The current volatility felt in the market is best gauged by The Cboe Volatility Index (VIX). Apart from earlier this week hitting its highest intraday level since 2008, year-to-date, the VIX has surged by 276%. For context, in 2008, following the market meltdown which ushered in the recession, the VIX finished the year up by 130%.

With the market swinging so dramatically from one extreme to the other, it is increasingly hard to pinpoint compelling investment opportunities. Here is when it’s best to turn to the pros’ advice.

We looked into 3 recent recommendations from Oppenheimer, one of Wall Street’s most renowned investment firms. Not to mention the firm ranks within the top 10 of TipRanks’ top performing research firms. Despite the bouts of volatility currently playing havoc on the markets, Oppenheimer sees much upside potential for three particular stocks. We used TipRanks’ Stock Comparison tool to get the lowdown and revealed that others on the Street forecast double digit growth for the trio in the next 12 months, too. Let’s dive in.

Purple Innovation Inc (PRPL)

Let’s get comfortable, kick off our shoes and begin with Purple Innovation. This company manufactures and sells patented, polymer-based mattresses and cushioning products. Purple has made waves in the industry by creating what it terms the “world’s first no pressure” mattress.

The Alpine, Utah, based company saw its shares rise over 80% in the last twelve months. Over the last week, though, it has been on the receiving end of a selloff, shedding over 21% in value. Oppenheimer’s Brian Nagel argues the pullback provides a favorable entry point which “suggests meaningful upside potential.”

Purple recently posted its quarterly results. Among the highlights were an increase of net revenue by 58.3% to $124.3 million, compared to last year’s same period’s $78.5 million. Gross margin improved by 47.7% compared to 34.2% in 4Q18, expanding by 1350 bps and beating the Street’s call for a mark-up of 1060 bps. Full year revenues increased by 50% to $428.4 Million. Looking ahead, management believes FY20E total sales will come in between $550–575 million.

Nagel believes Purple’s new leadership “has fortified core processes in operations, marketing, and financial controls.” The 5-star analyst further added, “Overall, we look upon trends at PRPL as very solid and reflective of an improving underlying infrastructure at the company. As we look through 2020, we remain encouraged that now better built-out manufacturing capacity will satiate more efficiently already strong demand for the company’s unique mattresses and bedding products.”

Nagel is feeling comfortable in Purple and keeps his Outperform rating as is, along with a $19 price target. The figure suggests possible upside of a considerable 100%. (To watch Nagel’s track record, click here)

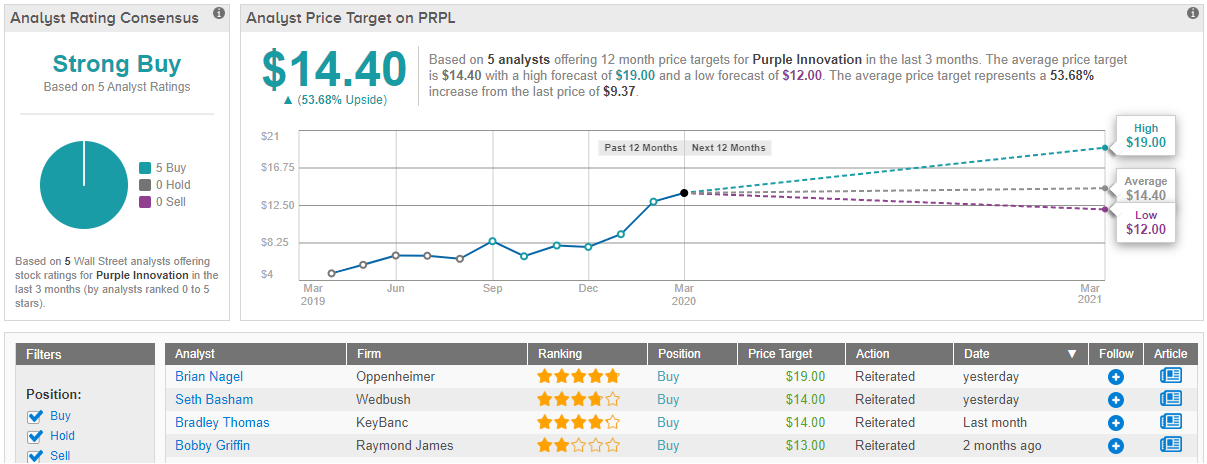

The Street is with the Oppenheimer analyst; no Holds or Sells, compared to five Buy ratings, add up to a Strong Buy consensus rating for the innovative mattress designer. The average price target hits $14.40, indicating the analysts see further growth in the shape of 54%. (See Purple Innovation stock analysis on TipRanks)

