Palantir Technologies could lose its contract with the US federal government to develop the Covid tracker system, according to a Daily Beast report. According to the Jan. 15 Daily Beast report, President Trump’s administration officials have suggested to the transition team for President-elect Joe Biden to do away with a Covid tracker developed by Palantir due to its inaccuracy.

Palantir (PLTR) had secured a contract last year with the Department of Health and Human Services (HHS) to better develop its system, HHS Protect to track the rising number of Covid-19 cases in the United States. Palantir’s data mining software was used to develop the system. (See PLTR stock analysis on TipRanks)

The company has also entered into other Covid-19 related contracts. Last year, the company won a $36 million contract with the National Institute of Health to develop a Covid-19 patient database. The data-mining company also secured a two-year contract at the end of last year with UK’s NHS (National Health Service) worth $31.5 million to develop a software platform for data processing of Covid-19 patients.

However, analysts expect the company’s growth to decelerate in 2021. Last week, Citigroup analyst Tyler Radke downgraded the stock from Hold rating to Sell but increased the price target from $10 to $15. Radke said that the stock seems “vulnerable” this year as its Covid-19 related contracts “have the potential to become headwinds in second-half 2021 into 2022,”

He further commented, “We are also more skeptical on the PLTR bull case in the commercial business, where there is optimism that PLTR’s simplified new products can drive an inflection in customer growth. Here, we see high levels of competition and the lack of investment by PLTR in the ‘right areas’ limiting success.”

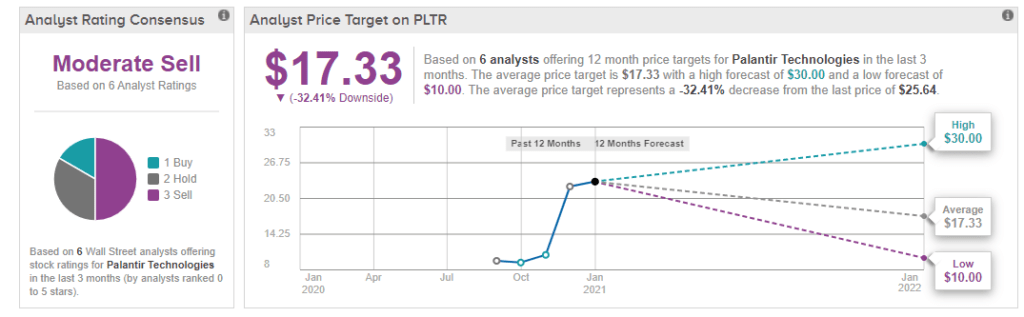

Analysts remain cautiously pessimistic about the stock as the consensus is a Moderate Sell with only one analyst recommending a Buy, 2 analysts suggesting a Hold, and 3 analysts recommending a Sell on the stock. The average price target of $17.33 implies a 32.4% downside potential to current levels. Shares have ballooned 158.7% over the past three months.

Related News:

Uber Planning to Spin-Off Postmates X – Report

Vail Resorts Sees Lower Ski Traffic in North America

Facebook’s WhatsApp Delays Privacy Update