Oppenheimer’s Chief Investment Strategist John Stoltzfus has released a detailed note laying out the boundaries and parameters of economic life right now, in what he has wryly termed ‘Coronaville.’

Stoltzfus’ top line sets out the most important point, that once economies reopen, life can return to normal. Stoltzfus says, “A world turned upside down for now by Covid-19 may prompt some to think that life may never be the same again. In our view technology and globalization, two key drivers of the world’s economy, challenge that premise with their capability to address the virus itself as well as the societal and economic dislocations the virus has wrought.”

For investors, responding to the pandemic will mean finding those niches that have potential to gain when the global economy stutters. Stoltzfus points out stocks in processed foods, especially cereal makers, canned goods, and frozen foods as especially well positioned right now. His colleagues at Oppenheimer, looking at various individual stocks, expand on that, bring up interesting choices on the bullish side, and noting at least one stock that investors should steer clear of.

We’ve opened up TipRanks’ database to peek ‘under the hood’ at these stock picks from Oppenheimer’s analysts. They are a fascinating bunch, in online entertainment, organic foods, and climate control technology. Let’s take a closer look.

Madison Square Garden Entertainment (MSGE)

We’ll start in the entertainment industry. Madison Square Garden Entertainment started trading on April 20 as a spin-off from Madison Square Garden. The parent company split its sports and entertainment businesses; MSGE will focus on life-streaming a wide variety of live entertainment programs. Shareholders in the parent company (MSG) will see their holdings convert to MSGE automatically. The spun-off company has a market cap of $2.06 billion.

The split takes advantage of the surge in demand for online entertainment options, as people are stuck in their homes due to anti-coronavirus lockdown policies. Streaming companies have seen increased demand, while customers are always eager for new content.

MSGE started trading as an independent entity just 6 sessions ago. In that time, the stock has gained over 27%. It’s a small sample from which to extrapolate, but also a good beginning for a new stock ticker.

Covering the stock for Oppenheimer, Ian Zaffino treats it as the natural successor to the original parent company, inheriting an array of “world-class venues, including the MSG Arena and the Chicago Theatre, and leases several other iconic venues, including Radio City Music Hall and the Beacon Theatre.” Zaffino sees these assets as a net strength, and a solid foundation on which to build a live streaming entertainment business. Regarding future growth, Zaffino writes, “Once COVID-19 passes, we believe the company can refocus on growth. Construction of the ~$1.66B Las Vegas Sphere is under way, but was temporarily halted owing to COVID-19. We expect the Sphere to achieve double-digit returns…”

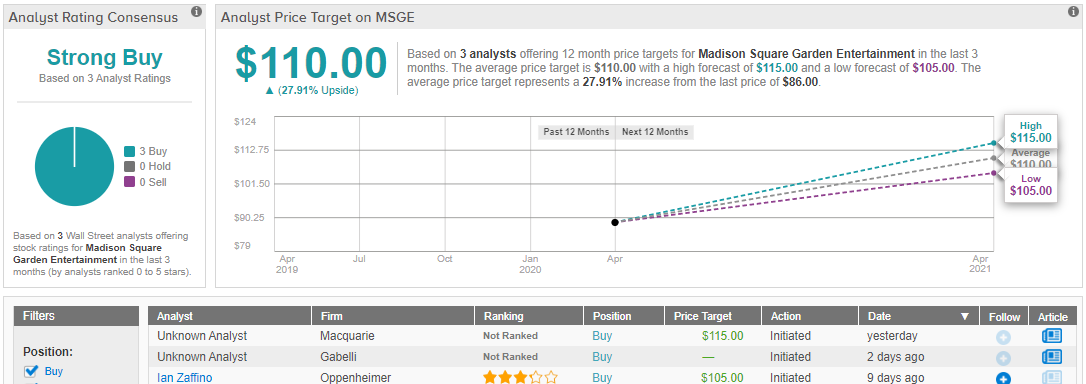

Zaffino rates MSGE a Buy, with a $105 price target, which implies 22% upside from current levels. (To watch Zaffino’s track record, click here)

With only 13 trading days behind it, MSGE is too new to have accumulated many reviews — only two other analysts have thrown the hat in with a view on the entertainment stock. The two additional Buy ratings provide MSGE with a Strong Buy consensus rating. With an average price target of $110, investors stand to take home an 28% gain, should the target be met over the next 12 months. (See MSGE stock analysis on TipRanks)

Sprouts Farmers (SFM)

And now we move on to the supermarket sector, where Sprouts Farmers is a consistently profitable name in the organic grocery segment. Sprouts offers a wide selection of brand name and private label products, including meats, dairy and cheese, bulk foods, bakery products, and beer and wine. The company boasts a market cap of $2.45 billion, has over 300 stores, and operates in 20 states.

SFM showed a sequential gain in earnings from Q3 to Q4, gaining 22%. Projections for Q1 – the first calendar quarter is normally the company’s strongest – are for 49 cents EPS, or 6.5% year-over-year growth.

The gains in earnings should not come as a surprise. Despite the lockdowns nationwide, people still have to eat, and grocery stores are among the retailers considered essential. Supply chain disruptions are a bigger threat than lack of consumer demand. And consumer demand has been strong enough that SFM is opening new stores and hiring new workers at existing stores.

Oppenheimer’s 5-star analyst Rupesh Parikh writes of SFM and its earnings potential, “On the EPS side, we believe SFM has potentially the most attractive upside potential among leading grocers due to top-line strength and improved merchandise margins associated with the recent sales lift.” The analyst added, “We overall look favorably upon the early efforts by the SFM management team in stabilizing margins with Q4 being an example. In Q4, operating margins expanded 20 bps to 3.4% from 3.2%.”