Kala Pharmaceuticals (KALA)

As noted, the markets are swinging wildly, with the majority of names across the board posting losses in 2020. Kala Pharmaceuticals, though, is bucking the trend. Year-to-date the eye disease focused biotech is up by a very impressive 113%.

The uptick in fortune comes off the back of positive Phase 3 (STRIDE 3) topline data for Eysuvis (KPI-121 0.25%), the biotech’s candidate for the short-term treatment of dry eye disease (DED).

The study met both of its primary endpoints and Kala is now preparing for a Class 2 NDA resubmission in the next quarter, with an expected six-month review timeline and hopeful approval by YE20. To recall, in August, the company received a CRL (complete response letter) from the FDA, requesting data from an additional clinical trial for Eysuvis.

Oppenheimer’s Esther Rajavelu argues that if approved, the treatment could address significant unmet needs in the nascent dry eye disease market, one worth, potentially, $3 billion.

Rajavelu said, “We increase the likelihood of Eysuvis approval to 90% from 75% with 2021E unadjusted revenues at $17M growing to $200M-plus over the next seven years. Our estimates assume an addressable market consisting of: 1) 4% of current ophthalmic steroid scripts; 2) 50% of chronic DED scripts; 3) 10M over-the-counter dry eye drop users; and 4) 1.3M currently diagnosed and untreated patients…”

Rajavelu backs up her words with actions. Along with maintaining an Outperform on Kala, the price target gets a considerable boost; from $13 to $16. The implication? Upside potential of an additional 97%, if everything goes as planned. (To watch Rajavelu’s track record, click here)

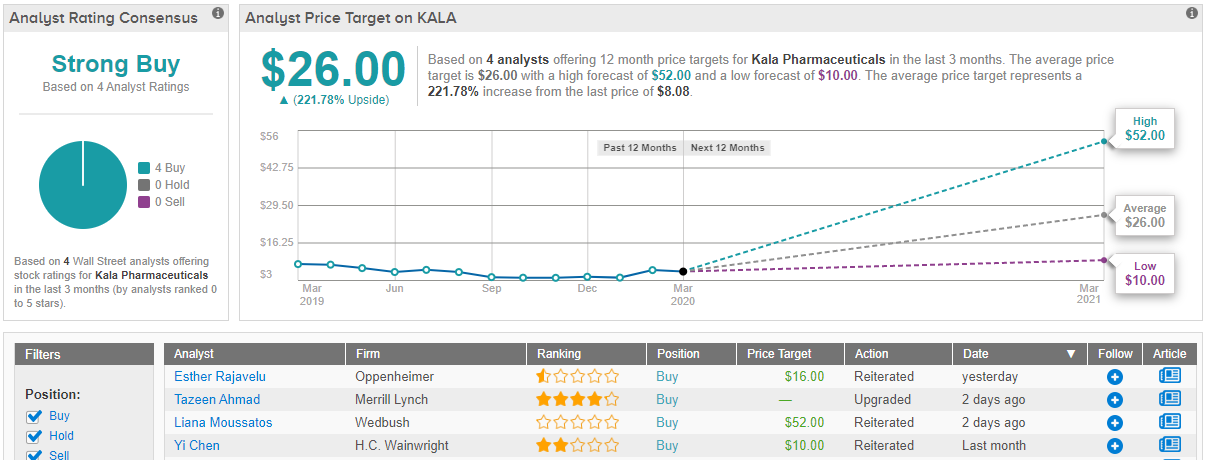

Out on the Street, Kala gets further support. Three additional Buy ratings add up to a Strong Buy consensus rating. At $26, the average price target indicates possible upside of a massive 222%. (See Kala stock analysis on TipRanks)

