How do you face risk? How do you account for it? Investing is inherently risky, there’s no way around that, and investors must be willing to shoulder that risk in order to reap a profit. The problem now, in the midst of the COVID-19 pandemic, is that our expectations of risk management and the reality of governmental and economic conditions are out of sync.

To start with, economies around the world are practically shut down to combat the spread of the virus. But at the same time, the early models of viral spread and total rates of infection and death and proven to be grossly overstated. To date, some 2 million people worldwide have gotten sick, and there have been about 103,000 deaths – but due to lags and inadequacies in the various testing and reporting policies around the world, those numbers are subject to high uncertainty.

A recent report from Oppenheimer lays out a case for buying into the markets now, while prices are still relatively low and before the economy restarts. John Stoltzfus, Chief Investment Strategist, advises investors to stick to the tried and true virtues: a diversified portfolio, patience, and well-managed expectation. Stoltzfus suggests an “overall focus … with cyclical sectors including technology, consumer discretionary, and industrials looking particularly attractive for when the tide turns against COVID-19…”

Oppenheimer’s stock analysis teams have been taking these themes to heart, finding investment choices that should pique your interest now, in preparation for longer-term market gains. We’ve used the TipRanks database to pull up three of the firm’s choices, all new rating assignments or upgrades to existing coverage, to find out just why they are compelling stock moves.

iQIYI, Inc. (IQ)

We’ll start in China, where iQIYI has become one of the world’s largest online video and streaming sites. Notice – that’s one of the world’s largest video sites. China has a population of 1.4 billion, and well over 800 million of them are connected to the internet. Even though the country restricts outside web access, its domestic market for online services is huge. In a gross measure of just how big, IQ boasts over 500 million active users and more than 6 billion hours of access every month.

Taking a macro look at IQ’s public trading history, the recent downturn in the markets simply pushed the stock’s price from a modest peak to a modest trough – but the share value remained within the stock’s long-term trading range. With earnings season ahead, China only starting to loosen its coronavirus lockdowns, it’s interesting to note that IQ is expected to post a net loss of 48 cents per share for Q1, in line with the Q4 net loss of 49 cents. While the company operates at a loss for now, revenue has been growing. The Q4 top line was $1 billion, up 7% year-over-year, and significantly higher than expected.

In another key metric, IQ continues to show a positive trend for investors. The company saw subscribed users grow by 106.9 million last quarter, a 22% yoy gain. Of that number, only 1.1% were free trials – the other 98.9% were paying users. While still below Netflix’ numbers, IQ’s growth rate outpaced the American company’s.

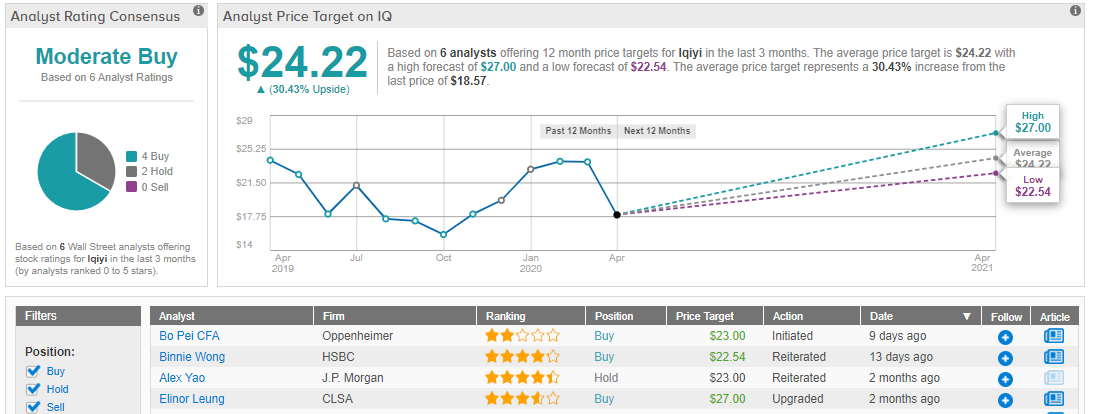

IQ’s strong market position convinced Oppenheimer’s Bo Pei to initiate coverage of the stock with a Buy rating and a price target of $23. At current levels, that target suggests an upside of 24%. (To watch Bo Pei’s track record, click here)

