Global crises are generally good news for gold, as investors turn to safe haven assets. As a result, the price of gold has surged this year, up by 15% year-to-date, with it trading at levels not seen since 2013. The upward trend has added a layer of gloss to precious metal miners, too; Shares of Yamana Gold (AUY) are up by an impressive 33% since the turn of the year.

CIBC analyst Anita Soni thinks there are more gains in the pipeline. In addition to keeping her Outperformer rating on AUY shares, the analyst raised her price target from $6.15 to $7. Investors stand to take a 32% premium back to the vault should Soni’s target be met over the next 12 months. (To watch Soni’s track record, click here)

What has prompted Soni’s reevaluation, then? Good news concerning two of the company’s mines, Jacobina and El Peñón.

At Jacobina, positive exploration results turned what was once considered the “extended mine life” of the asset into its base case scenario. The mine’s life expectancy has been moved to 14.5 years as opposed to 11.5 years previously. Management also indicated the possibility of further extension, based on previous exploratory success at the site.

As for El Peñón, drilling has resulted in the uncovering of additional gold veins, while surface exploration has generated more “exploration targets.” These results are “in line with the strategic LOM (Life of Mine) of at least 10 years,” Chen said.

Furthermore, it appears the site’s facilities are underused, meaning the “excess plant capacity” can be used to boost production.

Chen believes “Yamana offers near-term growth driven by improved performance of existing assets and ramp-up of new projects.”

The analyst added, “The company’s consistent delivery evidenced by upward guidance revisions in 2018, organic growth opportunities, and exploration potential combine nicely with an improving balance sheet and attractive relative valuation… We see these exploration results as positive news for the company as it continues to delineate its longer-term pipeline.”

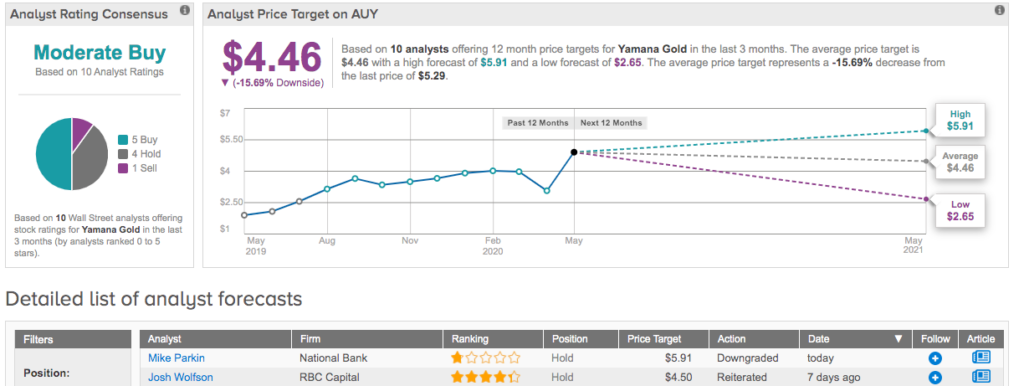

Turning now to the rest of the Street, Yamana’s Moderate Buy consensus rating is based on 5 Buys, 4 Holds and 1 Sell. However, overall, it appears the majority of analysts believe the stock has surged enough for now, as the average price target is $4.46, which implies downside potential of 16%. (See Yamana stock analysis on TipRanks)