For better or for worse (but mostly for better), COVID-19 has taken Novavax (NVAX) on a very wild ride.

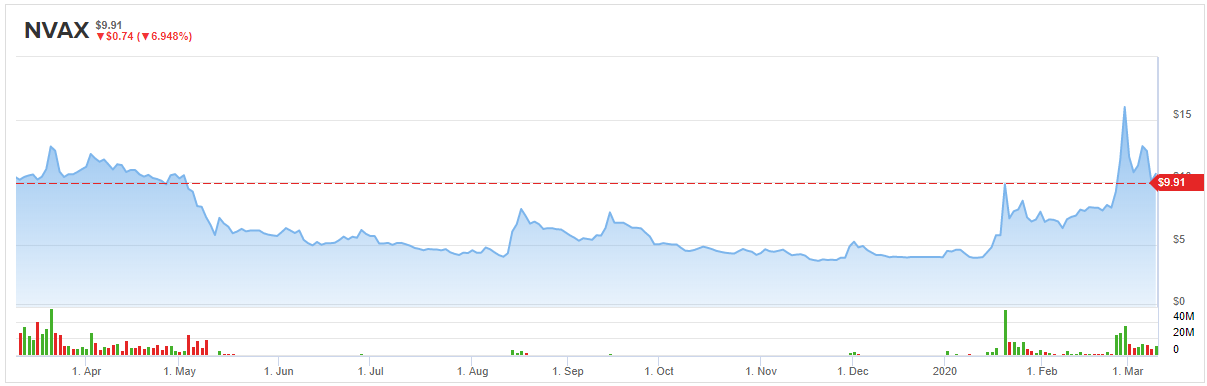

Since the first report of an infection with COrona VIrus Disease 2019 in Wuhan, China on December 31, 2019, shares of vaccine specialist Novavax literally quadrupled in the space of two months, topping out at $16 a share on February 28, before giving back some of its gains in March.

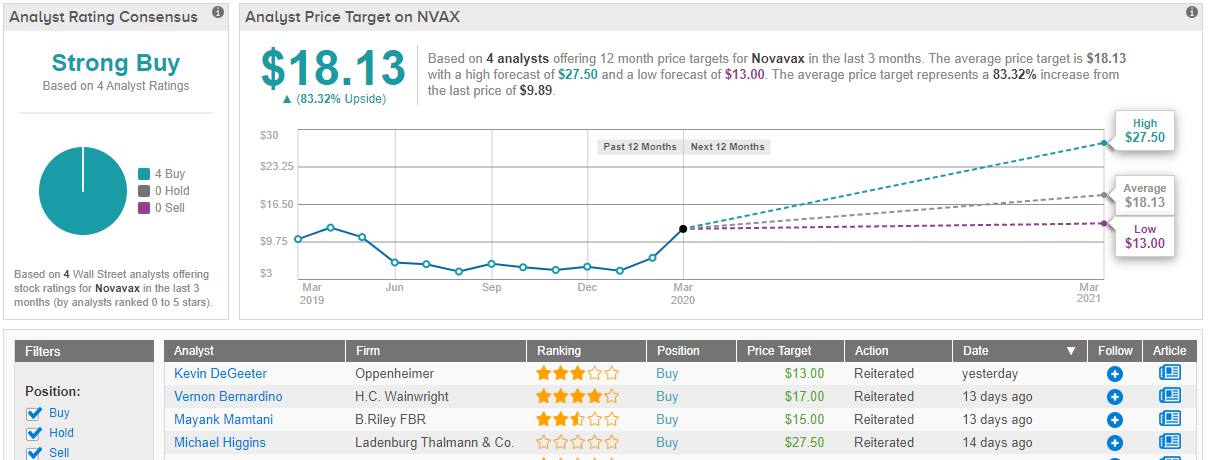

In a note issued yesterday, Oppenheimer analyst Kevin DeGeeter reiterated his “outperform” call on Novavax stock, stating a price target of $13 a share on the $10 stock. DeGeeter explained his continued optimism about Novavax by pointing to “two important announcements related to [Novavax’s] COVID-19 vaccine program,” released yesterday. To wit:

The Oslo, Norway-based Coalition for Epidemic Preparedness (CEPI) is providing Novavax with an initial $4 million grant “to accelerate vaccine development to prepare for Phase 1” clinical trials of Novavax’s COVID-19 vaccine, which are expected to start up in late spring of this year. (That’s slightly ahead of schedule from past projections for testing to begin in May or June, by the way). And additional funding may be provided as Novavax progresses its vaccine through the Phase 1 process.

Separately, Novavax says it has “entered into an agreement with” Emergent BioSolutions to first manufacture and supply Novavax with vaccine product for use in said trials and, should these trials prove successful, to later “leverage Emergent’s rapid deployment capabilities and expertise that provide Novavax scalability and capacity to produce vaccine product for future stockpiling.

Why are these developments important? First and foremost, of course, the money from CEPI will be nice to have. But perhaps more important, explains DeGeeter, is the “validation for the viability of NVAX’s program” provided by CEPI’s endorsement.

At the same time, DeGeeter reminds that one of his primary concerns about Novavax to date has been its lack of “manufacturing capacity to scale up future production,” should its vaccine prove effective. Lacking “vaccine candidate product specifications,” cautions the analyst, “in our view, it is too early to comment on potential production capacity from the facilities.” But even so, with support from Emergent now confirmed, DeGeeter says he now sees Novavax as “competitively positioned to secure additional government and NGO support for its COVID-19 vaccine program.”

And that’s really the headline of this note.

Still, DeGeeter reminds investors that although Coronavirus is the headline news here, Oppenheimer still sees more immediate prospects for profits coming from Novavax’s NanoFlu flu vaccine program. Phase III data on NanoFlu is expected to arrive sometime in Q1 2020 and, if positive, it could turn out to be “an important inflection point for the company.” Indeed, says DeGeeter, sufficiently positive data could create a chance for management to sell the company “to a large pharmaceutical company with [its own] vaccine commercialization infrastructure.”

One imagines that in such a situation, any progress Novavax can report with regard to creating a COVID-19 vaccine will only increase the company’s value to a potential acquirer — and increase the buyout price that investors can expect to receive.

Other analysts share a similar enthusiasm with DeGeeter when it comes to Novavax. TipRanks data shows out of 4 analysts tracked in the past 3 months, all 4 are bullish on the vaccine maker’s shares. With a consensus price target of $18, the potential upside is about 35%. (See Novavax stock analysis on TipRanks)