Piper Sandler upgraded energy giant BP Plc to Buy from Hold, while also lifting the stock’s price target to $31 (34.8% upside potential) from $28, citing cost-savings measures.

Piper Sandler analyst Ryan Todd is encouraged by BP’s (BP) cost reductions measures and believes “valuation at the European Majors is more attractive relative to the US Majors”. Todd noted that multiples, breakevens, and free cash flow yields are at “historically large discounts”. The analyst expects improving visibility in the medium- and long-term should partially lessen the near-term concerns.

Earlier this month, BP reported a 2Q loss after it downgraded the value of some of its assets on expectations of lower commodity prices. Its underlying replacement cost profit, used as a proxy for net profit, came in at a loss of $6.7 billion.

BP is planning to become a net-zero-carbon company by 2050 or sooner. Within 10 years, it plans to raise its annual low carbon investment 10-fold to around $5 billion a year. The company also committed to reduce its oil and gas production by 40% from current levels by the end of the decade.

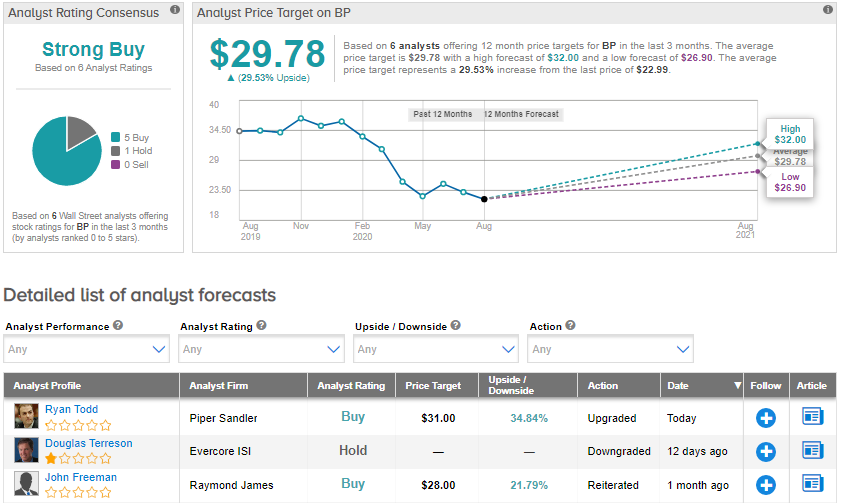

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 5 Buys and 1 Hold. The average price target of $29.78 implies an upside potential of about 29.5%. (See BP stock analysis on TipRanks).

Related News:

Wedbush Sticks To Hold On Nordstrom Ahead Of 2Q Results

Barclays Lifts NetEase’s PT On Gaming Sales Growth Bet

Truist Raises Yelp’s PT On ‘Balance Sheet Strength’