Procter & Gamble reported better-than-expected 1Q results on Tuesday as the coronavirus pandemic boosted demand for its skin, personal care and home cleaning products.

Procter & Gamble’s (PG) net sales increased 9% to $19.3 billion year-on-year surpassing analysts’ projection of $18.3 billion. Its overall volumes increased by 7%. Organic sales of fabric and home care products increased 14% and health care products revenue grew 12%. In addition, pricing and mix improved by 1% each.

The consumer product maker’s 1Q earnings jumped 19% to $1.63 per share year-on-year and beat the Street’s estimates of $1.43.

Buoyed by stronger-than-expected 1Q results, P&G raised its full-fiscal outlook. The company’s CEO David Taylor said, “We delivered another strong quarter of organic sales growth, core earnings per share and cash returned to shareowners, enabling us to increase our outlook for fiscal year results.” (See PG stock analysis on TipRanks).

P&G now anticipates fiscal 2021 sales to increase between 3%-4%, up from its previous guidance range of 1%-3% increase. The company also boosted its core earnings growth forecast from a range of 3%-7% to a range of 5%-8%.

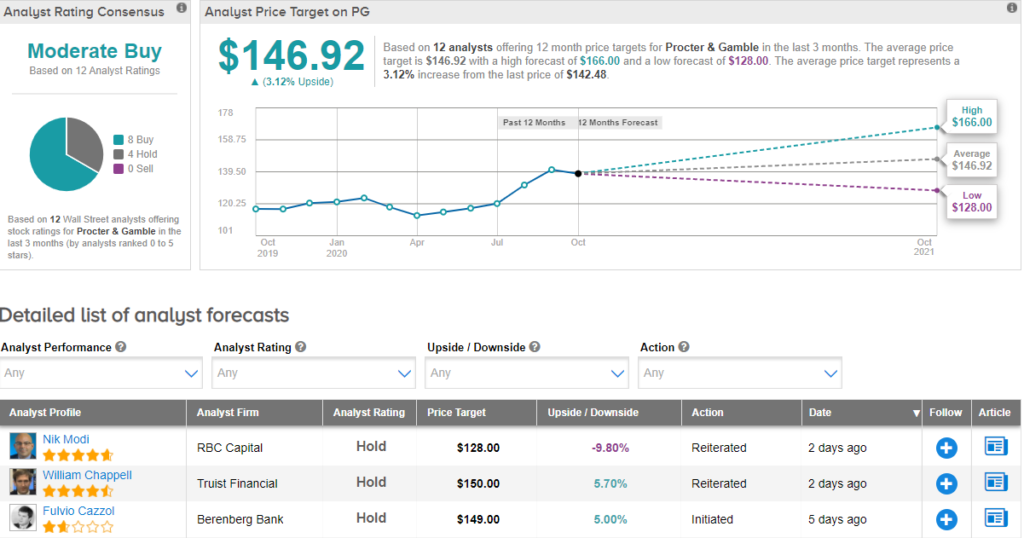

Ahead of the results, Truist Financial analyst William Chappell raised the stock’s price target to $150 (5.3% upside potential) from $125. In a note to investors on October 19, Chappell said that the lifted price target reflects the company’s multiple expansions across the space. However, the analyst reiterated a Hold rating cautioning that the stock trades above the high-end of its historical earnings multiple range.

Currently, the Street is cautiously optimistic on the stock. The Moderate Buy analyst consensus is based on 8 Buys versus 4 Holds. With shares up over 14% year-to-date, the average price target of $146.92 implies further upside potential of about 3.1% to current levels.

Related News:

Simmons’ 3Q EPS Beats Estimates; Analyst Sticks To Buy

Crown Holdings Posts 3Q Profit Win, Initiates Dividend Pay

Zions Beats 3Q Profit; Street Says Hold