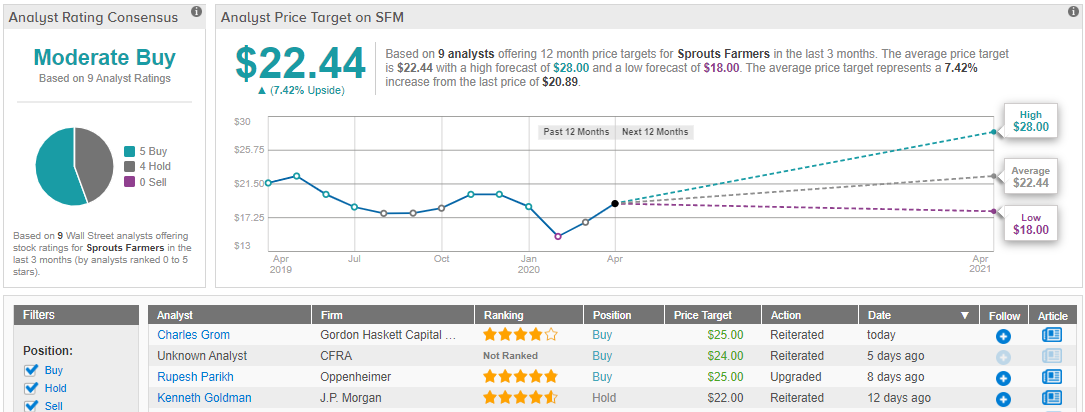

In line with his bullish outlook, Parikh has upgraded his rating on Sprouts from Neutral to Buy, and set a price target of $25. His target implies an upside of 20%. (To watch Parikh’s track record, click here)

All in all, Sprouts Farmers gets a Moderate Buy from the analyst consensus. Out of 9 reviews, 5 say Buy, 4 say Hold, and no one is saying to sell this stock. Shares are priced at $20.92, and the $22.44 average price target reflects a modest 7.5% upside. (See Sprouts stock analysis on TipRanks)

Johnson Controls (JCI)

Our last stock is Oppenheimer’s bearish review. Johnson Controls is an old name in the HVAC industry, originally founded in the late nineteenth century, and brings in over $30 billion annually through its production of HVAC, fire control, and security systems for large buildings. Johnson operates world-wide, and gained notoriety a few years ago when it moved its headquarters to Ireland as a tax inversion maneuver – the third largest in US corporate history.

As a leader in its industry, JCI should be in a strong position to weather the coronavirus storm. It provides a service necessary to keep modern office space in compliance with regulatory codes, and it has deep enough pockets to maintain a 3.6% dividend payment – a much higher yield than the average found on the S&P 500 – without difficulty.

While calendar Q4 (fiscal Q1) earnings were disappointing, and a showed a steep sequential drop, that was actually in line with the company’s long-term reporting pattern. Looking forward, the calendar Q1 projection is for 39 cents EPS; if that holds, it will be a 21% yoy gain.

At the same time, Johnson also shows vulnerabilities. A large part of its business is based on installations during construction – and construction activity is depressed due to the COVID-19 pandemic. Construction industry analysts are uncertain weather or not the pace of activity will resume, or how quickly and completely it will do so. That uncertainty trickles down to contractors like Johnson Controls.

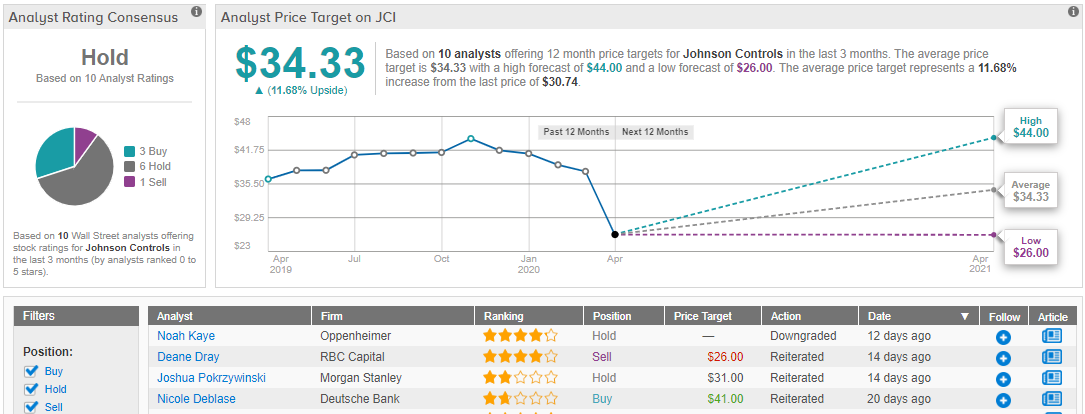

The uncertainty, in Oppenheimer’s view, is the important factor. Analyst Noah Kaye writes, “While we believe COVID-19 will increase the value of JCI’s HVAC/IR, building automation and security offerings to support public health requirements, we believe a lower growth trajectory for commercial building space construction and utilization could also manifest from the crisis, and are [downgrading JCI to Perform.]”

That downgrade moves JCI from Buy to Neutral, and Kaye has also rescinded his price target on the stock. While Kaye doesn’t believe in selling off JCI shares – he’s definitely cautious here and wants to see how growth returns going forward. (To watch Kaye’s track record, click here)

All in all, Johnson Controls has 10 analyst reviews, split three ways: 3 Buys, 1 Sell, and 6 Holds. Overall, the consensus view is to Hold here, to wait and see. Wall Street is taking the cautious stance, understanding that JCI has the resources to recover, but that such recovery will depend in part on conditions beyond the company’s immediate control. (See Johnson stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.