In his comments on the stock, the analyst wrote, “Based on our proprietary survey, we believe investors currently underestimate IQ’s ability to lift subscription prices. We also believe IQ will continue to produce high-quality content and to attract new paying subscribers in the coming years. IQ is still early in overseas markets, but as the company expands to Southeast Asia, we see it as another potential growth driver.”

Over the past 3 month, “buy” ratings have outnumbered “holds” four-to-two on iQIYI, and the average target price on Wall Street is just a smidge about Oppenheimer’s targeted $23 price — $24.22, across all analysts surveyed by TipRanks. Assuming they’re right about that, investors in iQIYI today stand to rake in about 30% profit over the next year. (See iQIYI stock analysis at TipRanks)

Pentair (PNR)

Shifting gears, we move to the water industry. Water is essential in most aspects of human life, and Pentair offers products for filtration, purification, pumping, and disposal in residential, commercial, industrial, municipal, and agriculture applications.

Pentair will be an early reporter for the Q1 results, and hold its conference call on April 30. Heading into the earnings season, after the COVID-19 disruptions of the first quarter, PNR can take comfort in the cushion provided by its strong Q4 results: 68 cents EPS, 13% above estimates, and revenue that rose to $755 million. The EPS forecast for this month’s earnings call is 45 cents, which would represent a 33% drop.

Through past several years, PNR has maintained its dividend payments, adjusting the amount as needed to ensure affordability. The company’s current payment is 19 cents quarterly, sent out to shareholders earlier this week. At 76 cents annualized, the dividend gives a yield of 2.5%. It’s an above average yield, and a far higher return than interest rates or bond yield can currently show.

Writing on the stock for Oppenheimer, Bryan Blair sees reason to upgrade Pentair from Neutral to Buy. He writes, “Although clearly still subject to the fluid demand (and developing supply chain) pressures from COVID-19, we expect PNR to be less impacted than most industrials… Given Aquatics low y/y bar and its generally stable, replacement-driven demand, we envision far less downside (and an earlier rebound) for PNR’s key cash generator vs. the steep declines expected for industrials broadly.”

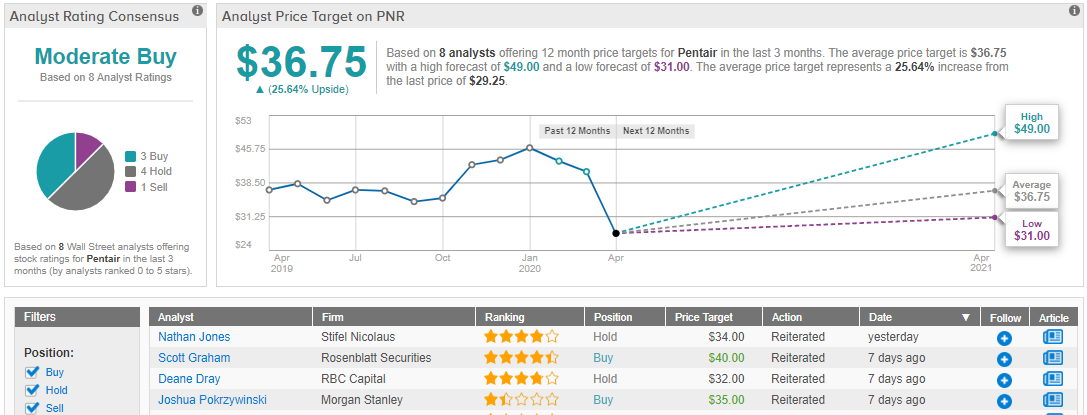

Blair’s price target on PNR, $38, implies room for a 30% upside. (To watch Blair’s track record, click here)

