Oracle shares are advancing 3.2% in Friday’s pre-market session after the software company announced better-than-anticipated results for the first quarter of fiscal 2021, which ended Aug. 31. Notably, demand for cloud services spiked amid the pandemic.

Oracle’s (ORCL) 1Q revenue grew 1.6% Y/Y to $9.37 billion, ahead of analysts’ estimates of $9.19 billion. Sales at its largest division, cloud services and license support, increased 2.1% to $6.95 billion Y/Y. Revenue from the cloud license and on-premise business rose 9.1% to $886 million. Hardware revenue was almost flat Y/Y while services revenue declined 8.4%.

Adjusted EPS rose about 15% to $0.93, exceeding analysts’ expectations of $0.86. Oracle CEO Safra Catz said, “Our cloud applications businesses continued their rapid revenue growth with Fusion ERP up 33% and NetSuite ERP up 23%. We now have 7,300 Fusion ERP customers and 23,000 NetSuite ERP customers in the Oracle Cloud.”

“Our infrastructure businesses are also growing rapidly as revenue from Zoom more than doubled from Q4 last year to Q1 in this year. I have a high level of confidence that our revenue will accelerate as we move on past COVID-19,” Catz added.

Looking ahead, the company expects 2Q revenue growth between 1% to 3% and adjusted EPS growth in the range of 10% to 14%. (See ORCL stock analysis on TipRanks)

Following the 1Q results, Oppenheimer analyst Brian Schwartz reaffirmed his Hold rating on the stock and noted that Oracle generated good application results despite an uncertain operating environment. However, the infrastructure business was slightly below his expectations, while the company’s shrinking North American business leaves a “negative optic”, according to Schwartz.

“Oracle’s cloud business and margin growth are trending positively and F1Q results overcame a low bar after last quarter’s disappointment. However, we think the results and commentary are unlikely to meaningfully shift sentiment on the stock.” Schwartz wrote in a note to investors. “We see the potential for Oracle sustaining better consistency in future reports, offset by only modest revenue growth ahead and a below-market average EPS growth trend.”

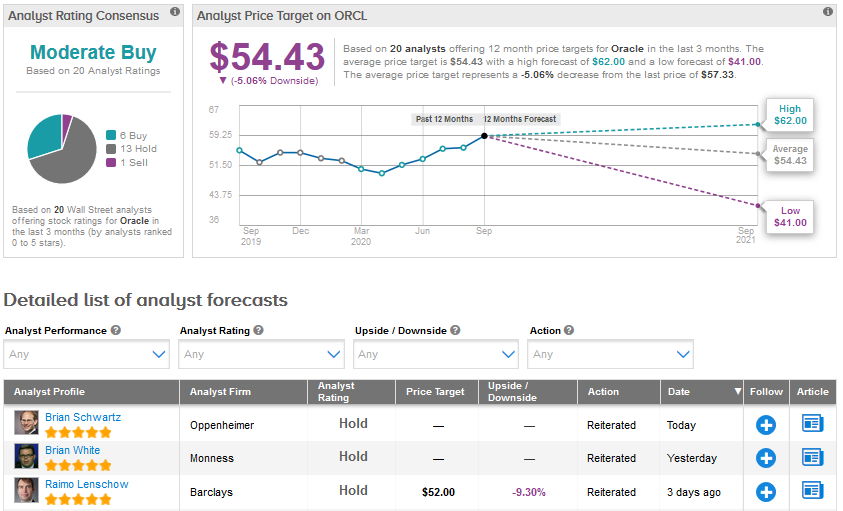

Overall, the Street has a Moderate Buy analyst consensus on the stock based on 6 Buys, 13 Holds and 1 Sell. With shares up over 7% year-to-date, the average analyst price target of $54.43 implies potential downside of 5.1% in the coming months.

Related News:

Tower Semiconductor Expects Cyber Attack To Hit Q3 Results

Verint Up 10% On Earnings Beat As Cloud-First Strategy Pays Off

Zscaler 4Q Sales Outperform Fueled By Cybersecurity Demand