Mobile device chipmaker Qualcomm (NASDAQ: QCOM) has been weathering the macroeconomic storm for some time now. However, there are signs that it’s getting to be too much for even this leader. The company lost 8.3% in premarket trading on Thursday and recovered only slightly so far. Qualcomm posted earnings just yesterday, and the results weren’t what most wanted to see. The company delivered $3.13 per share in earnings, matching estimates. Revenue, meanwhile, proved a fairly close match for projections as well. The company posted $11.39 billion in revenue, against projections calling for $11.37 billion.

However, what prompted the slide was a disappointing forecast. With smartphone shipments on the decline, Qualcomm’s room to make sales is similarly on the decline. Qualcomm’s projections were $2 billion below established market estimates, and the company noted that its excess inventory could take six months to clear out.

I’ve been bullish on Qualcomm for some time now, but after seeing just what the macroeconomic environment is doing to the company, I have little choice but to pivot down to neutral. There’s still hope, but a conservative response is to stay out of the line of fire until things improve.

Is Qualcomm a Good Stock to Buy?

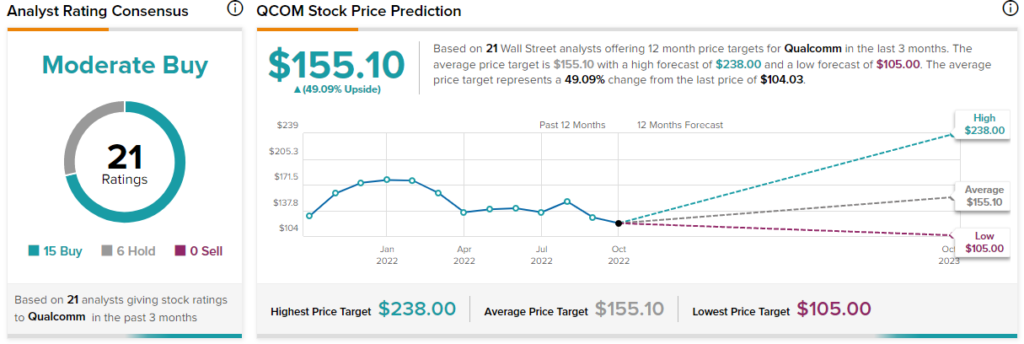

Turning to Wall Street, Qualcomm has a Moderate Buy consensus rating. That’s based on 15 Buys and six Holds assigned in the past three months. The average Qualcomm price target of $155.10 implies 49.09% upside potential. Analyst price targets range from a low of $105 per share to a high of $238 per share.

Not all is gloomy for Qualcomm. Currently, Qualcomm has a Smart Score of 8 out of 10 on TipRanks, suggesting that the company has a solid chance of doing better than the broader market.

Hedge funds are also a bright spot for the company, as they hiked their holdings by 289,600 in the last quarter.

Some of Qualcomm’s raw numbers certainly help the company’s position. Qualcomm’s dividend history proved stable but also offered regular increases, even during the pandemic. That’s no mean feat; the company actually raised its dividend from $0.62 to $0.65 between March and June 2020. Another boost followed in June 2021 and another in May 2022.

Further, Qualcomm has some fairly attractive fundamental numbers to consider as well. For instance, the company’s P/E ratio is under 10x. Plus, its operating cash flow is on the rise, as it went from $1.08 billion in September 2021 to $1.45 billion in September 2022.

Revenue is also rising; the $11.39 billion the company posted in its most recent quarter is higher than the $10.94 billion posted in June 2022. It also represents the highest figure seen in over a year; the previous high was $11.16 billion back in March 2022.

When No One Wants a New iPhone

There’s good news for Qualcomm here besides the solid numbers the company can put up. First, it can continue to count Apple (NASDAQ: AAPL) as a customer for at least the next year to come. Some believed that Apple would switch over to its own processors for future iPhones.

Even Qualcomm itself was only expecting to provide roughly one in five of the 5G modem parts for the iPhone line. However, that proved to not be the case.

Qualcomm is also taking steps to limit its expenses and thus better absorb a potential downturn. The company has already established a hiring freeze that should stabilize its labor costs. That’s especially true, given the backlog the company already has on hand. With a “double-digit” drop in phone sales potentially on the horizon, it will need all the limits it can establish.

This is part of the problem for Qualcomm right now. Phone sales are dropping. People are too focused on keeping their lights and heat on, food on their table, and gas in their car to be quite so concerned about this year’s iPhone.

After all, 25% of shoppers plan to buy second-hand holiday gifts this year. That means more will likely look at their current smartphone and say, good enough, at least for now. That’s going to hurt Qualcomm’s chip sales.

Sure, Qualcomm has been working to address this point with Snapdragon systems for self-driving cars, among other things. However, if people are feeling too cash-strapped to buy a new phone, will they be in a better position to buy a new car?

Conclusion: Tightened Purse Strings are Bad News for Qualcomm

The picture for Qualcomm is not a complete disaster. The company still has the Apple trade for the foreseeable future and will still have people interested in the products that contain Qualcomm chips. It’s just that those sales will slow down for the next several months, potentially even several years.

Qualcomm will therefore suffer the same strictures as many retailers are facing right now. Qualcomm is just an indirect supplier to these retail operations. If the retailers suffer, so too does Qualcomm.

There will be troubles ahead for Qualcomm in the short term, but it may recover in the long term. That’s enough to leave me neutral on Qualcomm.