Buoyed by optimism over the label expansion of Amarin’s (AMRN) flagship drug, Vascepa, the fish oil drug maker’s stock has run off to the races — up over 60% year-to-date. But how long can that last? This afternoon, US investment giant Oppenheimer predicted an imminent crash in Amarin shares.

Oppenheimer analyst Leland Gershell and his team joined a small, but vocal camp of bearish folks waving investors away from Amarin stock. Gershell initiated coverage on AMRN with an “underperform” rating and a $7.00 price target, predicting the stock will drop about 70% in the next 12 months. (To watch Gershell’s track record, click here)

Amarin submited sNDA to the FDA seeking label expansion of its fish oil drug Vascepa to include patients at risk of a heart attack and other major adverse cardiovascular events (MACE). The FDA is scheduled to make a decision by December 28, 2019, and an FDA advisory committee already unanimously (16-0) recommended approval.

However, Gershell highlights the stock’s lofty valuation as particularly problematic. The analyst noted, “With a ~$7.3B EV, we believe AMRN’s valuation reflects expectations that, following an anticipated near-term label expansion of sole omega-3 product Vascepa: 1) sales will inflect and grow to $2B+ by 2023-24; and 2) operating margins will meaningfully improve. In contrast, we forecast sales growth to underwhelm and heavy selling costs to impede profitability. Furthermore, we believe that a ~12-month stream of late-stage competitor data starting next month will increasingly weigh on shares as these products, which we believe offer superior profiles, are factored into models. While some may regard AMRN as a probable M&A target, we see the likelihood of this outcome as only shrinking with time.”

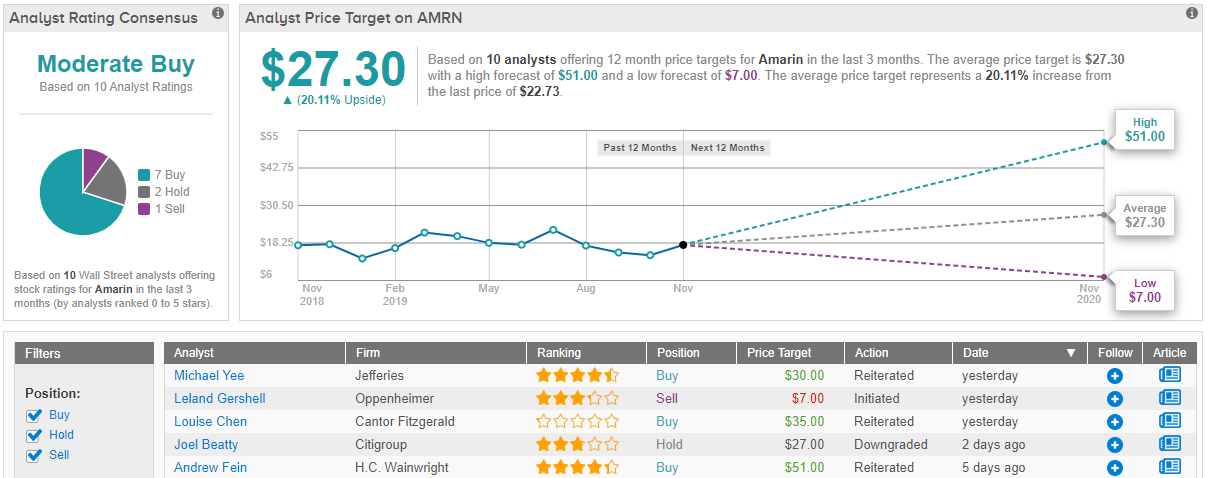

Based on the word of the Street, Gershell seems to be the sole bear running loose here. Out of 10 analysts polled by TipRanks in the last 3 months, 7 rate AMRN stock a Buy, while two say Hold, and one recommends Sell. The 12-month average price target stands at $27.30, marking a 20% upside from where the stock is currently trading. (See Amarin stock analysis on TipRanks)