This week peak earnings season rolls on with over 600 companies set to report for Q1, we’re going to hear from a lot of names in the tech, pharma and industrials space in particular.

Today we’re also going to take a look at some energy companies out with earnings this week to see how they’ve been impacted by last week’s oil rout which is now extending into this week.

And lastly we end with some econ data to look out for this week, including Case-Shiller on Tuesday, Q1 GDP on Wednesday, and Jobless claims on Thursday.

First let’s start by recapping last week a bit.

Big Tech Reports

We had a couple of big tech and FAANG names kick off peak earnings season, starting with NFLX on Tuesday. Despite being a favored “stay at home” name, they missed bottom-line expectations by 8 cents a share, but slightly beat on revenues and the real clincher was global net subscriber additions which were almost double analysts expectations. Those came in at 15.8M vs. estimates of 8.2M. Neftlix said they expect subscriber numbers to peak this quarter and then slowly back off as lockdown mandates are lifted across the globe.

We also saw an impressive report from Intel which blew away analysts expectations for profits and revenues, partially on account of their client computing segment. Analysts had been predicting that INTC would benefit in the short term from people working from home, increasing the need for laptops and cloud computing power. However, this trend may not be as strong in Q2, with the company issuing guidance for Q2 that was lower than analysts’ estimates, and they gave no guidance for the second half of the year which has become a concerning trend this earnings season.

As you can see we’ve currently got a smart score of 9 for Intel, with every segment looking positive for now. The best performing analysts on TipRanks rate Intel as a moderate buy, with a price target of $62.81, 6% higher than where it stands now.

Despite the banks dragging down markets in the first half of the week, things were looking up Thursday and Friday as plans to reopen America emerged, and Gilead Sciences announced its antiviral medicine remdesivir was showing promise in combating COVID-19. It’s likely those are the headlines that will push investors this earnings season, instead of the earnings themselves, which might be a good thing for this rally.

US Housing Market

Housing numbers came in as badly as we thought they would last week, and even worse. Existing home sales reported their largest month-over-month (MoM) drop since November 2015, while New Home sales had their biggest MoM drop since July 2013. Sales were down in all regions, with the West being the hardest hit followed by the Northeast.

Gilead Sciences

We spoke about Gilead’s trials for their possible COVID-19 treatment, remdesiver, and since then we’ve gotten a lot of mixed news – first in the form of an FT article that reported trials for the drug in China showed it did not improve conditions for COVID-19 patients. The FT cited leaked World Health Organization documents as their source. Gilead followed up to say the results of that study are still “inconclusive” and the document contained “inappropriate characterizations.” We’ll wait to hear more from then when Gilead reports Thursday.

This week, now to transition to what we’ll be watching for, we get earnings results from a couple of other big names on the forefront of COVID-19 vaccines and treatments, Pfizer and Amgen.

Health Care

Pfizer is working on a vaccine in conjunction with BioNTech and was just cleared to start human testing this week in Germany and is expected to win US approval shortly. They’ve otherwise been mum on their vaccine, but when they report tomorrow we’ll be listening in for more details.

Pfizer currently earning a Smart Score of 10, overall analysts rating this a moderate buy, but the best performing analysts on our platform are actually call this a hold for now. The price target currently stands at $38.65.

Another health care name reporting this week that’s been picking up steam due to coronavirus related shutdowns is Teledoc. With most doctors only available for emergencies, most routine visits have been replaced by telemedicine, and Teledoc is a platform that facilitates these virtual visits.

The company said last month that it was “experiencing unprecedented daily visit volume.” Since coronavirus began to escalate in the US in March, Teledoc has seen demand shoot up to ~15k visits requested a day, up 50% from the weeks prior to that. Looks like telemedicine is here to stay.

Teledoc also with a Smart Score of 10, but with Return on Equity down over the last year. The most accurate analysts calling this a moderate buy, with a price target of $150.

