Opko Health announced the initiation of a Phase 2 trial of Rayaldee as a treatment for mild-to-moderate COVID-19. After rising in the pre-market trading hours, Opko stock was down 0.63% at the close on Tuesday.

Opko Health’s (OPK) Rayaldee is an extended-release oral formulation of calcifediol, a prohormone of calcitriol, the active form of vitamin D3 and was launched in 2016 for treating secondary hyperparathyroidism in adults with stage 3 or 4 CKD (chronic kidney disease) and vitamin D insufficiency.

The company announced that the trial (called REsCue) will be a randomized, double-blind placebo-controlled study to evaluate the safety and efficacy of Rayaldee (calcifediol) extended-release capsules to treat symptomatic patients infected with SARS-CoV-2.

The trial, which will be conducted at multiple COVID-19 outpatient clinics in the US, is expected to enroll about 160 subjects, many with stage 3 or 4 CKD who are at higher risk for developing more severe illness. Opko expects to report top-line results from the Phase 2 trial before the end of this year.

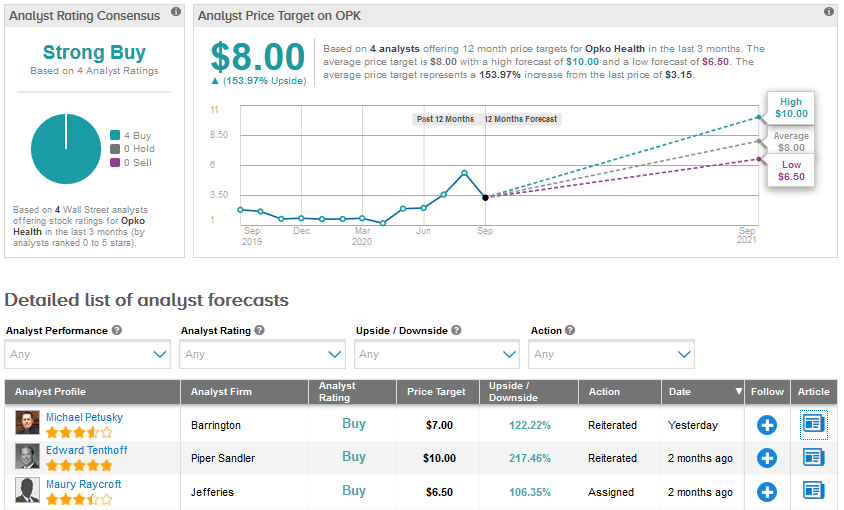

Yesterday, Barrington analyst Michael Petusky reiterated a Buy rating and a price target of $7 for Opko Health stating, “OPKO’s lab business has greatly benefitted from its ability to land COVID‐19 related PCR [polymerase chain reaction] and antibody serology testing agreements since the crisis began to impact the U.S. in Q1.”

“To date, the company has provided COVID‐19 testing to the general public through its relationships with several states and cities, has signed major partnerships with Rite Aid and CVS, and also has secured several high profile deals with major sports organizations including the NFL, the NBA and Major League Soccer.” (See OPK stock analysis on TipRanks)

The Street has a Strong Buy consensus for Opko Health based on 4 recent Buy ratings. The stock has risen an impressive 114% so far in 2020 and the average analyst price target of $8.00 indicates a further upside of about 154% in the coming months.

Related News:

Nestlé Launches $2.6B Tender Offer For Aimmune Therapeutics

Pfizer CEO: Our Covid-19 Vaccine Could Be Ready In US By Year-End

Gilead Inks $21B IMMU Deal, Adding Trodelvy To Its Oncology Arsenal