Poseida Therapeutics ($PSTX) stock is skyrocketing today on news that the company has reached an acquisition agreement with Roche Holdings ($RHHBY). Known for its work in the fields of allogeneic cell therapy and genetic medicines, Poseida announced today that Roche will be acquiring it in a cash and stock deal that values its total equity at up to $1.5 billion. Following the closing of this deal, Poseida will join the Roche Group as part of its pharmaceuticals division.

What’s Going On with PSTX Stock?

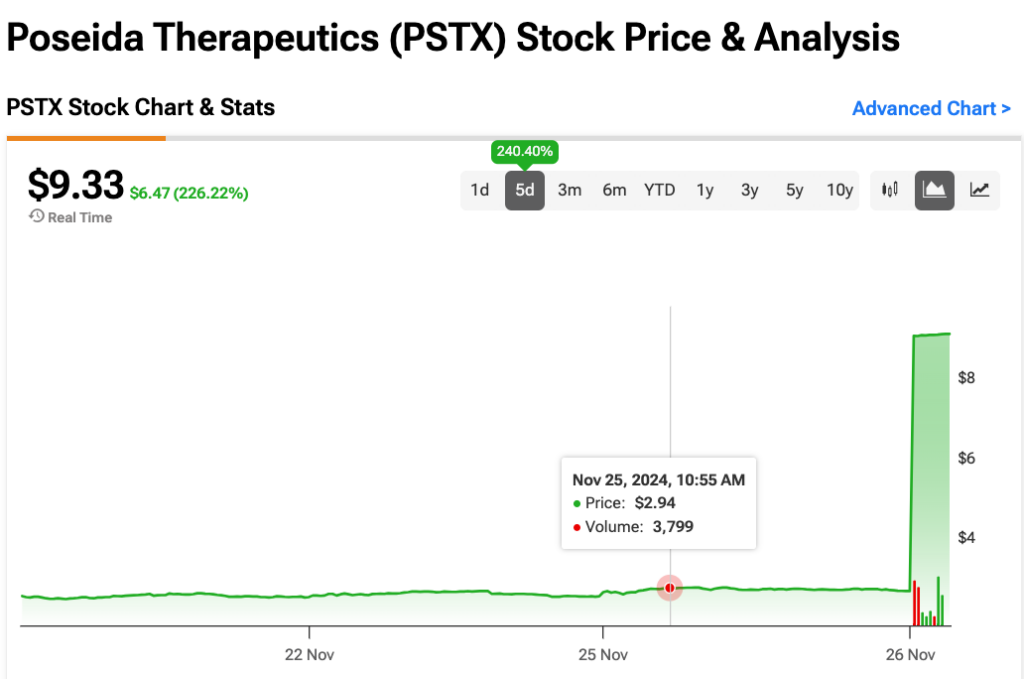

News of the acquisition has sent PSTX stock surging this morning. Shares have skyrocketed 225% since markets opened, and they are showing no signs of slowing down. This performance has pushed it up 240% for the week. After trading at penny stock levels just 24 hours ago, Poseida has gone from less than $3 per share to more than $9. If the stock’s current trajectory continues, Poseida could easily pass the $10 mark within the next few hours and continue rising from there.

As part of this acquisition, Roche will be acquiring all outstanding shares of Poseida stock. Shareholders will receive $9 per share, plus a non-tradeable contingent value right (CVR) to receive “up to an aggregate of $4.00 per share in cash.” Although PSTX has surged today, this will still yield a significant profit for anyone who purchased shares in 2024, as the stock hasn’t traded at a higher price than $4 per share all year.

According to MarketWatch, the two companies have been working together for years, developing CAR-T cell therapies to treat patients with hematological malignancies, a group of cancers that impact blood and bone marrow. Given Roche’s status as a pharmaceutical leader across Europe, this acquisition will allow Poseida to gain exposure to new markets.

Is Poseida Stock a Buy, Sell or Hold?

Turning to Wall Street, analysts have assigned a Strong Buy consensus rating to PSTX stock, based on four Buys and no other ratings in the past three months, as indicated by the graphic below. After a 240% rally in its share price over the past year, the average PSTX price target of $14 per share implies 49% upside potential.