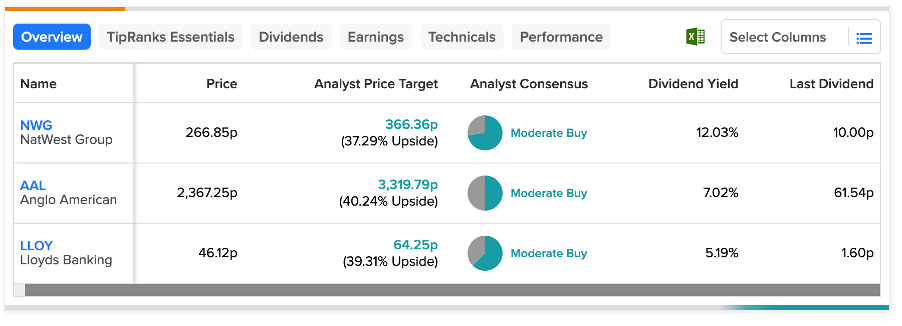

UK-based NatWest Group (GB:NWG), Anglo American PLC (GB:AAL), and Lloyds Banking Group (GB:LLOY) all have dividend yields higher than 5%. These stocks also offer good growth in terms of capital appreciation and have been rated a Moderate Buy by analysts. For investors seeking an ideal blend of income and capital growth, these stocks serve as highly suitable options.

Using the TipRanks Dividend Calculator tool, selecting the appropriate dividend stock has become easy. This tool facilitates the calculation of future dividend income by considering factors such as expected yield, share price growth, reinvestment plans, and more. One notable feature of this tool is the ability to modify any of these parameters and compare the dividend income across various stocks.

Let’s dig deeper into some details.

Are NatWest Shares a Good Buy?

NatWest ranks among the UK’s four largest banking groups. Based on its dividend yield of more than 12%, NatWest appears to be a leading income stock in the UK market.

The bank paid a total dividend of 30.3p per share in 2022, which also included a special dividend of 16.8p paid in September 2022. The total dividend paid in 2021 was 10.5p per share. According to the latest projections, the dividend yield for NatWest will remain around 6%, and it is expected to be covered by anticipated earnings over 2.5 times.

NWG stock has a Moderate Buy rating on TipRanks, based on eight Buy and three Hold recommendations. At an average price target of 366.36p, the stock has an upside potential of 36% at the current trading levels.

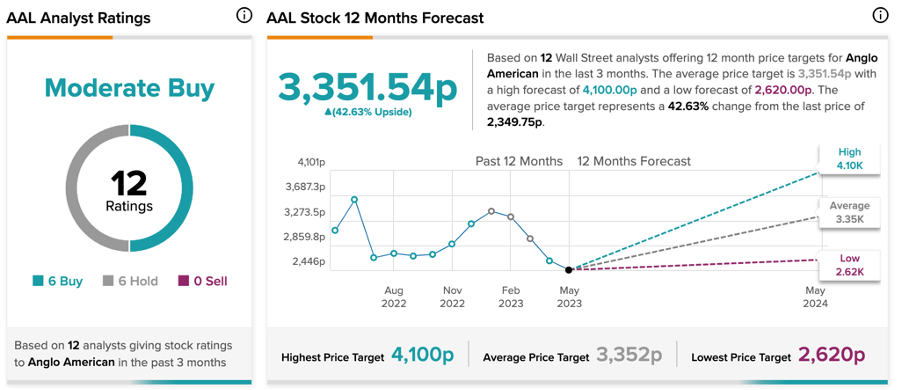

Is Anglo American a Good Investment?

Anglo American is a multinational mining company that possesses a diverse portfolio, including diamonds, platinum, copper, iron ore, and other resources.

The stock carries a dividend yield of 7.1%, as compared to the industry average of 1.87%. In 2022, the company paid total dividends of 167.14p per share. The company’s stock has been trading down by 27.3% in the last three months, and analysts believe it makes a good entry point for investors. Considering the company’s strong financial position in terms of net cash and profit margin, the dividend story looks consistent.

According to TipRanks’ analyst consensus, ALL stock has a Moderate Buy rating. This is based on six Buy and six Hold recommendations. The average price prediction for the next 12 months is 3,351.54p, which implies an upside of 42.63% from the current level.

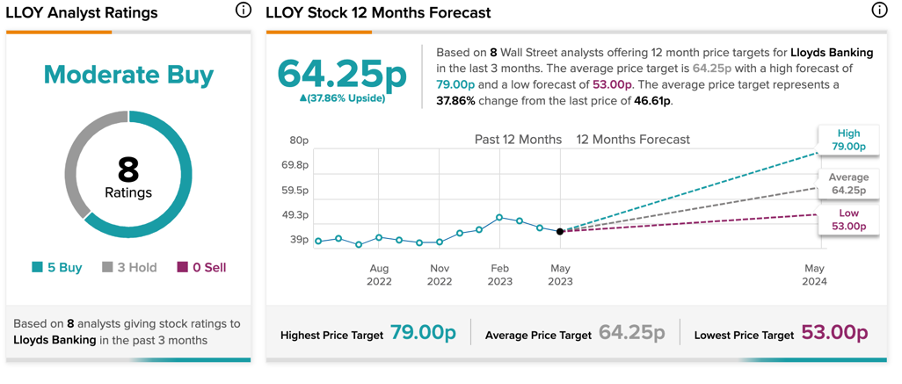

Is Lloyds Banking Group a Good Share to Buy?

Lloyds Banking Group is among the largest and oldest financial institutions in the UK. The bank is known for its consistent dividends and is one of the best-paying companies in the FTSE 100 index.

In 2022, the bank distributed a total dividend of 2.4p per share, resulting in a yield of 5.23%. Lloyds increased its dividends in 2022 by 20% as compared to the previous year. According to analysts, the total dividend per share is anticipated to increase to 2.8p in 2023 and is expected to further elevate to 3.1p in 2024.

Based on five Buy and three Hold recommendations, LLOY stock has a Moderate Buy rating on TipRanks. The average price target is 64.25p, which is 38% higher than the current price level.

Conclusion

These UK-based companies could serve as ideal additions to the portfolios of investors seeking a perfect balance of higher dividend income and capital appreciation.

Analysts are moderately bullish on these stocks and expect promising upside potential in their share prices.