Chip component manufacturer ON Semiconductor (NASDAQ:ON), also known as onsemi, had a mixed day two days ago after it reported earnings. While its third-quarter results came in better than expected, guidance was somewhat dull. Nonetheless, Susquehanna analyst Christopher Rolland, who is also a five-star rated analyst on TipRanks, remains bullish on the long-term outlook of the company.

Demand from the automotive market was a major catalyst for revenue growth last quarter. Increased adoption of onsemi’s SiC semiconductors, insulated gate bipolar transistors by electric vehicle customers, and CMOS image sensors by ADAS customers were beneficial.

Notably, the demand for onsemi’s SiC products is expected to remain strong for the remaining year. Management expects revenues from SiC to reach $1 billion in 2022, three times that of last year.

Rolland also expects the weakness in Industrial to be slightly balanced out by the strength in energy infrastructure, which is expected to grow 60% year-over-year in 2022.

The analyst cut his near-term price target to $80 from $82 and also reduced his estimates for near-term margins to account for the headwinds that lie ahead for onsemi. “Overall, we consider weakness in industrial/consumer/compute to be a new downside that may weigh on revenue and GMs in 2023,” noted Rolland.

However, the analyst maintained his Buy rating for ON stock. He believes that under new management, the company to be shifting away from being a commodity power management provider to high-growth markets (automotive, industrial, 5G, and server) as a value-add supplier. Rolland opined that strategic mergers and acquisitions can further boost this transition.

The analyst also believes onsemi to be a good buy because the stock has traditionally been cheap, but this time, it comes with several opportunities for growth. “New higher-margin products and improved execution by the management team should lead to multiple opportunities for organic growth and multiple expansion, driving a multiple re-rating for this traditionally inexpensive stock,” explained Rolland.

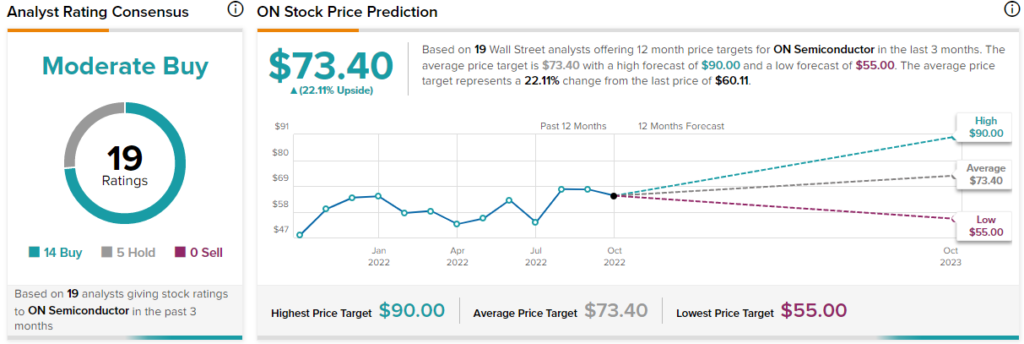

Is ON Semiconductor Stock a Buy, According to Wall Street?

Wall Street analysts are cautiously optimistic about ON Semiconductor stock, with a Moderate Buy rating based on 14 Buys and five Holds. Analysts are expecting the price to climb about 22.1% over the next 12 months to reach $73.40.

Conclusion: ON Semiconductor Could be a Long-Term Winner

The secular growth opportunity for onsemi stems from the perpetual want for semiconductors to build technology. Being a long-standing name in the heart of the technology sector, onsemi could be a great addition to one’s portfolio.