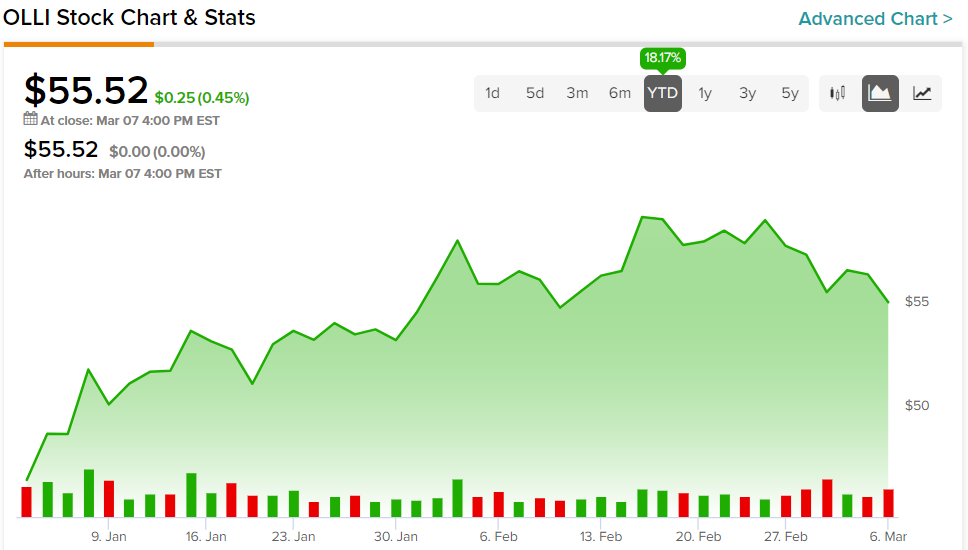

Having jumped so much this year, there’s a sense that Ollie’s Bargain Outlet (NASDAQ:OLLI) stock may be due for a pullback. Indeed, recent rumblings in the options market imply such. However, OLLI stock really offers a contrarian opportunity, particularly amid a still-weakened consumer environment. Plus, the underlying business facilitates flexibility. Therefore, I am bullish on the closeout retail specialist.

At first glance, OLLI stock seems like a sensible investment. While improved from the wild peaks of last year, inflation remains stubbornly high. Moreover, mass layoffs represent the sad order of the day, particularly as enterprises wind down their operations amid high inflation and a worsening economy. Under these circumstances, a discount retailer would appear to make much sense.

However, money talks – and some other unspoken material walks, as the colloquial saying goes. Recently, derivatives traders voted with their wallets, causing OLLI stock to become a notable highlight for unusual stock options volume.

Specifically, following the close of the March 2 session, OLLI’s volume reached 4,195 contracts against an open interest reading of 10,572. The delta (or the measurement of change) between the Thursday volume and the trailing one-month average volume came out to 948.75%. That’s a massive (over 10-fold) difference against normal activity. Further, call volume hit 1,071 contracts while put volume jumped to 3,124. This resulted in a put/call volume ratio of 2.92, mathematically favoring the bears.

Still, that’s a blip on the radar for an otherwise intriguingly bullish narrative.

OLLI Stock Offers Flexibility During Economic Storms

Fundamentally, the main reason for optimism for OLLI stock centers on its underlying flexibility. With the discount retailer able to accommodate various economic scenarios, it’s a worthwhile idea for the present market ambiguity.

Primarily, concerns about ever-rising inflation kept a lid on sentiment for risk-on assets last year. Once that temporarily faded earlier this year, the benchmark S&P 500 (SPX) began rising, as did other speculative vehicles like cryptocurrencies. However, as inflation again reared its ugly head, the market softened.

Not to be the bearer of bad news, but it’s quite possible for inflation to jump higher this year too. If China’s recent economic reopening sparks intense commercial activity, this will lead to resource consumption. At that point, more dollars would chase after fewer goods, catapulting global inflation. Of course, discount retailers would enjoy an organic benefit here, thus potentially boosting OLLI stock.

Secondly, it’s always possible for the Federal Reserve to overreact, aggressively raising interest rates. Therefore, a deflationary environment – fewer dollars chasing after more goods – might materialize. In this scenario, job losses would accelerate.

Even so, OLLI stock would likely be a beneficiary. Let’s say consumer prices decline overall. Those who may be working don’t have the luxury of spending freely because they witnessed the pink slips being distributed to their colleagues. They could be next, thus incentivizing prudence. So, whether there’s inflation or deflation, Ollie’s commands relevance.

Solid Financials with Some Heat Mixed In

While OLLI stock benefits from an underlying solid financial profile, it’s not without faults. Mainly, an argument can be made that it’s overpriced.

For instance, the market prices OLLI at a trailing earnings multiple of 37.8. Relative to the retail industry, this ranks worse than 82% of the competition. In terms of its forward earnings multiple, the company trades at 20.45x. While significantly better, this ranks worse than 68.9% of the field.

However, the counterargument is that Ollie’s enjoys a profoundly relevant business. Therefore, an extra premium to the underlying sector may be justified. As well, the overall strengths balance out many concerns.

Operationally, its three-year revenue growth rate stands at 12.8%, beating 81.3% of its rivals. Its book growth rate during the same period is 11.1%, above nearly 70% of the industry. On the bottom line, Ollie’s net margin pings at 5.31%, outpacing 81.8% of the competition.

Is OLLI Stock a Buy, According to Analysts?

Turning to Wall Street, OLLI stock has a Moderate Buy consensus rating based on seven Buys, five Holds, and one Sell rating. The average OLLI stock price target is $57.69, implying 3.9% upside potential.

The Takeaway

Although OLLI stock may have attracted bearish traders – possibly because of its valuation premium – overall, there’s still much to like about the discount retailer. With the economy facing either inflationary or deflationary pressures, investors need a flexible enterprise in their portfolios. Ollie’s is exactly that, making for a compelling contrarian investment.