Spx Corp. (SPXC)

Lastly, we come to Spx Corp, a global supplier of infrastructure equipment. This company operates via three segments: HVAC (heating, ventilation and air conditioning), detection & measurement, and engineered solutions. Boasting operations in 17 countries, it is the largest on our list, with a market cap of $1.82 billion. Unlike the previous two tickers, though, Spx’s fortunes have been tied to the overall market’s slump in 2020. SPXC stock is down by 19% year-to-date.

Oppenheimer’s Brian Blair believes now is the time to load up on shares of the Charlotte, North Carolina based company. Blair initiated coverage of Spx, with an Outperform rating and a price target of $52, indicating potential upside of 26%. (To watch Blair’s track record, click here)

The company has been busy on the acquisition front, the latest of which came in November, when subsidiary the Marley Company acquired Patterson-Kelley from the Harsco Corporation for roughly $60 million. Patterson-Kelley is a manufacturer and distributor of commercial boilers and water heaters and is the fifth major purchase since the Flow spin off in 2015. Blair notes the company’s accelerating M&A strategy, with “$400 million-plus in dry powder supporting material upside potential,” and expects “strategic M&A to leverage Spx’s EPS CAGR to +DD levels for the foreseeable future.”

Blair further added, “We believe SPX’s post-spin operating successes are evident, as its reshaped portfolio, reinvigorated growth strategies, and ramping CI program have combined for underlying core growth >3% (excluding ES project selectivity) and over 700bps of segment margin expansion since 2015. Combined with SPX’s resilient demand profile, we expect operational fine-tuning to support normalized core EPS growth in +HSD range.”

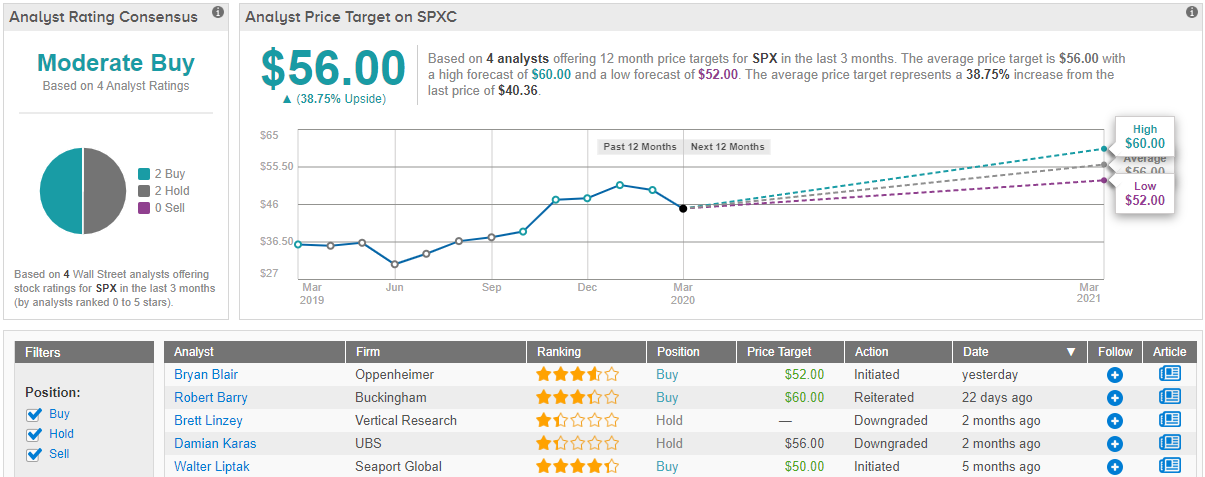

2 Buys and 2 Holds add up to a Moderate Buy consensus rating for SPX. At $56, the average price target could provide investors with returns in the shape of 39%, should the figure be met over the next 12 months. (See Spx stock analysis on TipRanks)