Koninklijke Philips (PHG) on Monday withdrew its outlook for this year, as the Dutch health technology company saw its first-quarter earnings hit hard by the impact of the global coronavirus outbreak.

Looking ahead Philips is warning investors that the second quarter is poised to be even worse. In the first quarter, net income slumped to 39 million euros ($42.4 million) from 162 million euros during the same period last year. Earnings before interest, taxes and amortization (EBITA) dropped 33% to 244 million euros ($265 million), while comparable sales declined 2% to 4.15 billion euros.

“The impact of COVID-19 gradually increased in the course of the first quarter, initially affecting our businesses in China and Asia Pacific starting late January, and subsequently affecting our businesses in the rest of the world from March onwards,” Philips Chief Executive Frans van Houten said. “On that basis, we expect that all our geographies will be impacted throughout the second quarter.”

Van Houten added that the technology company sees a steep revenue decline in its personal health products such as touthbrushes and shavers, and a sizable high-single-digit decline for its diagnosis & treatment businesses. The expected declines are poised to be partly offset by a “significant” increase in revenue of its connected care businesses.

The outbreak of the coronavirus pandemic has boosted global demand for Philips’ ventilators, scanners and other hospital equipment.

Van Houten said that Philips was aiming to return to growth and improved profitability in the second half of the year. For the full year 2020, the company seeks to achieve a modest comparable sales growth and adjusted EBITA margin improvement.

“Given the current uncertainty and volatility, we will not provide more specific guidance for 2020 at this time,” Van Houten said.

Philips has previously given annual 2020 guidance for a 4%-6% advance in comparable sales and a 100 basis-point improvement in its profit margin.

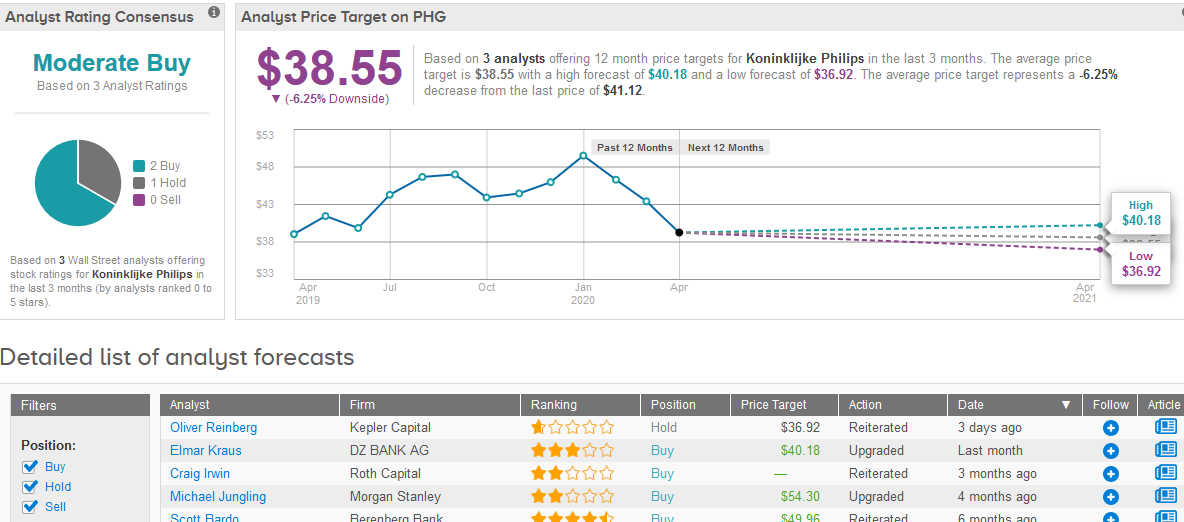

Wall Street analysts have a Moderate Buy consensus rating on the stock based on 2 Buys and 1 Hold. Meanwhile, the $38.55 average price target projects potential downside of 6.3% in the shares in the coming 12 months. (See Philips stock analysis on TipRanks).

Related News:

Novartis Buys U.S. Start-Up Amblyotech For Lazy Eye Treatment

China Development Bank, General Electric Cancel Boeing 737 MAX Jet Order

Debt-Laden Chesapeake Energy Scraps Dividend After Reverse Stock Split