Industrials

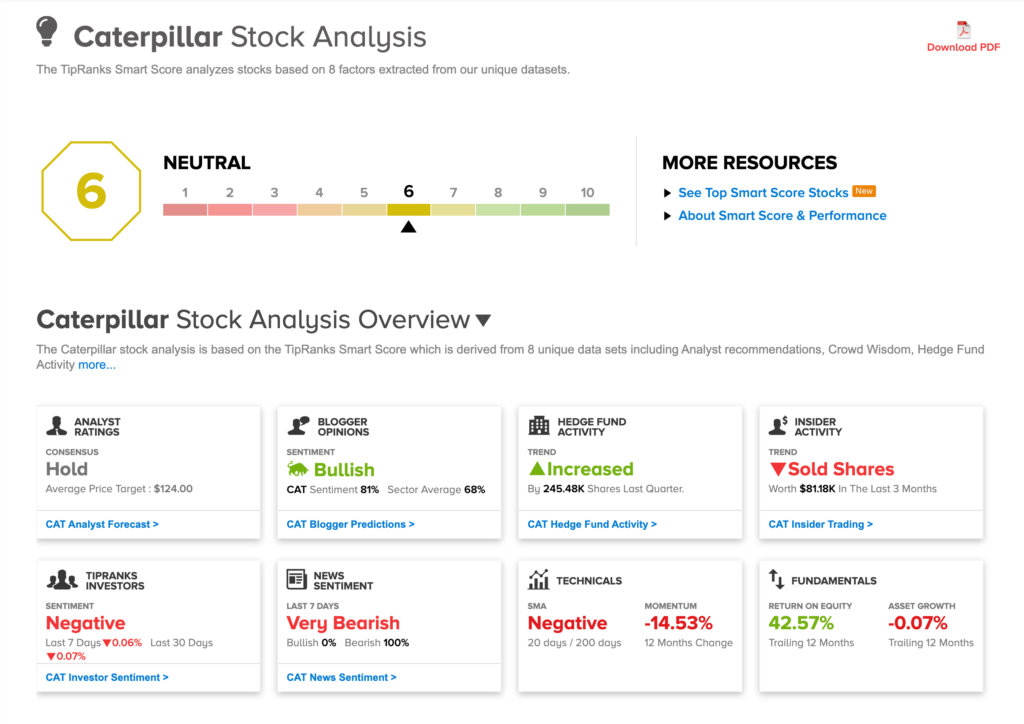

Also this week we hear from a handful of huge industrial names. Starting with Caterpillar out tomorrow, always seen as a bellwether of global growth. They are expected to report a YoY profit decline of 43%, and a revenue decline of 18% as it’s major end markets struggle. Roughly 45% of Caterpillar’s revenue comes from Energy & Transportation industries, followed closely by Construction industries at 38%.

CAT currently with a neutral score of 6.

But other industrials such as Honeywell and 3M have gotten a boost during this time. MMM out with earnings tomorrow, and Honeywell on Friday. Both of these companies, along with Owens & Minor have received Pentagon contracts to make 39M N95 masks for medical workers under the Defense Production Act, a contract that totals $133M. 3M has already done well, with their masks selling out everywhere and hard to find, but similar to CAT their end markets are in a rough place.

Because of this we see 3M has a Smart Score of 3 based on decreased hedge fund and insider activity, as well as concerning technicals. The best performing analysts calling this one a hold with a price target of $142.

And of course Industrials and Energy names go hand in hand. We start to get some results from energy companies this week, which will be interesting in the wake of last week’s oil volatility. On Monday we saw West Texas Intermediate (WTI) oil futures for May trade at negative prices for the first time ever, meaning traders holding oil futures were paying buyers to take it off their hands. US crude futures started to rise towards the end of the week however, as hopes began to mount that the US would adjust production to fit shrinking demand. But this morning oil is back down 25% on fears that storage will soon fill. Markets seem to be more optimistic tho on news of states planned reopenings.

The largest US Oil company, Exxon, reports Friday. As you can see they only have a Smart Score of 4, and the best analysts on our platform have them as a moderate sell right now.

Econ metrics out this week

Case-Shiller Home Price Index reports tomorrow and will give us an indication of how home prices were impacted for the month of February. This in many ways is more critical to consumer confidence than the stock market, as more Americans own homes than equities. Home prices are expected to be flat to slightly down for the next 12 – 18 months.

US Q1 GDP reports on Wednesday and estimates have been all over the map with the New York Fed’s Nowcast now clocking in at -0.4%. Many banks have been much harsher, Goldman Sachs for example anticipating the US economy has contracted 9% in Q1, with JP Morgan forecasting an even lower -10%.

Jobless Claims report on Thursday. Analysts expect that number to continue falling, but now that we’ve received another $484B injection in the Paycheck Protection Plan, we’ll want to focus on another reading… the continuing claims number which tracks how many people are currently receiving benefits. With more PPP funding that number should steadily drop as employees that were furloughed now can get back on the payroll.

Next week peak earnings season continues with over 700 companies expected to report for Q1.