The Moderate Buy analyst consensus rating on PNR is derived from 3 Buys and 4 Holds, along with a single Sell, all set in recent weeks. Shares are priced at $29.25, and the average price target, at $36.75, indicates that the stock has about 25% growth potential in the coming 12 months. (See Pentair stock analysis on TipRanks)

US Bancorp (USB)

Last up is US Bancorp, one of the major providers of banking services in the US. The company’s subsidiaries control over 3,100 bank branches and 4,800 ATMs in the Midwestern and Western regions of the country. US Bancorp’s services include personal banking, mortgage services, payment processing to and for individuals, merchants, and government entities, and investment banking. The company brought in over $6.9 billion in top line revenue in 2019.

Banks typically lead the earnings season, and USB reported Q1 results earlier this week. The bank’s results were mixed – EPS came in at 72 cents, which was down 33% from Q4 – but was also 47% above the forecast. So, earnings were down, but nowhere near as badly as expected. The company got a tailwind from higher loan and deposit balances, and top-line revenue rose 3.5% yoy to reach $5.77 billion.

Also of interest to investors, USB paid out its 42-cent quarterly dividend on April 15. The payment was the third at the current rate, and gives an annualized yield of 5.3%. USB has an 11-year history of reliable dividend payments, and the payout ratio of 58% signals that the company can afford to keep the dividend reliable.

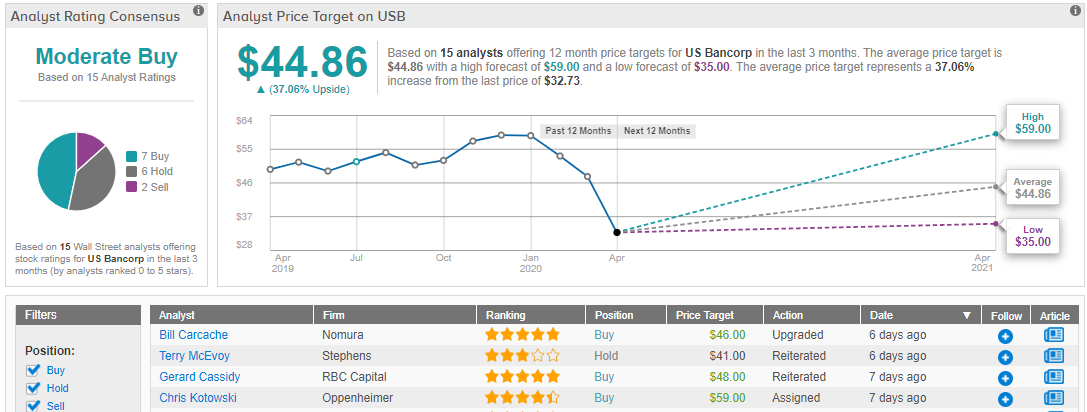

5-star analyst Chris Kotowski, in his review for Oppenheimer, assigns this stock a Buy rating, with a $59 price target that suggests US Bancorp will see a most robust 80% share appreciation over the next 12 months. (To watch Kotowski’s track record, click here)

In his comments on the stock, Kotowski writes, “USB’s 1Q20 results were generally in line with our expectations and highlighted the resilience of the underlying earnings power of the business… Since rates started rising in late 2015, USB has started to see accelerating core earnings growth again. Third-quarter 2019 brought the sixth consecutive quarter of positive operating leverage, and we think USB is now well poised to outperform.”

TipRanks suggests the cautious analysts match up against the bulls rooting for USB’s opportunity. Out of 15 analysts polled in the last 3 months, 7 are bullish on the stock, while 6 remain sidelined, and 2 are bearish. With a return potential of 37%, the stock’s consensus target price stands at $44.86. (See US Bancorp stock analysis on TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.