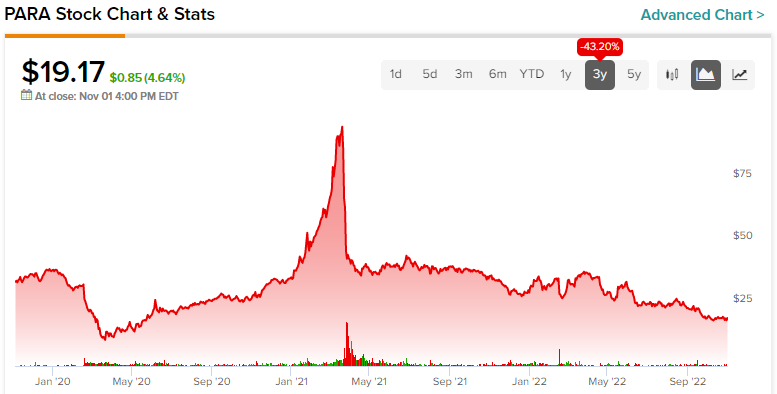

Shares of media firm and video-streaming underdog Paramount (NASDAQ: PARA) have continued to fall into the abyss, punishing dip-buyers who viewed the firm as a deep-value play. Undoubtedly, famous value investor Warren Buffett is in the name, but not even he has been able to catch the bottom in a stock that cannot seem to find its footing amid macro and industry headwinds. Though Paramount stock may be in the no-fly zone for many investors, I do think Paramount has real value to offer to those value investors who are patient enough to let the firm navigate through a rough patch in time that could get a bit rougher as we head into a recession year.

Simply put, Paramount stock is an unbelievably cheap company, with shares currently going for 3.6x trailing earnings. In the face of an economic downturn, the price-to-earnings (P/E) multiple could expand as the firm tackles pressures weighing on its bottom line. However, the absurdly-low 0.5 times price-to-book (P/B) multiple makes it difficult to overlook the value in the name. For the dirt-cheap price tag, I find it hard to be anything but bullish on shares of PARA.

Paramount Faces a Tough Road Ahead of It

Like every other business whose stock is in a bear market, Paramount faces immense challenges as we enter 2023. More streaming investments will be made, and subscriber adds could come in lower than expected if the economy turns south in a hurry.

In times of economic hardship, consumer sentiment could shift suddenly, and there’s a good chance that Paramount could take a few more steps back as it continues to improve its footing in the streaming universe. The depressed valuation suggests such, in my opinion.

With such a low bar ahead of the firm at $19 and change per share, it’s difficult to pass up today’s prices. Not much has changed about the Paramount story since Warren Buffett picked up shares earlier this year. Though the macro storm clouds have already begun to work their way into companies’ financial results, Paramount’s streaming foundation is still fully intact.

It could take years before the firm can make significant strides over its rivals. However, the firm is experiencing strong momentum out of the gate. In any case, I think many investors are discounting growth in streaming due to a combination of recession woes and climbing streaming losses. Indeed, a higher-rate environment has limited the tolerance for widening losses in initiatives that aren’t guaranteed to rake in considerable profits over the nearer term.

The direct-to-consumer (DTC) business sported impressive growth in the second quarter, with revenue surging a whopping 56% to $1.2 billion. Despite strong growth and a solid content pipeline, investors seem to have overemphasized the negatives. In the case of Paramount, it’s tough to look past the hefty capital expenditures to come. Management expects $1.8 billion worth of streaming losses for the year.

Undoubtedly, Paramount is paying a pretty penny to win over new subscribers. With investors souring on the broader video-streaming industry, it seems as though many expect the trade-off to be less than worthwhile, at least until rates can turn a corner.

Paramount’s Managers Seem Focused on the Long Haul

In this day and age, investors want to see rising profitability metrics or, at the very least, narrowing losses. Paramount isn’t pulling the brakes, as many other firms have in recent months. With a lofty $6 billion content budget that management is standing by, Paramount seems focused on taking real strides and (hopefully) market share in a streaming market that remains intensely competitive as streamers experiment with lower-cost, ad-based tiers.

Indeed, streaming is an industry where you’ve got to continuously spend money to take market share, and the market just doesn’t seem to think such spending is a good thing in the face of a Fed-mandated recession that’ll accompany higher interest rates.

It is respectable that Paramount’s sticking to its growth-focused strategy. As a streaming underdog, it probably shouldn’t cut back on spending just to appease certain investors. The Paramount+ service has a lot of runway to catch up to the streaming heavyweights. As long as the firm can deliver on the quality front while keeping losses in check, I think there’s a considerable opportunity for multiple expansion.

With Halo, 1883 (a spin-off from the popular show Yellowstone), Beavis and Butthead, and other intriguing shows bound to attract viewers’ attention, I think Paramount+ is a service that could end up surprising us all.

Indeed, Apple’s (NASDAQ: AAPL) Apple TV+ service seemingly came from out of nowhere a few years ago. Nowadays, it’s making a lot of noise at the Emmys. Paramount+ could easily be next up to the plate if its content sticks with viewers. Fortunately, management is fully-focused on the long-term growth of its streaming platform. As other streamers cut their budgets, I’d look for Paramount to treat a recession year as a year to pull ahead.

Is PARA a Good Stock to Buy, According to Analysts?

Turning to Wall Street, PARA stock comes in as a Hold Out of 14 analyst ratings, there are four Buys, three Holds, and seven Sell recommendations.

The average Paramount price target is $23.31, implying upside potential of 21.6%. Analyst price targets range from a low of $13.00 per share to a high of $36.00 per share.

Conclusion: Paramount Stock Looks Incredibly Cheap

Paramount stock looks incredibly cheap at these depths. The streaming platform has a lot of catching up to do. In the meantime, the market may continue to punish investments in growth. Regardless, the valuation already seems so discounted that any potential share-take in streaming could translate into solid gains for patient investors.