With a recession moving in, investors may want to watch healthcare stocks. Even as many pundits downplay the severity of a potential slowdown, with calls for a “soft landing” or “no landing” type of scenario (meaning there won’t be a recession), it’s always smart to stay diversified in the face of profound uncertainty.

Though investors have had ample opportunity to play defense ahead of the looming downturn, there remain several intriguing healthcare names that aren’t exactly expensive. Therefore, in this piece, we’ll use TipRanks’ comparison tool to look at three modestly-valued healthcare stocks that sport a Strong Buy consensus rating, according to Wall Street.

CVS Health (NYSE:CVS)

CVS is the pharmacy behemoth we all know and love. Of late, investors have fallen out of love with the name, with shares now down more than 30% from their early-2022 peak. Despite the recent plunge, Wall Street analysts remain upbeat, and it’s not hard to see why. The stock isn’t expensive for the type of healthcare innovation you’ll get from the name. As a result, I stand with most Wall Street analysts and am bullish on the name.

The company clocked in some pretty impressive fourth-quarter results (topping on revenue and earnings). Still, its plans to acquire Oak Street Health for $10.6 billion left a bad taste in investors’ mouths. It may not be a bargain pick-up, but Oak Street is an intriguing healthcare asset that may be far more valuable in CVS’s hands.

Though it’ll take time for Oak Street to prove its worth, I do think there are significant synergies to be had as CVS looks to improve efficiencies while gaining exposure to the healthcare space. Currently, management expects $500 million in synergies from the deal. I view this target as realistic.

I think you have to give CVS the benefit of the doubt as it looks to make a bigger splash in the healthcare market. Ultimately, such deals will help CVS get back on the growth track. For now, many investors are discounting CVS’s prospects on the back of the Oak Street deal.

At 24.1 times trailing earnings (8.5 times adjusted earnings, 16% lower than its five-year average), with a 3.2% dividend yield and a 0.63 beta (lower means less correlation to markets), it looks like CVS presents compelling value.

What is the Price Target for CVS Stock?

Wall Street loves CVS, with a Strong Buy rating intact based on nine Buys, two Holds, and no Sell ratings. The average CVS stock price target of $113.82 implies 57.3% upside ahead.

Zoetis (NYSE:ZTS)

Zoetis is a pet health company that’s also a fine candidate for weathering a potential recession. Like CVS, the stock is amid a bear market, now off around 35% from its late-2021 all-time high. The company is coming off a solid fourth quarter that saw 11% in adjusted earnings growth. Despite the earnings beat, though, investors are souring on the name over margin pressures. Nonetheless, I am bullish on the stock.

Pet healthcare is a niche that’s worth investing in since people should keep spending to keep their pets healthy both in good and bad times. The company is a proven market leader (in terms of sales) with tools to overcome headwinds en route to higher levels.

Further, Zoetis is a compelling play for ESG investors after Ethisphere named it one of the world’s most ethical firms. Indeed, ESG will be increasingly important as more young investors jump into the markets over the next decade.

However, at 30 times forward earnings, the $74.7 billion pet care firm still doesn’t look all that cheap, even after its nasty spill. Regardless, Zoetis is one of the high-quality names worth paying up for. Like CVS, Zoetis has a low beta (0.76) and a well-covered dividend (yielding 0.92%) that’s likely to grow, with or without a soft landing for the economy.

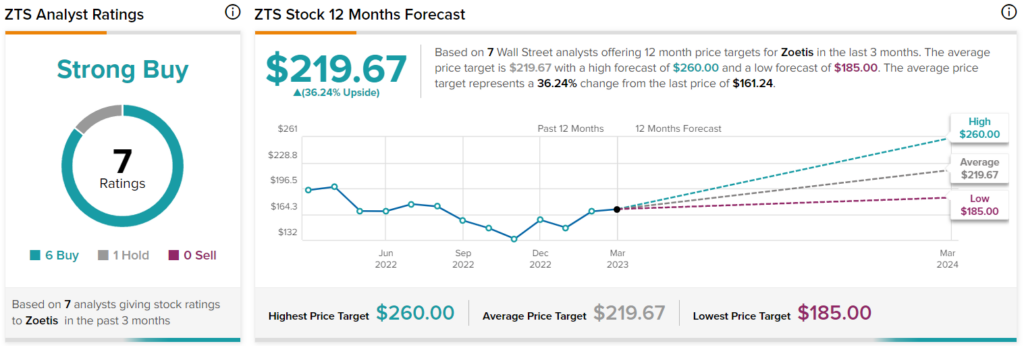

What is the Price Target for ZTS Stock?

Wall Street has a Strong Buy on the stock, with six Buys and one Hold. Further, the average ZTS stock price target of $219.67 implies 36.4% upside potential.

Intuitive Surgical (NASDAQ:ISRG)

Intuitive Surgical is the riskiest healthcare play on this list. The stock has been steadily climbing back after taking a 50% peak-to-trough haircut during the 2021-22 tech rout. Now down around 33% from the top, investors are warming up to the robotic-assisted surgery play again. I think they’re right to, as the firm looks to power through a harsher economic environment while pulling back on operating expenses for the year. I remain bullish.

Higher rates or not, robotic-assisted surgery is still a high-growth market, and Intuitive is one of the firms that’s steadily grown its moat within the field. Indeed, many doctors will become more comfortable using the technology over time. Further, demand for minimally-invasive surgery could rise considerably as the company puts out new studies regarding the benefits of its technology for those on the operating table.

Indeed, surgical robots are still on the cutting edge (please forgive the pun) of medical device tech, a market that’s still booming. Like other innovators, though, Intuitive is getting its costs under control. For 2023, the firm is slowing hiring to keep profitability prospects from fading fast in the face of higher rates.

Turbulent times may be ahead for the economy, but there’s no denying the magnitude of growth from a product as innovative as the da Vinci surgical robot. As the product gets better and minimally-invasive surgery becomes a more preferred choice among patients, I expect Intuitive will be in a great spot to pick up where it left off once the recession passes.

The stock trades at 67.5 times trailing earnings. That’s higher than the advanced medical equipment industry average of 44 times. Regardless, I think the da Vinci robot has proven itself to be worth such a premium.

What is the Price Target for ISRG Stock?

Analysts love the name, with a Strong Buy rating comprised of 12 Buys and four Holds. The average ISRG stock price target is $274.07. That implies 12.1% upside potential from here.

The Takeaway

CVS, Zoetis, and Intuitive Surgical are recession-resilient healthcare stocks still praised by Wall Street, but analysts expect the most upside from CVS (>57% gains) for the year ahead.