Beyond Meat (BYND) has worn a few hats since hitting the market last May. From May to July BYND stock wore the hat of “red-hot stock.” Then, from July to January, the stock wore the hat of relatively disliked stock. From January to March, the stock took off the bearish hat and put on a bullish one. In March, unsurprisingly, BYND put on the “surrendering” hat.

And now? BYND is wearing the “stuck in neutral” hat, at least if you ask Oppenheimer’s Rupesh Parikh who reiterates a Perform (i.e. Hold) rating on the stock. (To watch Parikh’s track record, click here)

As is customary on Wall Street these days, Parikh recently adjusted his model for the veggie patty maker. The analyst expects sales for FY20 to come in at $376.4 million vs. the previous call for $507.6 million, and Adj. EBITDA of $33 million compared to the previous estimate of $43.2 million.

Although Parikh looks “quite favorably” on the brand’s trend setting characteristics and “longer term prospects,” in the present stay-at-home climate, there are too many negatives to justify an upbeat assessment.

“New distribution and expanded Beyond Meat menu offerings at existing foodservice customers have represented important parts of the BYND story… In the near-term, we expect coronavirus to weigh upon BYND’s restaurant and foodservice results, limiting the potential for outperformance,” said the 5-star analyst.

And there is the crux of it. Among the many industries to take a hit since the viral outbreak, the food industry’s decline has been acute, as enforced closures of restaurants and bars have had a devastating effect. As 51% of BYND’s sales in FY19 were to restaurant and foodservice customers, the impact on its business is clear. And although Parikh expects grocery results to “remain strong,” they are not enough to offset the “foodservice headwinds.”

Nevertheless, the good news is that Beyond Meat currently has no liquidity issues. Closing out FY19, the company had roughly $276 million in cash and cash equivalents on its balance sheet. Based on Parikh’s calculations, it should be enough to see the company through the current crisis.

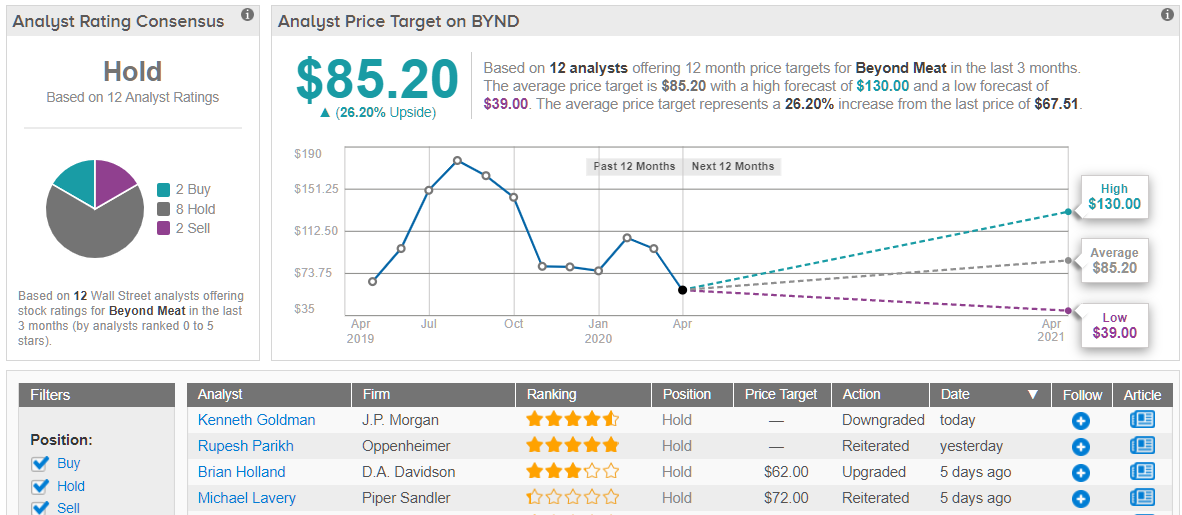

All in all, the Street backs Parikh’s call, as the analyst consensus rates Beyond Meat a Hold. That said, the bulls have the edge, as the average price target is $85.20, and suggests possible upside of 26%. (See Beyond Meat stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.